Fall of Netflix and Zoom share prices shows why ‘boring’ could be best

Netflix, Zoom and Amazon are all struggling in the share market but there’s on type of stock that seems to be holding firm.

ANALYSIS

A wave of repricing is coming through the markets as inflation rises. But not every company is going to get hit by the wave in the same way.

One way to judge whether the wave will help or hurt your investments is by looking at how boring they are.

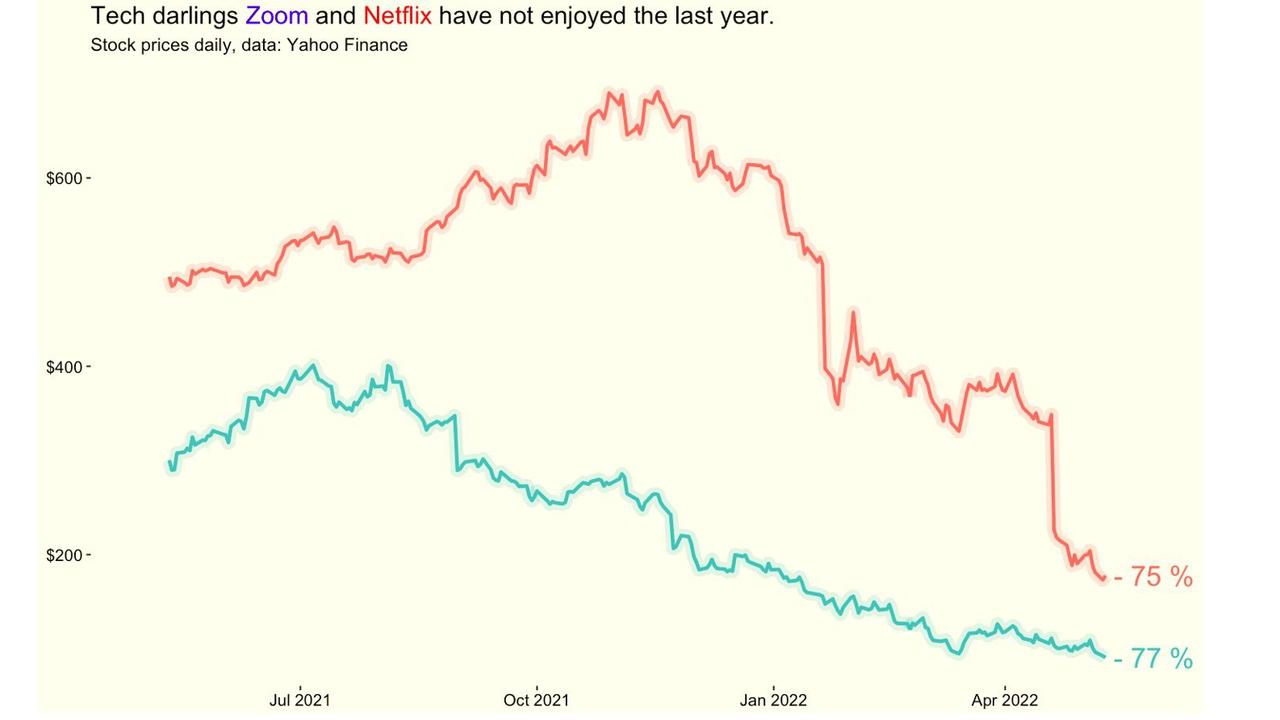

Netflix and Zoom: Exciting assets with new business models and incredible growth opportunities? These assets are now going down the toilet.

But boring assets, ones your grandpa was investing in by ringing up a stockbroker on his home phone in 1992? Many of these have been OK.

• Coles, up 14 per cent in the past year

• QBE insurance, up 17 per cent in the last year

• Commonwealth Bank, up 7 per cent in the last year

Put another way: If you were in Tesla, it might be time to consider Telstra. If you were in NFTs, it may be time to have a look at NAB.

