How to get the tax refund you deserve

TAX time is here again and there are plenty of ways to boost your annual refund from the taxman and get what you deserve.

IT’S time to tackle tax. Group certificates have arrived, shoeboxes are full of receipts and tax agents are clamouring for your business.

More than three-quarters of taxpayers receive a refund each year, worth an average $3600, but many miss out on more money by failing to claim everything they should.

Here are 20 tips to navigate tax time this year and potentially score a bigger refund.

1. PLAN OF ATTACK

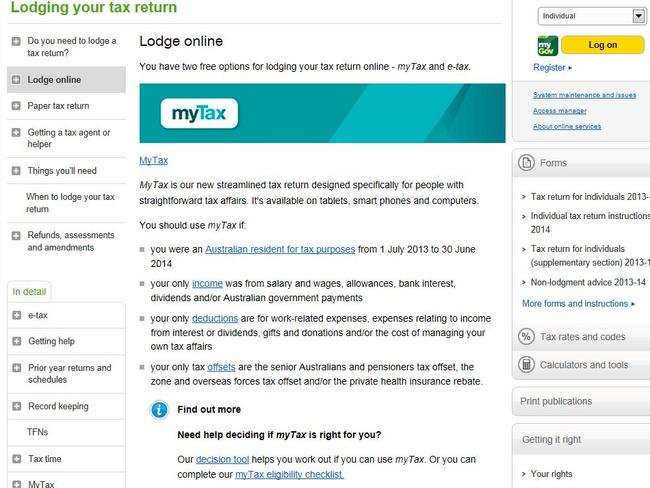

Decide who will do your tax. A tax agent typically charges $100 to $150, while a senior accountant may charge hundreds of dollars more. Or do you take the free, DIY approach and use the Australian Taxation Office’s eTax online lodgement software or its more basic myTax? If your tax affairs are complex, good advice is invaluable.

2. HIGH-SPEED RETURNS

ATO assistant commissioner Graham Whyte says myTax was launched last year and helped some users complete their tax return in 20 minutes. It automatically includes your financial data supplied by banks, employers and government agencies. “People can do their tax return in their pyjamas at home if they like,” Mr Whyte says.

3. KNOW THE RULES

The ATO has a mountain of information online about what you can and cannot claim, including specific guides for certain occupations, first-time employees and investors. Spending 20 minutes exploring ato.gov.au can give you plenty of new knowledge.

4. KNOW YOUR SPENDING

Go back through credit card statements and other bank accounts to search for any transactions that may be tax deductible. Every dollar you claim puts money back in your pocket.

5. WHAT YOU GET BACK

Remember that the entire tax deduction won’t be returned to you — only the percentage equal to your tax rate. For example, if your taxable income is between $37,001 and $80,000, your marginal tax rate is 32.5 per cent plus the 2 per cent Medicare Levy, so you’ll get 34.5c back for every dollar of tax deductions you make.

6. ACCOUNTANTS AREN’T WIZARDS

Tax accountants can’t conjure a big tax deduction if they don’t know what you spent your money on and you can’t prove you spent it. You are wasting your and their time if you visit them unprepared.

7. KEEP EVERYTHING

Receipts and other records are vital. For some people, the shoebox still works, while smartphone technology allows people to take photos of receipts. Finance commentator Justine Davies says it’s a good idea to keep digital copies. “The ink on most receipts fades, so be sure to scan them and keep a copy,” she says.

8. ‘APPY WITH TECHNOLOGY

Harness the power of technology. The ATO’s app allows people to record their receipts and other deductions with photographs, check the progress of their tax return and create a motor vehicle expense logbook. Its website has lots of calculators, while many accounting firms and tax agents also have online tools, checklists and calculators.

9. GENEROSITY REWARDED

You can claim a tax deduction for donations of more than $2 given to most charities. More people are donating online to workmates’ causes, so check your emails to see if you made any donations during the year that you have forgotten.

10. MONEY IN YOUR DRIVEWAY

If you used your car for travel between different workplaces, carrying bulky goods for work or attending conferences, you can get some money back. There are several ways to claim motor vehicle expenses and they vary in complexity, but the simplest is the cents per kilometre of work-related travel at about 65c per kilometre. However, you can’t claim for private travel to and from work.

11. HOME IN ON DEDUCTIONS

People who work from home — even if it’s only a few hours at night or on weekends — can claim deductions for a wide range of home office expenses. Ms Davies says these include stationery, computers, printers, software, office furniture, cleaning costs and a portion your energy and phone bills. “You can only claim the portion of these costs that specifically relate to work,” she says.

12. GET IN EARLY

Individuals’ tax returns aren’t due until October 31 but if you’re among the majority who will get a refund, why wait until then? The extra cash is better working for you than sitting at the ATO waiting to be handed back.

13. PERILS OF PRE-FILLING

While the ATO pre-fills your online return with bank interest, wages, share dividends and other data, it’s your responsibility to make sure it’s correct. In previous years people have had to wait several months for some investment fund data to flow through. Last year the ATO processed 450,000 amendments, usually for taxpayers who didn’t declare income.

14. EYE SPY

Cheating on your tax return will cost you. The ATO’s data matching technology compares your claims with the correct figures supplied electronically by financial institutions and government agencies. H & R Block director of tax communications Mark Chapman says incorrect claims must be repaid with annual interest around 9.5 per cent. “If the ATO believes that the taxpayer has acted carelessly, a penalty between 25 per cent and 95 per cent of the tax avoid may also be charged,” he says.

15. TAKE AN INTEREST

You must report any bank interest you received, but don’t forget to claim tax deductions for interest on investment loans for shares or property. Even if the interest gets added to your loan principal, you still paid it for tax purposes.

16. APPRECIATE DEPRECIATION

Property investors can grab a wide range of deductions, but the most lucrative is depreciation of fixtures, fittings and an annual deduction of 2.5 per cent of the building cost. It can add thousands of dollars to a tax refund and you don’t spend a cent to get it. Investors should get a depreciation report from a quantity surveyor — their fee will be more than covered by the extra money they get you.

17. SHARE THE LOVE

Dividends from shares usually come with attached tax credits for the 30 per cent tax already paid by the company. It’s great news for retirees and others who pay lower or zero tax. These franking credits can be refunded, and you can apply for them online, over the phone or with a paper form.

18. A FREE KICK

If you total claims are under $300, you do not need to keep written evidence for certain work-related expenses. However, the ATO says it “may ask” you to explain why the claim is reasonable. Experts say many taxpayers send in their returns with zero deductions despite this small lodgement loophole.

19. NO DOUBLE-DIPPING

The ATO has warned it is keeping a close eye this year on workers who double dip with their tax deductions. If your employer has reimbursed you for phone costs, meals or other items, you cannot claim a deduction for that spending.

20. AFTER YOU FILE

Don’t worry if you discover a small error after you have filed your return, as it’s now easier to get it sorted out. “For the first time this year, people are able to lodge amendments to their tax returns for 2015,” the ATO’s Mr Whyte says. You can check your tax refund’s progress online, and expect it to take at least a couple of weeks. “We work to a service turnaround of 12 business days,” he says.