Bitcoin price stabilises after Elon Musk’s $1.9 billion investment

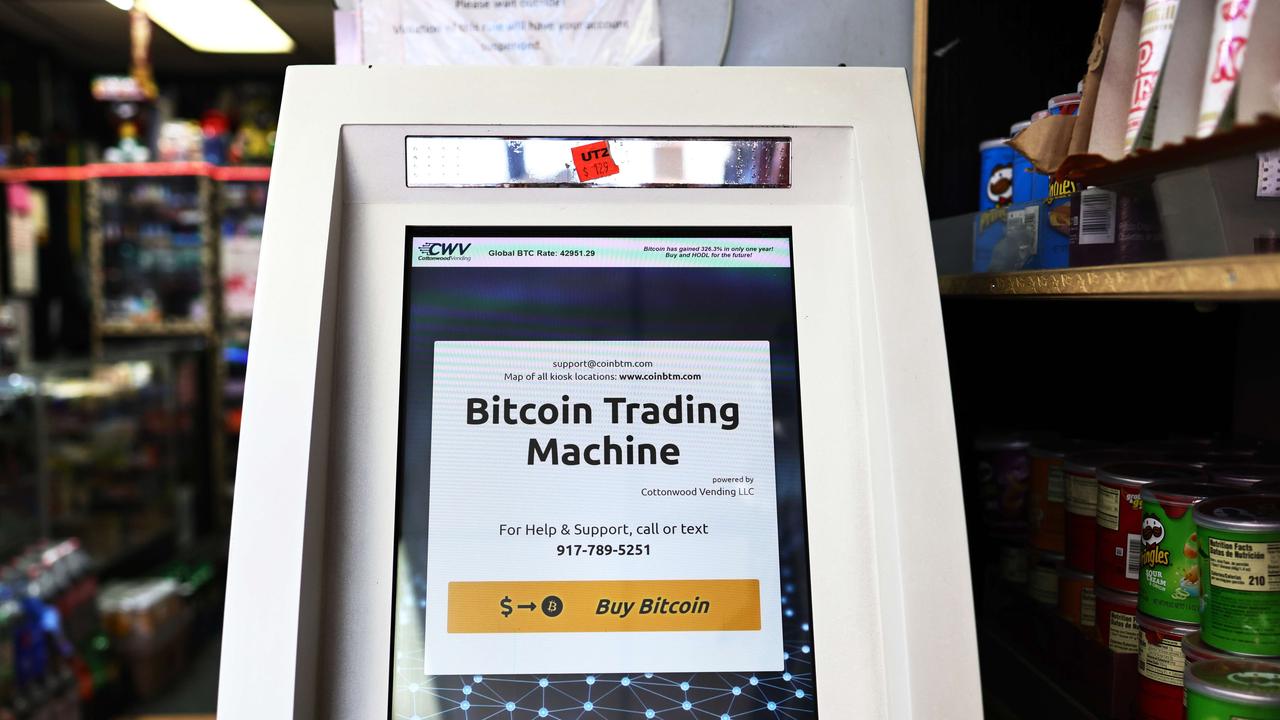

The price of bitcoin is sitting at a stable $62,500 a coin after Elon Musk’s mega billion-dollar move saw the cryptocurrency’s value rocket.

The price of bitcoin has temporarily stabilised after Elon Musk’s $US1.5 billion ($A1.9 billion) saw the cryptocurrency’s value rocket.

A single bitcoin is currently worth more than A$62,500 as investors race to take advantage of an inevitable post-Musk surge.

In a statement earlier this week, Tesla revealed it would soon accept payments in bitcoin, and the world’s richest man admitted the firm had made a massive investment of its own in the surging online currency.

Crypto market watchers now believe a wave of Silicon Valley billion-dollar investments could spark another surge, with Twitter among several companies rumoured to be planning a Tesla-style share purchase.

Meanwhile another tweet from Musk sent another cryptocurrency soaring after he described the once-mocked dogecoin currency as “the future”.

The coin, which began as a joke in 2013, has surged in value by 1250 per cent over the past year after a huge number of investors decided to simultaneously pump cash into the coin to make it a legitimate trading option.

RELATED: The ‘absurd’ rise of joke bitcoin rival

RELATED: $86 million locked in bitcoin password

TESLA PURCHASE PROMPTS MOVEMENT

Tesla’s recent exploration of the crypto realm is believed to be prompting movement from bitcoin whales; individuals or entities who hold huge amounts of the cryptocurrency.

An anonymous crypto user moved 2292 bitcoin from crypto exchange Coinbase to an unknown wallet today, Finance Magnates reported.

The total value of the transaction stood at around $131 million.

Whale traders can influence markets by transferring the currency from exchanges to wallets, in an effort to create a supply shortage.

BITCOIN HITS NEW HIGH

Bitcoin hit a record high after two major US financial institutions announced they would accept cryptocurrency.

MasterCard said on Wednesday that later this year it would begin moving cryptocurrencies directly across its card payments network.

