China Evergrande Group is on the brink of default and it’s bad news for Australia

One of the biggest property developers in China is at risk of defaulting on billions of dollars of loans – and it’s bad news for Australia.

Evergrande, one of China’s biggest property developers, is on the brink of collapse – and it could mean bad news for Australia.

The company owes hundreds of billions of dollars, and creditors are beating down the doors.

As one expert described the property developer as being in a “death spiral”, Evergrande this week warned it could default on its substantial debts. It has about $408 billion in total liabilities.

“The group has risks of defaults on borrowings and cases of litigation outside of its normal course of business,” the Shenzhen-based company said in a recent earnings statement. “Shareholders and potential investors are advised to exercise caution when dealing in the securities of the group.”

SCRAMBLING TO PAY LENDERS

Evergrande has been scrambling to raise funds to pay its many lenders, who are threatening legal action.

It has responded by halting projects, renewing borrowings and disposing of equity interests and assets.

The cash-strapped company has also delayed payments to suppliers and contractors in a sign its financial troubles are impacting business operations.

Subsequently, the share price has taken a battering, down 72 per cent in Hong Kong this year.

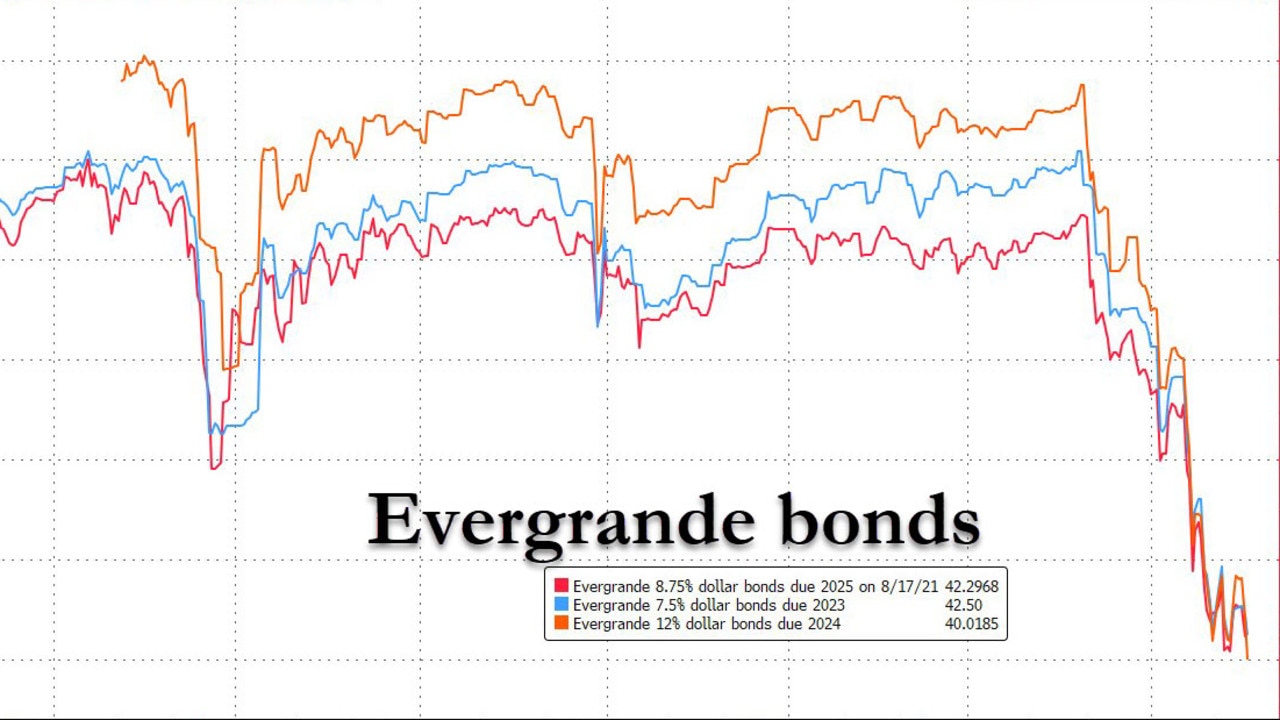

Evergrande’s bonds are also under pressure.

And to rub salt in the wound, its electric vehicle business was recently identified as the worst performing stock in the world.

GLOBAL RAMIFICATIONS

Hedge Fund Telemetry LLC president Thomas Thornton warned the giant Chinese company was in a “death spiral”.

“This is not just a China-only issue as the amount of foreign money at risk is substantial,” he warned on Twitter.

It’s something Australia should be concerned about. Should Evergrande collapse, the reduction in construction would significantly reduce demand for iron ore. That in turn could push the price for iron ore lower.

China’s construction industry accounts for about half of the steel used in the country, the AFR reports.

Today iron ore was trading at $194 a tonne, with Australia already feeling the squeeze from Beijing, which has vowed to find alternative suppliers and reduce consumption as tensions between the countries refuse to abate.

Michael Shoebridge, director of defence, strategy and national security at the Australian Strategic Policy Institute, said the Evergrande issue was just part of bigger picture of China’s economy as a whole.

“A huge part of China’s economic program continues to be stimulus of the domestic economy through the construction and development sector and it’s been great for Australia as it sucked in huge amounts of iron ore and also coal – until they decided to cease trade,” he told news.com.au.

“Evergrande is the second-biggest property developer so its future really matters to the future of China’s economy,” he said.

As well as the immediate effect the collapse of Evergrande would have on demand for Australia’s iron ore, it would be likely to send jitters through the whole Chinese real estate market, making it harder for other developers to raise debt – turning the whole situation into a vicious circle.

TOO BIG TO FAIL?

China has embarked on a regulatory crackdown this year, with tech titans like Tencent and Alibaba in the crosshairs.

Fintech firm Ant Group has been forced to overhaul its business and the share price of ride-hailing company Didi was hit after a government probe was announced.

China’s $120 billion for-profit tutoring sector has also been targeted by new regulations.

The sweeping crackdown on business has wiped $4 trillion off the market value of the country’s biggest companies, CNN reports.

Given the current climate, the question remains as to whether Beijing will step in to save Evergrande – or let it fail.

Julian Evans-Pritchard, senior China economist at Capital Economics, said Beijing would probably intervene to soften the blow.

“China’s leadership is presumably reluctant to offer a bailout to Evergrande, given the desire to punish reckless behaviour by private entrepreneurs and discourage speculative property investment,” he wrote in a note to clients in June.

“But given the firm’s sheer size and systemic role, officials would step in to try to ensure an orderly restructuring in the event of a default.”

The chairman of China Evergrande Group, Hui Ka-yan, is one of China’s wealthiest men with an estimated net worth of $18 billion.

He appeared in a photograph on Wednesday with other senior executives where he signed a guarantee to deliver the company’s projects to customers, the South Morning China Post reported.

The image appeared on a blog post on the company’s official WeChat account.

“Everyone in the company, led by chairman Hui, has made the pledge,” the Shenzhen-based company said.

“We are determined to ensure the quality of our construction, and make sure that we deliver quality projects in quantity at full stretch and by any means possible.”