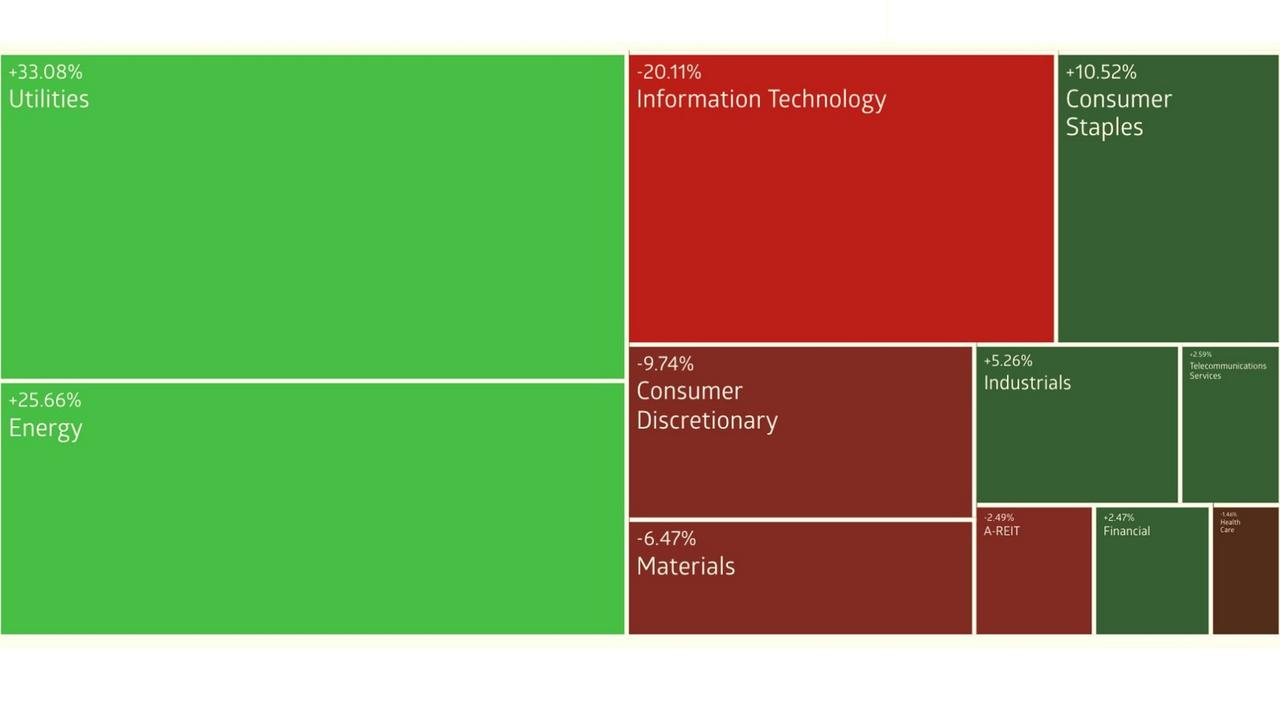

The next heatmap shows ASX sectors over the last 12 months. Consumer staples are beating consumer discretionary, but IT stocks are the real losers.

Energy and utilities – safe boring companies nobody has thought about much recently – are streaking ahead.

Crescat Capital calls the recent era “tech bubble 2.0” but it also says the whole market is overpriced.

“Easy-money policies and excess liquidity have created one of the worst asset valuation distortions in history,” reads its April monthly newsletter.

What does that mean?

The market is driven by macro forces, and those are changing once again.

The era of strong Chinese growth, cheap Chinese goods, low inflation, low interest rates, quantitative easing and high asset prices could be coming to an end.

It’s probably hard to remember that capital markets were once hard to win at because capital was scarce. Not every new company went up. Markets rewarded CEOs who were good at business, not good at Twitter. And companies went public because it was hard to get funding any other way. Now funding is abundant for public and private companies. Venture capital became mainstream.

It’s hard to overstate just how much money is sloshing around out there, propping up the value of companies.

Instagram sold to Facebook for just $US1 billion in 2012, and that seemed like a lot at the time. But just two years later Facebook bought WhatsApp for $US19 billion. What counts as a high valuation changed dramatically. Now Apple is worth over $US2.5 trillion ($A3.6 trillion). Elon Musk is paying $US44 billion ($A61.4 billion) for Twitter, apparently. A company that makes almost no money.

Where have all these high valuations come from? Well. Let’s look at the balance sheets of central banks. They have been printing money and trading it for assets (mostly bonds).

When they do that, the ratio of money to assets in the world goes up. Just like at the end of a game of Monopoly when everyone has passed Go a lot of times and the bank is nearly empty. Your stacks of Monopoly money are so fat you can’t even tuck the edge of them under the board any more and suddenly your sister wants to sell you Old Kent Road for $2000. This is asset price inflation.

Where does the money go? Recently it has gone to the exciting assets. At first it was because the high-growth companies like Amazon represented a good investment idea in times of low interest rates and low inflation. If you’re looking at a 0.1 per cent return on a 10-year bond, you might as well put your money in an early stage, high-growth tech company that also won’t pay out much in 10 years but could go boom thereafter.

Exuberantly

But eventually so many tech assets got such high valuations that popularity drove popularity. Investors piled in, founders followed, more investors came after, and you ended up with the NASDAQ at a record, hundreds of crypto assets, dozens of buy now pay later brands, way too many streaming services and rideshare companies, too many of which are valued as though they are the one that will dominate the market.

Now central banks are shrinking their balance sheets, swapping back the assets for money. Less money chasing more assets.

Here’s what the RBA governor said the other day when he raised interest rates.

“The board expects the [Reserve Bank’s] balance sheet to decline significantly over the next couple of years as the Term Funding Facility comes to an end. The board is not currently planning to sell the government bonds that the bank purchased during the pandemic.”

You can read that like this: We are letting our balance sheet shrink – but not too fast as we know that could be brutal.

If we enter a world where growth is slow and capital is scarce, what happens to companies that attracted capital because they had large addressable markets, charismatic CEOs and exciting growth plans? The answer is they need to pivot to making profit – or suffer.

This is why Netflix is raising prices and bringing in ads. Expect to see similar from all sorts of hot companies.

Amazon proudly announced it wouldn’t do that. In its 2021 shareholder letter it said: “We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.”

The market responded by dumping Amazon stock. It is down 32 per cent this year. I’m fascinated to see whether Amazon sticks to its line about the long-term or not. My guess is the company will keep saying it, but whether it also cranks up margins to keep Wall Street happy will be the true test.

What happens to assets that make no profit, like NFTs and crypto?

The answer is they have been getting killed and it is happening in the order of most exciting to most boring. The best performing major crypto is bitcoin, down just 25 per cent in three months. A coin like solana is down 38 per cent in the same period, as the heatmap below shows.

Dogecoin is down 52 per cent. Plenty of NFTs are down 99.9 per cent.

The answer, in the current environment, is to consider pivoting.

The tech whiz kids may well have had their day. Go ask your grandpa for stock tips.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology