$344 billion crypto price plunge: Why Bitcoin, Ethereum, Cardano, Solana have dropped

A panicked mass sell-off overnight has sparked one of the biggest price drops in cryptocurrency history. And China is to blame.

Cryptocurrency has taken another substantial hit overnight, wiping $344 billion off the market in a single 24 hours after panicked buyers sold off their tokens.

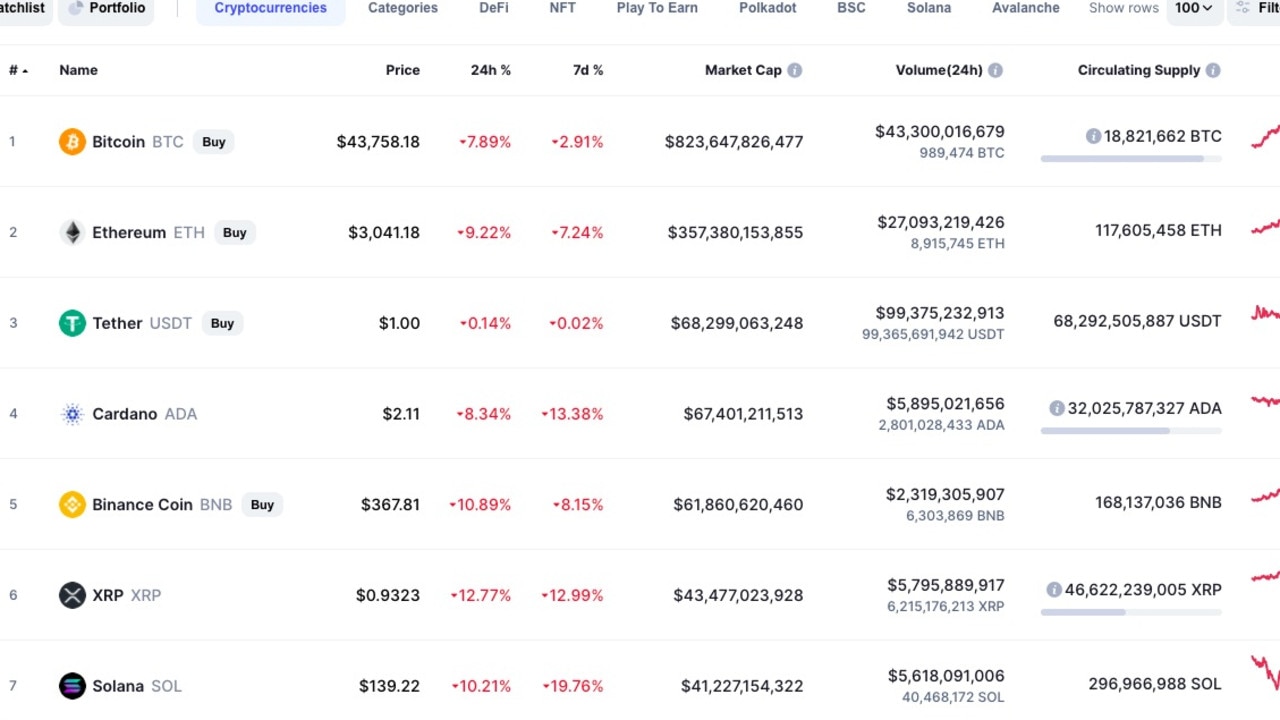

The top cryptos — bitcoin, ethereum and cardano, binance as well as the emerging Solana — all fell by as much as 12 per cent.

At the peak of the mass sell-off, bitcoin dipped nine per cent to US$42,669 while ethereum also plummeted by around nine per cent to a low of US$2,940.

That was the lowest both coins had been since early August.

The two coins now sit slightly higher, at US$43,578 and US$3042 respectively, at time of writing.

Binance dropped by more than 10 per cent while Ripple XRP fell by a staggering 12 per cent.

Even cardano and solana — which have mostly remained immune to other price drops — both plunged by about 10 per cent at the height of the sell-off.

The market capitalisation of the combined world‘s cryptocurrencies dropped by $2.62 trillion, more than 10 per cent, according to Forbes.

There is one clear and simple reason for the panicked sell-off: China.

Evergrande, China’s second largest property developer, is on the brink of collapse and is billions of dollars in debt, with its lenders threatening legal action.

It owes $413 billion to creditors and has contracts to build as many as 1.6 million apartments.

Its shares have plunged more than 80 per cent this year in what an expert earlier dubbed a “death spiral”.

In the last 24 hours, Evergrande’s shares dropped by a whopping 19 per cent, the lowest it has been in 11 years.

Since then it has recovered slightly, closing at 10.2 per cent lower in the Hong Kong market on Monday.

Jonas Luethy of digital asset broker GlobalBlock told Forbes that he believed the cryptocurrency sell-off was because panicked digital coin holders feared that the collapse of Evergrande would affect a broader market.

Monday blues! Hang Seng Index drops 3% as #China worries related to #Evergrande, the second-biggest property developer in China with about USD 300 billion in #debt, spike. pic.twitter.com/mj7jHTyFvK

— jeroen blokland (@jsblokland) September 20, 2021

September isn’t shaping up to be a good month for cryptocurrency.

This is the second time the digital coins have taken a huge dive, and for a completely different reason.

Earlier this month, the price of bitcoin dropped by a staggering 10 per cent, and this had flow-on effects to other cryptocurrencies such as ether and binance.

The massive price crash on September 7 came as El Salvador became the first country to introduce bitcoin as legal tender.

Although the country’s radical move at first buoyed the market, it soon sent bitcoin plummeting after the country had to pause digital wallets because of a glitch.

Ethereum, cardano and binance recorded even sharper falls than their bitcoin counterparts.

The three digital coins plunged between 13 per cent and 18 per cent earlier this month.