Falling stock market could signal start of global recession

Six different shocks at once, focused on the world’s three largest economies, mean the prospects of a global recession are rising fast.

For the past several years, investors enjoyed a historic rally in stock prices.

But, more recently, global stock markets have begun to lose altitude and, the most high-flying of all, the American S&P500 is fast approaching the threshold of a -20 per cent bear (falling) market.

And it is six separate storms which have hit the world’s three biggest economies that are leading us fast towards a global recession.

Why has this happened and what lies ahead?

We can break the question into two parts. What is happening to earnings? And what is happening to the price investors are prepared to pay for those earnings?

Let’s take the second part first.

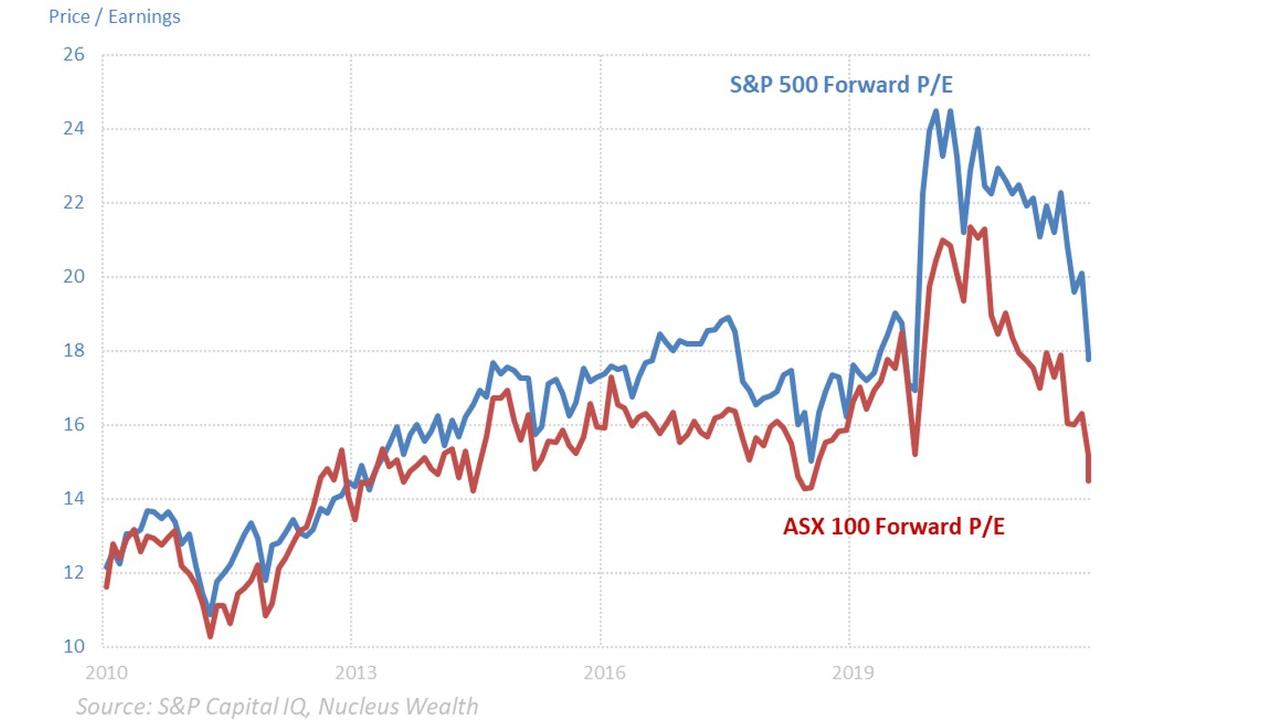

During Covid, stock markets were supported by a deluge of free money. This has now begun to be withdrawn and that affects the price multiple of stocks (ratios of a stock’s market price to some measure of fundamental value per share).

The price multiple is also being driven down by rising inflation and yields. This forces markets to privilege shorter-term definite earnings instead of bidding on prospective profits of speculative companies.

The price multiples for international and local stocks have come down significantly already.

That’s the easy part of the equation. The tougher part is what is happening to the profits of companies.

This is impacted by many variables such as inflation, competition, margins and demand. But the most important for the entire asset class of stocks is economic growth.

The global economy is being hit with six different shocks at once, focused on the world’s three largest economies, and the prospects of a global recession are quickly rising.

China, Europe and the US

In China, a property market crash and Omicron lockdown have gutted domestic demand. The lockdowns will end but the prospect of a weak recovery is obvious given reopening will also liberate the virus, leading to more restrictions.

In Europe, war and an energy shock are damaging both demand and supply. European consumer confidence is struggling amid Ukraine chaos and soaring energy prices from the same have already shut down some industries.

In the US, inflation has taken root much more deeply than elsewhere and the central bank is determined to snuff it out by downsizing demand to fit with the limited labour supply. This is leading it into a series of 50 basis point interest rate hikes that will, sooner rather than later, damage household consumption.

When that happens, demand weakness will spill over as an export shock in Europe and China, compounding their problems.

Thus the macro question of top-down earnings growth is not promising, either, and so markets are beginning to discount a significant slowdown in profits growth if not outright contraction.

So, both price multiples and earnings prospects are under pressure – which is enough to deflate stock markets.

We need to add one more peculiarity of this cycle to understand the speed of the correction.

Growth in heavily financialised economies like that of the US tends to follow asset prices because the credit issuance that drives them is so central to all activity.

The US has not seen an inflation breakout in 20 years. Over that span, the centrality of asset prices to growth has grown substantially because money was so cheap.

So, now that Federal Reserve is fighting inflation head-on, it needs to deflate asset prices front and centre if it is going to curtail the labour market.

But whether this is a temporary quirk or a complete paradigm shift to a more difficult era for asset prices, only time will tell.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.