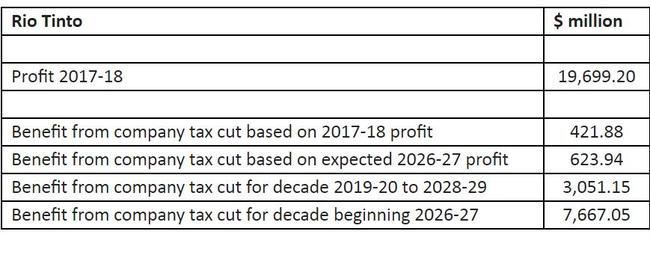

One company’s profits show massive cost of tax cuts

ONE company alone stands to benefit by more than $7 billion in revenue over 10 years thanks to the government’s proposed corporate tax cuts.

THE company reporting season threatens to become a running battle for the government with a think tank planning to calculate the tax revenue its policy would forego.

The calculations by the Australia Institute are aimed at making the government wince and put on the defensive as it renews its bid to get corporate tax relief through the Senate from August 13.

The examination of reports has started and the Australia Institute calculates that one company’s half-year result alone would see the Government lose more than $7 billion in revenue over 10 years from 2026, were its full tax scheme operating.

And it further calculates the effect on essential service provision from what it sees as reduced spending.

“The company tax cuts are economically unsound and will result in less revenue being available for community services and productivity enhancing public infrastructure,” Australia Institute executive director Ben Oquist said today.

He said: “Our research has consistently shown there is no correlation between lower company tax rates, employment, or economic growth.

“The community are looking for good service delivery and the revenue to fund it, not a tax cut giveaway to companies like Rio Tinto.”

The Australia Institute’s project, named Revenue Watch, will be repeated for every big business financial report, and began with mining giant Rio Tinto and its half-year report released last night.

The institute’s analysis found company tax cuts would be worth $7.67 billion in lost revenue over first decade of the policy.

The full range of big business cuts would operate from 2026-27.

The Australia Institute today said the foregone revenue would be the equivalent of employing 8450 nurses, 7610 secondary school teachers or 6310 police.

It said this was based on the average payments for the occupations in May 2016 and updating for the actual and projected wage increases.

Senior government ministers have underlined their determination to get the corporate tax cuts through the Senate or put them to the fore during the coming general election campaign.

Treasurer Scott Morrison has strongly underlined faith in the policy’s effectiveness in creating jobs and boosting wages.

“And we continue to work with the senate to get the best possible outcome for the Australian economy,” Mr Morrison told ABC radio yesterday.

“There’s no question this is not the right policy for Australia. And the government will do the right thing for the economy.

“We’re not in the business of political expediency to jettison policies that we think are good for the Australian economy and we have to be practical about that.”

Mr Morrison pointed out the banks pay more tax through the bank levy.

“We have a bank levy that is raising two billion dollars a year,” he said.

“The banks will always be paying more tax than all companies in the country. We introduced the bank levy.”

Finance Minister Mathias Cormann is still negotiating with the crossbench, and might agree to change the policy to get it through the senate.