Australian tourism, regional Australia in trouble if backpacker tax does not pass in the Senate today

A DEAL between the Australian Greens and the Government will resolve the deadlock over the backpacker tax.

A DEAL between the Australian Greens and the Government will resolve the deadlock over the backpacker tax.

The Greens earlier on Thursday said they supported Labor’s compromise of a 13 per cent tax rate, but they have now said they will support the proposed 15 per cent rate, giving the Government the numbers it needs to pass the bill in the Senate.

Richard di Natale said that what his party had negotiated was “a win for farmers, a win for the environment and an end to the uncertainty.”

It comes after a tense day for the Government, for tens of thousands of young overseas students fighting to stay in the country and for regional communities and businesses. Today is the final sitting of Parliament so time was running out for a decision to be made on what percentage Australia will tax these travellers.

The Coalition and Labor had been unable to reach an agreement, with the ALP initially wanting the tax to be as low as 10.5 per cent.

Malcolm Turnbull said Bill Shorten was prioritising “rich white kids from Europe” over seasonal workers from Pacific Islands who are taxed at a rate of 15 per cent.

#QT underway, #backpackertax first up, already **very** shouty. Joyce laying into Shorten "you're not worthy of the highest office" #auspol

— Anna Vidot (@AnnaVidot) December 1, 2016

There was plenty of discussion during the Senate sitting this morning. Backpacker tax anyone? 13 per cent is the figure looking most likely pic.twitter.com/4b47BbBdsp

— Rob (Robert) Keating (@RobKeating) December 1, 2016

If a decision had not been made today, backpackers would have been taxed 32.5 per cent beginning from January; sending most of them home, or further abroad to Canada, where the rate is much lower.

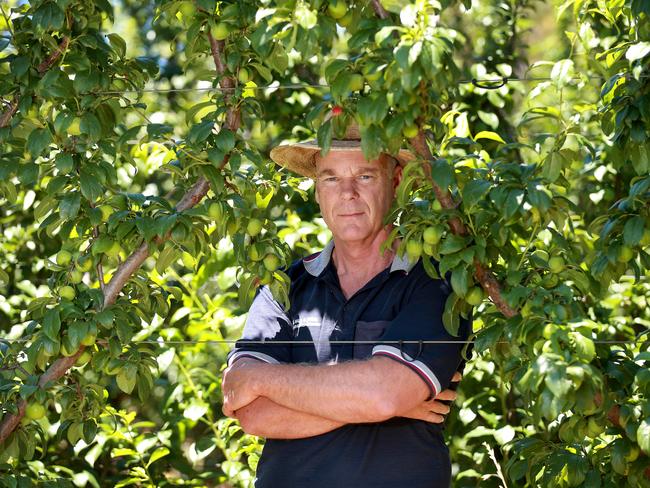

Losing these travellers has massive impacts on the tourism and regional industry.

“The backpacker tax is incredibly important,” the National Farmers’ Federation president Fiona Simson told news.com.au.

“It guarantees seasonal labour at a time when farmers need it the most.

“Farmers pick fruit, vegetables and cotton seasonally and the Australian work force is not keen to take on those roles, so we have for some years depended on the backpacker work force which has come in at the busy times.

“These people live in the regional communities, spent what they earned in regional communities and travel the country spending their money on Australian tourism.

“We remain a favoured option for backpackers by putting more money in their pocket here than in Canada and other destinations.”

All seemed relatively calm yesterday when the Government thought they had struck a deal with senators to lower the tax rate to 15 per cent, but in a surprise twist, crossbenchers Derryn Hinch and Rod Culleton sided with the Labor Party to back an even lower rate, at 10.5 per cent.

“Last night we had a meeting with Scott Morrison in his office and I said, ‘get a piece of paper, I will sign 13 now, you could have this up by 13 in the morning and it could be law by noon”. And he declined,” said Mr Hinch this afternoon.

But both Mr Turnbull and Treasurer Scott Morrison have dug in their heels at 15 per cent.

“Bill Shorten thinks rich kids from Europe should pay less tax than Pacific Islanders working here to send money back to their villages,” Mr Turnbull said today.

