Woman’s $80,000 salary sacrifice nightmare

A healthcare worker who used salary sacrificing to lease a car has spoken up with a warning about hidden fees that pushed her to “the edge of bankruptcy”.

EXCLUSIVE

A healthcare worker whose salary sacrificed car lease cost her close to double the value of the car and pushed her to “the edge of bankruptcy” has issued a stark warning over the finance products.

Adelaide woman, Kim Van De Heuvel, 58, said that by using novated leasing, she was given a loan she couldn’t afford and paid almost $80,000 for a $41,000 car after incurring hidden fees and charges.

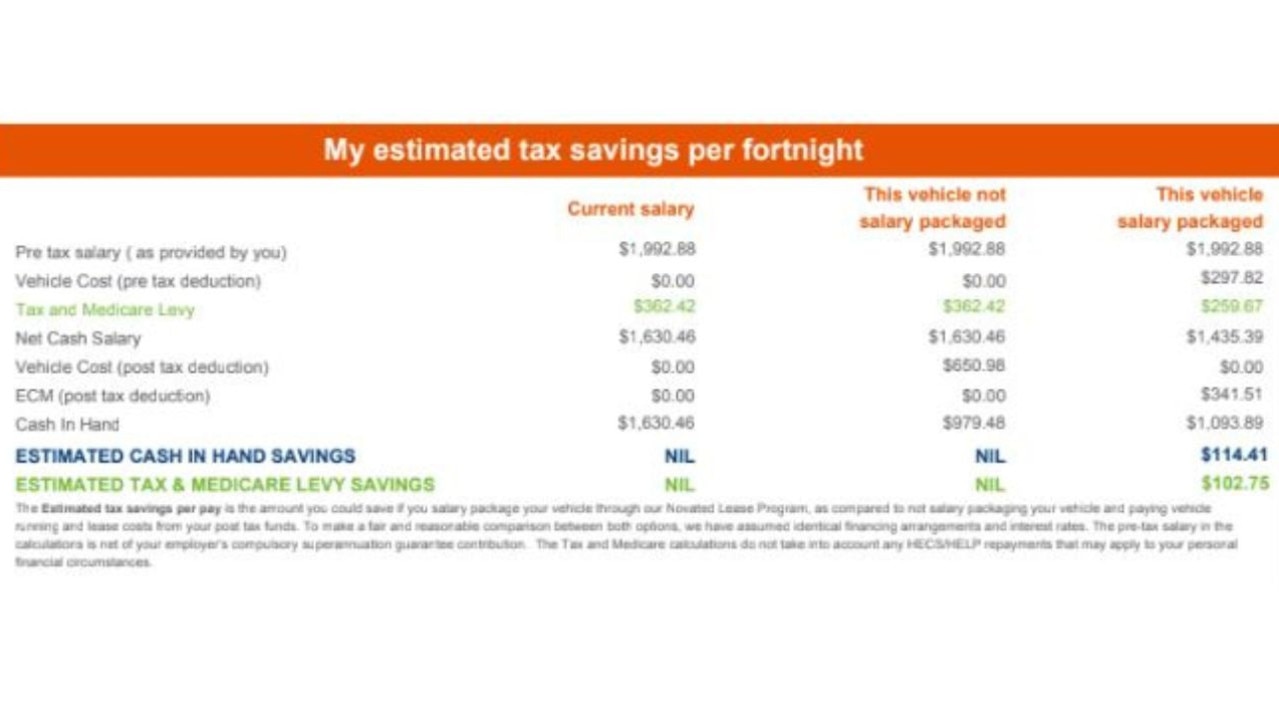

Novated leasing is a three-way finance arrangement between an employee, their employer and a leasing company that allows employees to part-pay for a new car lease from their pre-tax salary under a salary sacrificing arrangement, with the remainder payable from their take-home pay.

It’s pitched as a way for workers to reduce their tax payable, while also scoring a new car.

Have a similar story? | michelle.bowes@news.com.au

In January 2018, Ms Van De Heuvel was approved for a $49,000 lease on a 2017 Nissan Navara, despite the fact that she was only making $50,000 a year at the time.

“I was surprised when they approved it because there’s no way I would have got that loan from a bank,” she told news.com.au.

By August, she found she couldn’t keep up with the payments and negotiated to have them reduced by extending the lease agreement.

After making three financial hardship claims, borrowing money from her parents and being on what she describes as “the edge of bankruptcy”, Ms Van De Heuvel sought help from consumer financial advocates GetMyRefund.

“They [GetMyRefund] found all kinds of stuff when they went through it,” she said.

Founder of GetMyRefund, Carly Woods, told news.com.au that novated leases are a problematic financial product that her company is receiving an increasing number of complaints about, and are responsible for “landing thousands of Australians into debt they should not be taking on”.

Ms Woods said salary sacrificed novated car leasing is a common perk offered to essential workers such as nurses, police, and defence force personnel as well as being widely available in corporate Australia.

She added that novated leasing companies often target workers that are “not that well paid” and that they “prey on naivety”.

Among the problems identified by Ms Woods, novated leases usually package up many extras along with a vehicle including comprehensive car insurance, lease protection insurance, gap insurance, extended warranties, roadside assistance, servicing and maintenance, fuel, tyres and ‘incidentals’.

She added that in many cases, cheaper alternatives for these extras were available on the open market.

A closer examination of Ms Van De Heuvel’s lease, seen by news.com.au, showed that while the fortnightly repayments on the vehicle were initially set out at $430 before GST, that figure increased to $639 before GST when extras like insurances, fees, fuel, and ‘incidentals’ were included.

The fine print shows these ‘incidentals’ to be car washing and detailing.

In total, these extras cost her more than $6,500.

Ms Woods also cited an example of another worker she has helped, who had incurred $9,500 in fees, interest and add-on products on top of a $52,000 car loan.

“We’ve seen leases with five sets of tyres that they’re paying for on top of the other costs and they’re only doing 12,000km a year.”

Ms Woods said that in addition to these types of extras, novated leases typically came with fees such as brokerage, break fees and charged “extremely high” interest rates.

“We have seen sometimes that it is cheaper to buy a car on a credit card,” she added.

Ms Woods said that because novated leases are considered a commercial finance product “they don’t actually have to stipulate things on the contract that have to be on consumer contracts”, a situation she describes as a “loophole”.

Product quotes highlight the tax savings while the fees and costs involved are less transparent, and Ms Woods added that the interest rate being charged is not required to be disclosed on the quote.

Many customers are also caught out by end-of-lease costs such as balloon or residual payments, resale value guarantees or disposal fees, which she added can “cost thousands in additional charges”.

In Ms Van De Heuvel’s case she was faced with a residual payment at the end of the lease of almost $12,000.

She said that if she had fully understood the terms of the lease she would never have agreed to it.

“I was naive, I admit, I’m a bit of a battler,” Ms Van De Heuvel said.

She added that despite being “a bit embarrassed” that she had landed in financial trouble, she was speaking out because “I just don’t want anyone else to be in this situation”.

In total, it took her five years to extricate herself from the financial situation which she said “almost broke me”.

“When I finally paid it off, the loan was sitting at almost $80,000, nearly double what the loan was originally worth.”

Have a similar story? | michelle.bowes@news.com.au