Gold price hits new record of $2,160 as Chinese buyers hedge their bets

Gold is surging and has hit a new record in world history but it’s not for the reason you might think.

The price of gold has just hit a record high but at first it had experts baffled as to why.

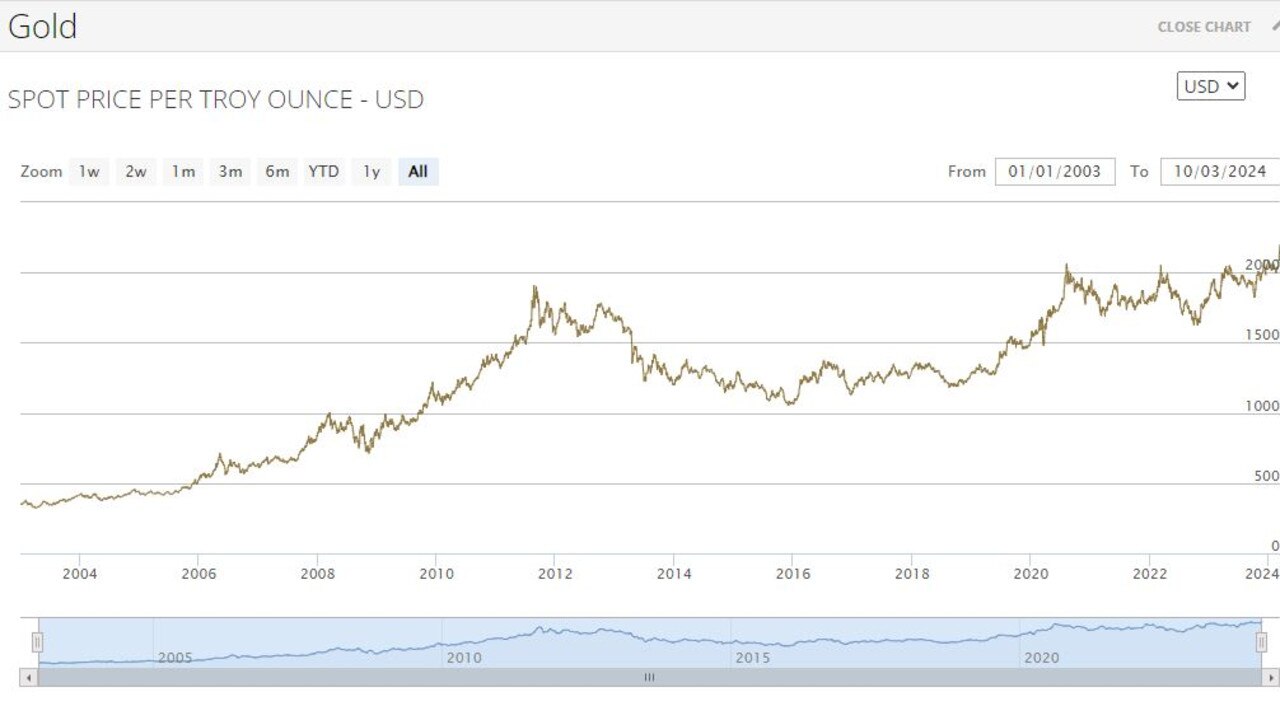

At the end of last week, gold hit a record of US$2,160 per troy ounce.

While that might mean nothing to you, for comparison, that’s up 8 per cent from the previous record set in December, when the price came in at US$2,135.

In the current market, at first glance, the sudden gold rush makes little sense.

Gold usually rallies in times of conflict and volatility, but nothing changed drastically in the world in the past seven days.

And with inflation impacting the globe, gold doesn’t seem an ideal investment candidate.

Gold doesn’t give the purchaser any interest. As a result, the average buyer doesn’t typically buy gold in a cost of living crisis.

But China is defying the odds.

Chinese buyers are driving the surge in gold.

It’s not just individual Chinese citizens, but also the country’s central bank.

According to Bloomberg, central banks in “emerging markets” have bought up gold at record levels.

And you guessed it – China is leading the charge.

The reason is simple – China is losing faith in its economic structures.