“They say a backpacker from Europe, a rich kid on holidays here from Germany or Norway, backpacking around, he or she should pay less (than) Pacific Islanders who come here to pick fruit during the season and is sending that money back to his village — some of the poorest countries in the world.”

Mr Turnbull was referring to the Seasonal Worker Program, where Pacific Islanders from Fiji, for example, come to Australia to work on the same farms. They are taxed a rate of 15 per cent.

The problem is, Mr Turnbull does not have enough votes in the Senate, and is relying on Senators Jacqui Lambie, Mr Hinch and Mr Culleton to vote in his favour.

Yet in a press statement, the trio called on the government to compromise and agree to a guaranteed, internationally competitive backpacker tax rate of 13 per cent.

Ms Lambie was not available for comment when contacted by news.com.au.

“The PM called me in to see if there is any negotiation we can do, any leeway and I just told him, no, 13 (per cent) is the top, that’s it,” Mr Hinch said in a statement earlier today.

“I put up another proposition last night to the Treasurer which we thought was a good one, and that was just postpone it until, say, August and then come in with your guns blazing and try it again, because that way this season’s crop all gets picked and we all go home and have a good Christmas.

“First of all, last night the Treasurer told me that was not on, and I said we will just keep putting things on the table and he said that’s not on.

“I asked why, because with the concurrence of the farmers, they would happily postpone it for some months for the election, so there is no reason why we couldn’t postpone it again.”

But Ms Simson says the tax rate is “about fairness, it’s not fair for backpackers to pay one rate, Pacific Islanders pay another rate and Aussies pay another rate.”

“For us it’s a critically important issue that we don't end up with 32.5 per cent.”

Ms Simson said a 15-19 per cent tax rate was “internationally competitive” despite Ms Lambie claiming 13 per cent was an internationally competitive price.

Labor defended its plan for the 10.5 per cent rate.

“The combination of super tax and the tax rate means the effective tax rate for backpackers under Labor’s compromise of 10.5 per cent is higher than for the Seasonal Worker Program, as these workers are not subject to the same superannuation clawback arrangements,” shadow treasurer Chris Bowen said.

Yet while politicians continue to argue, farmers’ anxiety continues to grow, with the fear a stalemate will lead to the worst possible outcome. Too many crops and not enough hands to pick them. The domino effect will see regional businesses and communities suffer.

“What we really want is a resolution, we don't want to walk out of here with 32.5,” Ms Simson.

“Labor’s position is difficult to understand, they’ve come into this discussion quite late, they’ve only entered the discussion in the last 18 days, despite this issue being on the table for 18 months.”

Backpackers tend to be university students from overseas. They tend to be from Europe, specifically France, Germany, Switzerland and the UK, and they tend to be either uni graduates or part way through their degree.

“It's a completely different scheme to the Seasonal Worker scheme where we get people from Fiji and undeveloped countries and work hard and save everything they make and send home,” said Ms Simson.

“Backpackers spend everything they make here.”

All industries in #NorthernAustralia are reliant to a large extent on #backpackers not by design, its just a matter of fact #backpackertax

— NTFarmers (@NTFarmers) December 1, 2016

The Senate isn't here to rubber stamp bills. The majority of the Senate don't want the 15% backpacker tax. Negotiations continue #auspol

— Senator Rod Culleton (@SenatorCulleton) December 1, 2016

Clock ticking to avoid #BackpackerTax. Pls contact @HumanHeadline, @SenatorCulleton & @JacquiLambie. Tell them 15% is competitive & fair! pic.twitter.com/OjVxsh3lXU

— National Farmers Fed (@NationalFarmers) December 1, 2016

I voted to improve the #backpackertax to ensure Australia is internationally competitive #auspol #politas pic.twitter.com/boEqhAd6tn

— Jacqui Lambie (@JacquiLambie) November 30, 2016

I offered ScoMo two deals: A 13% tax or, until August, take off table and let this season’s crop be picked. He rejected the latter

— Derryn Hinch (@HumanHeadline) November 30, 2016