Liberal leader Peter Dutton warns tax cuts for rich are in limbo

Opposition Leader Peter Dutton has appeared to shy away from a previous claim about tax cuts for high-paid Aussies.

Liberal leader Peter Dutton has poured cold water over expectations that high-income earners with a salary over $180,000 can expect to have promised tax cuts restored if he wins the next election.

Labor’s changes to the so-called stage three tax cuts passed Parliament earlier this year with the Coalition’s support, doubling tax cuts for average income earners but slashing the benefits for the rich.

The biggest losers were those earning more than $180,000. The tax cut for people who earn more than $200,000 a year was halved from $9,075 to $4,529 a year.

But after initially dangling the prospect of restoring the tax cuts if elected, the Liberal Party is now warning it will depend on the budgetary position.

“If there are ways in which we can help people, we’ll do that, but it’ll largely be dependent on what the numbers are coming into the next election,’’ Mr Dutton told ABC radio.

“I think it just depends on where the numbers are as we go into the election and how much money is available and how we prioritise our spending and how we do it in a way which is targeting inflation, so that interest rates can come down.

“I was talking to one of the banks the other day, somebody on a mortgage of $500,000 is paying an extra $1,800 a month in repayments, and they’re only getting, with a quarter of a per cent reduction in interest rates, about $80 a month in terms of relief of repayments. I just think there are a lot of families out there at the moment who just can’t make their budget work.”

The Liberal leader warned that taming inflation was the biggest priority.

“The Government’s on a spending spree at the moment, which is why inflation’s high and it’s why interest rates are staying higher for longer, and the Reserve Bank Governor has pointed this out,’’ he said.

“Australians are paying more for their mortgages now than they should.

“I think the priority, to be honest, is to get inflation down, to get interest rates down and to support jobs in the economy, because I think we’re coming into a difficult period. I think a lot of families are well and truly experiencing that difficulty right now.”

Labor’s revamped plan that secured bipartisan support delivered bigger tax cuts to all taxpayers earning less than $146,486 and doubled tax relief for those on the average income.