Then on Thursday, Wall Street player BNY Mellon announced plans to accept digital currencies.

BNY Mellon, which is known as the oldest US bank, said it will form a new digital assets unit to transfer, safeguard and issue digital assets in response to client demand.

UBER WON’T BUY BITCOIN

Meanwhile, Uber’s CEO has “quickly dismissed” the idea of buying bitcoin with corporate cash.

Dara Khosrowshahi told CNBC on Thursday the company planned to keep its cash safe, as it wasn’t “in the speculation business”.

However, he left open the possibility of Uber eventually accepting cryptocurrencies as payment.

“Just like we accept all kinds of local currency, we are going to look at cryptocurrency and/or bitcoin in terms of currency to transact,” he said.

Mr Khosrowshahi said this kind of move was “good for business”.

TWITTER CONSIDERING BITCOIN

Twitter’s chief financial officer Ned Segal has said the social networking service is considering whether to hold bitcoin on its balance sheet.

In an interview with CNBC on Wednesday, Mr Segal said the company had been looking at whether it could pay vendors or employees using the cryptocurrency.

“We might consider whether we would be transferring dollars to bitcoin at the time of the transaction or if we wanted bitcoin on our balance sheet ready to complete that transaction,” he said.

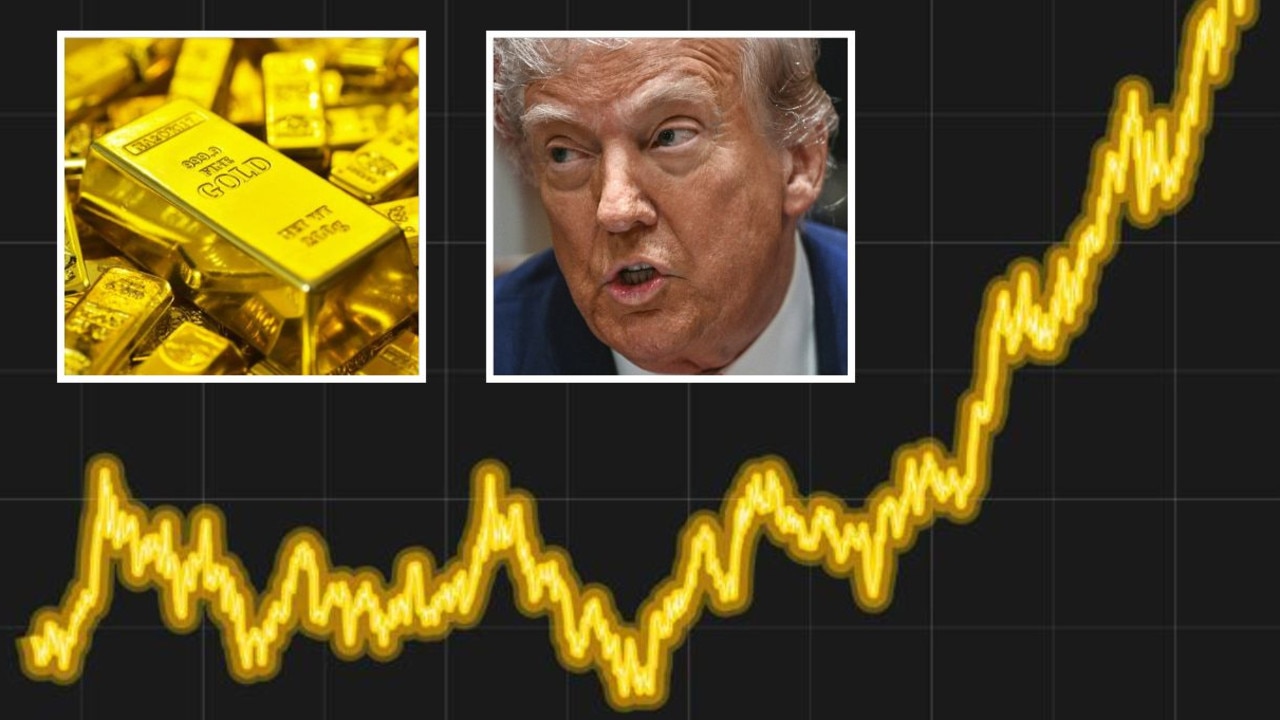

INVESTORS CONSIDER GOLD OVER CRYPTO

One of the world’s leading gold miners has said the rapid rise of cryptocurrencies should be a prompt for investors to consider buying gold.

Newcrest Mining CEO Sandeep Biswas told Bloomberg TV that bullion may “act as a bit of a hedge against the volatility of cryptos”.

While the two assets were distinct, Mr Biswas said they were complementary; owning bullion could benefit cryptocurrency holders as it was more stable.

“Gold is a different class of investment,” he said.

“It’s a tangible asset: You can see it, you can touch it, you can feel it, you can mould it, you can make it into jewellery, whatever you want.”

This article originally appeared on The Sun and was reproduced with permission