Chinese citizens are stockpiling gold coins, bars and jewellery despite the high prices, to hedge their wealth against inflation and also the country’s turbulent stock market and property sector.

In January, Chinese property juggernaut Evergrande plunged into liquidation with $A498 billion worth of debts.

This sparked fears of a ‘contagion’ spreading and indeed, more property giants fell in quick succession, including Country Garden, another multi-billion dollar developer.

In 2023, China’s housing sales fell 6.5 per cent, according to Dongxing Securities, a Chinese investment bank.

Analysis from Dongxing Securities found that in December alone, China’s property sales were down a whopping 17.1 per cent from a year earlier as people turned away from housing as a sure investment, and found other vehicles to put their money.

At the same time, just as purchases slowed, so too did new developments. The number of building projects being undertaken dropped by 9.6 per cent in 2023.

Gold is an age-old hedge against the eroding effects of rising prices due to inflation.

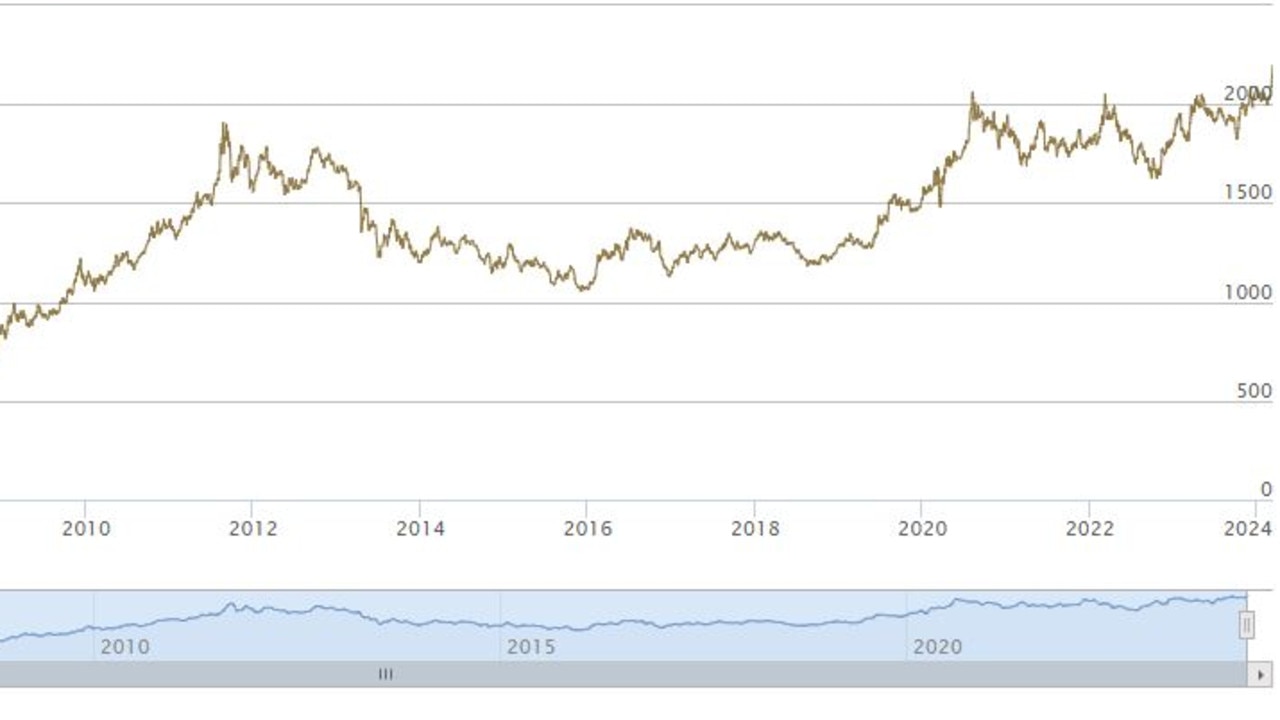

Since 2000, gold has risen more than 600 per cent.

But with money adjusted for inflation, the technical all-time record was set in January 1980.

At the time, gold hit a high of US$850 which is equivalent to more than US$3,000 in today’s dollars.

During the Covid era, in 2020, gold surpassed the $2000 mark for the first time, and has remained above that ever since.