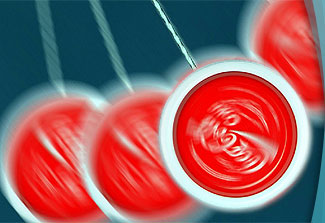

Follow the stairs, not the yoyo

THE share market has often been described as like a man walking up stairs while playing with a yoyo, writes Anthony Keane.

Follow the stairs, not the yoyo

THE share market has often been described as like a man walking up stairs while playing with a yoyo.

While the yo-yo constantly goes up and down, if you watch the overall trajectory of the stairs you will see it always goes higher.

Today's share market downturn might tempt many people to think that the man has fallen down the stairs and is lying in a bloodied heap with his yoyo on the concrete below.

But this bear market is nothing new. While there have been a few casualites that might not recover - such as Centro Properties, Allco Finance and ABC Learning Centres - anyone who is invested in a diverse range of major companies should do well in the long-term.

Of course, the fall has been the heaviest in 17 years. That probably has something to do with the rapid rise of margin lending over the past decade that allows people to borrow against their shares to buy more shares.

People who aggressively took out margin loans in recent years have not only lost much more of their money than the average investor, but have also been forced by their lenders to sell shares at the worst possible time. While this has made the downturn more painful than it perhaps should have been, it does not spell doom for the share market as some people like to believe.

The companies that have come close to collapse in recent months were all very aggressive players and borrowed heavily to fund their rapid expansion, which came unstuck because of rising interest rates. They are not blue-chip companies.

Blue-chip companies include Woolworths, which sells all the necessities we need to survive. Nobody stops buying milk or toilet paper when financial markets go bad.

The Commonwealth Bank leads the nation in home loans and has huge online stockbroking and superannuation businesses.

BHP Billiton is the world's biggest mining company and is expected to continue feeding insatiable demand from China for decades.

Look at other major companies. Telstra owns the phone lines. Toll Holdings owns the trucks. Westfield owns the shopping centres. Woodside Petroleum owns the oil.

Doom for the share market would mean doom for all these companies. And if that happened, the least of our worries would be losses in our superannuation or share portfolios.

Just remember to watch the stairs, not the yoyo.

*The author owns Woolworths and BHP shares.