Financial crunch causes surge in instant noodle sales

The global cost-of-living crisis has created a sales surge for one particular pantry staple, with shoppers turning to the item for a cheap meal option.

As a cost-of-living crisis grips the globe, a shift in culinary preferences is becoming evident. A prime example of this trend is the rising global demand for the humble instant ramen, a pantry staple known for its simplicity and affordability.

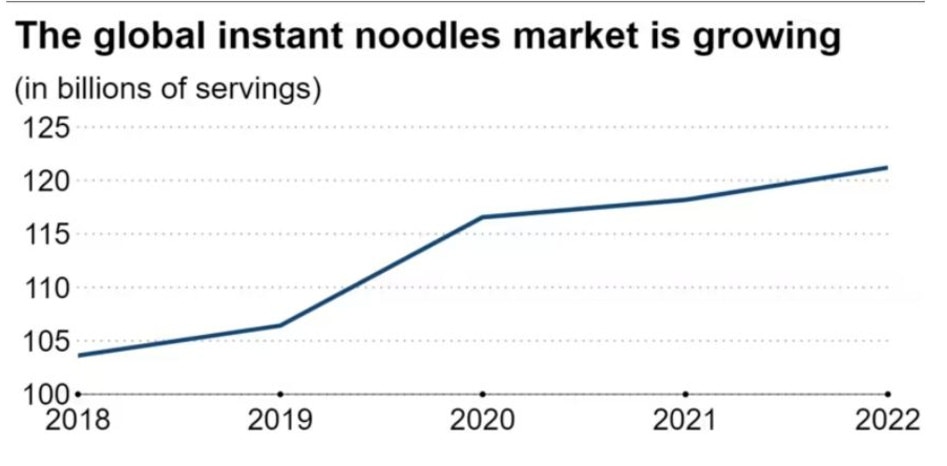

According to the World Instant Noodles Association, 2022 saw record consumption of 121.2 billion servings of instant noodles worldwide.

This marked the seventh consecutive year of growth, a trend largely fuelled by escalating food prices due to inflation.

The economic crunch has led consumers, especially from the middle class, to seek cost-effective alternatives, making instant ramen an increasingly popular choice.

“Middle-class consumers who did not eat instant noodles before are now incorporating them into their daily lives” instant noodle maker Nissin Foods told the Nikkei business paper.

In Australia, the trend mirrors the global pattern.

The demand for instant noodles locally has increased steadily, from 400 million servings sold in 2018 to 450 million in 2022.

This equates to over 17.5 servings per capita annually, indicating a significant growth trend in the Australian market.

Instant noodles retail in Aussie supermarkets such as Coles and Woolworths for as low as $1.00 per single serve, or $3.95 for a pack of five.

In countries with no traditional noodle-eating culture, such as the United States and Mexico, there has also been a notable increase in instant ramen consumption.

In Mexico, demand surged by 17.2 per cent in 2021 and continued to grow by 11 per cent in the subsequent year.

The US market saw a 1.4 per cent decline in instant noodle sales in 2021, but sales rebounded with 3.4 per cent growth in 2022.

Japanese companies like Nissin Foods and Toyo Suisan, leading players in the instant noodle market, are responding to this surge in demand.

Nissin Foods has announced a US$228 million (A$348 million) expansion in the US, including a new factory in South Carolina, while Toyo Suisan is increasing its flavour range to fit global tastes.

“The number of consumers who regularly eat instant noodles is going up, and we will increase our variety of flavours moving forward,” Toyo Suisan said.

However, the cost-of-living crisis has not spared the instant noodle industry itself.

In Japan, major noodle manufacturers have had to increase prices by about 10 per cent in 2022 and again in 2023, responding to the rising costs of ingredients and packaging.