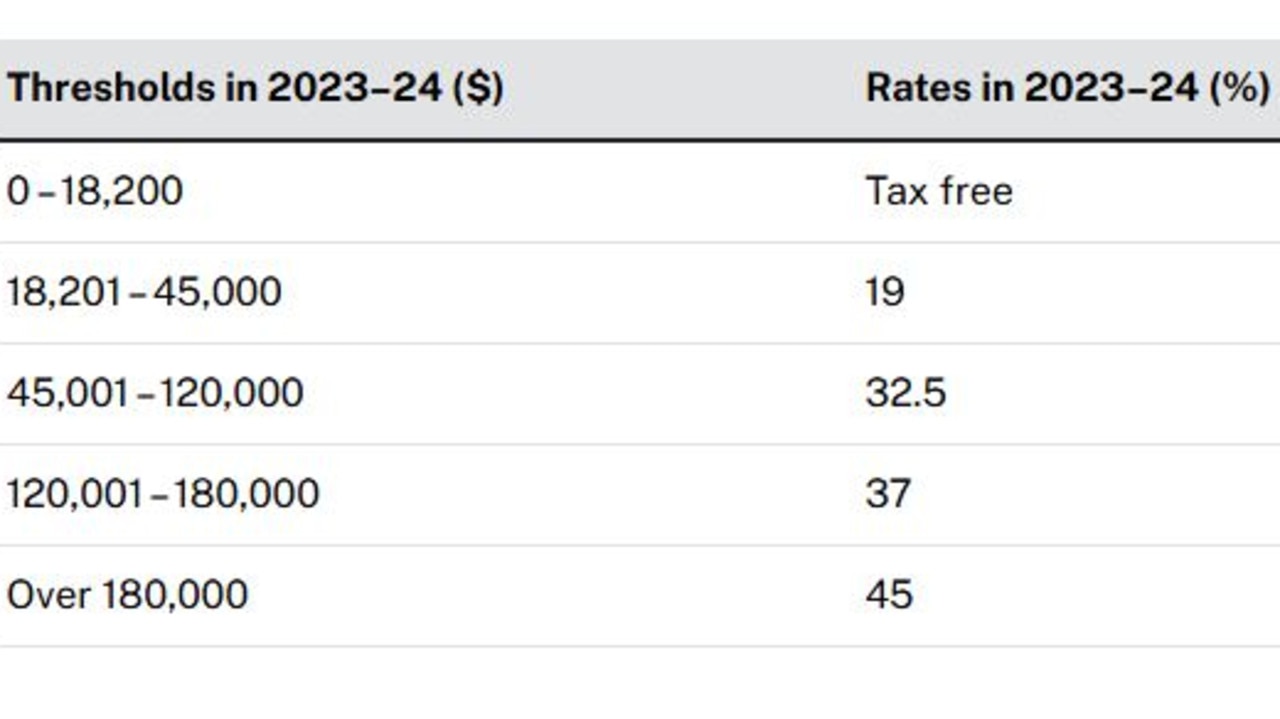

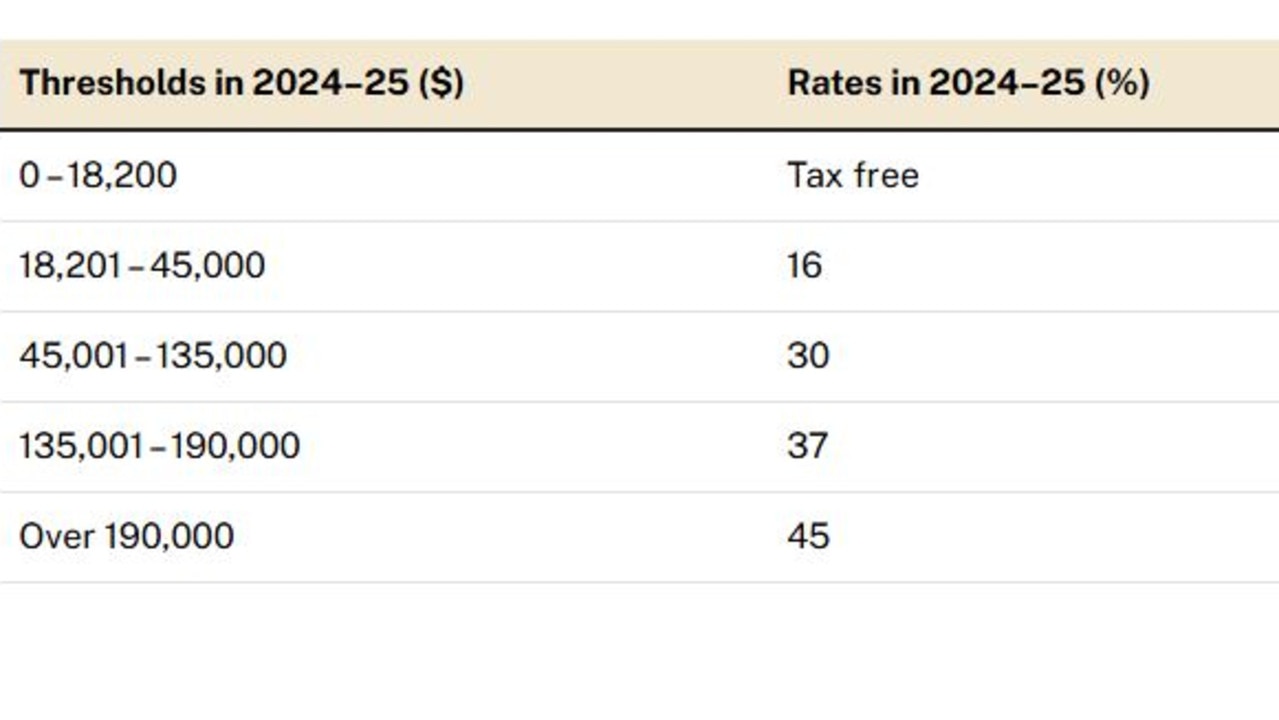

Under the Stage 3 tax cuts, a single 30 per cent rate was to apply to incomes between $45,000 and $200,000. Instead, the government sought to apply this rate to incomes between $45,000 and $135,000.

The existing 37 per cent rate, which Stage 3 was to abolish, was instead retained, and applied to incomes between $135,000 and $190,000.

The top rate of 45 per cent remained for incomes above $190,000, rather than the $200,000 level envisaged under Stage 3.

“Well again, we supported stage one, stage two, stage three of the tax cuts from when we were in government. Stage one and two in particular, stage three as well – all of it was designed to address the evil of bracket creep,’’ Mr Dutton said.

“So people are paying more tax each year as they get a pay rise, even if the tax rates stay where they are right now.

“I think when you look at people talk about lessons out of the US and the rest of it, I think when families are struggling, when small businesses are closing their doors, they want to know that a government is there to help, not hinder them.

“At the moment, the Albanese Government gas presided over three budgets, and they’re in a situation where they’re making it harder for Australians, not easier. I want to put downward pressure on interest rates, not upward pressure, and that’s exactly what the Reserve Bank Governor has been warning about.”