China’s ‘aggressive’ new move to Australia causes massive drop in iron ore price

China said it wanted to cause “pain” to Australia and now it has acted on that promise in another major blow to an industry contributing $136 billion to our economy.

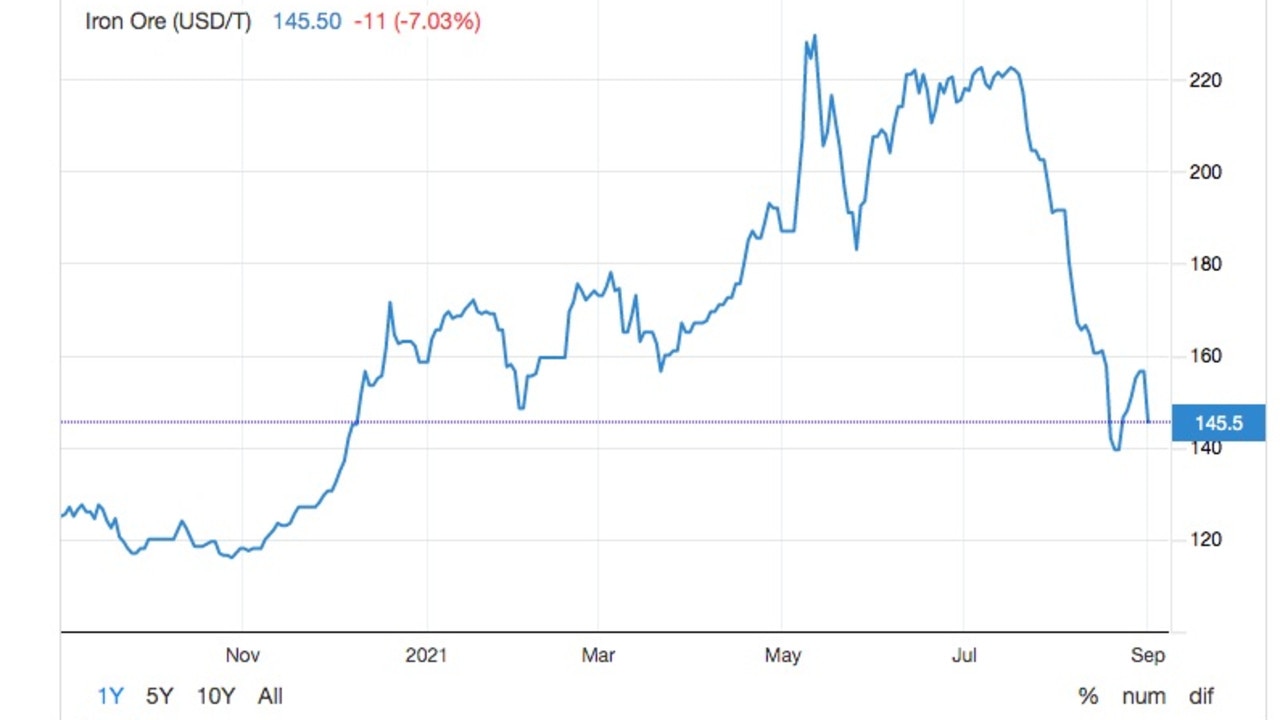

September isn’t off to a good start with Australia’s iron ore taking a hammering after prices plummeted by 6.7 per cent to $US143 ($194) a tonne overnight.

That’s a 40 per cent drop since the commodity’s all-time high in May when prices soared to a record $US237 ($317) a tonne.

It shows that Australia’s iron ore industry — which is predicted to contribute $136 billion to the country’s economy this financial year — is finally starting to feel the squeeze from communist China.

In May, China vowed to bring down the cost of the popular export because Australia was “profiteering” off excessive prices.

It planned to drive down costs and create economic “pain” for Australia by reducing demand from purchasing less in a nationwide five-year plan to cut its steel capacity by 236 million tonnes.

Despite the May announcement, Australia’s iron ore was on the up for several months before taking a sudden plunge in August, prompted by China’s biggest steel mill, Baowu, cracking down on its production.

Now a leading economist says that the price has fallen again because China bought so much steel in previous months that it is now having to drastically cutting back to reach its end of year target.

Commonwealth Bank mining and energy economist Vivek Dhar told news.com.au, “China is aggressively cutting steel this month, that is driving price down.”

Over the weekend, steel producers in major industrial provinces including Anhui, Gansu, Fujian, Jiangsu, Jiangxi, Shandong, and Yunnan were told to limit their production to 2020 volumes.

It’s finally caught up to the share market.

Mr Dhar explained Shandong Steel, one of the largest steel producers in the world, has been ordered to cut down production by November — only two months away.

China’s steel production rose by 8 per cent in the first seven months of the year, which means they’re now going to have to cut back by 12 per cent to meet government targets.

“It’s more the speed of the decline is the concern,” Mr Dhar said.

“The sudden price drop has come from a steel supply reform as opposed to steel demand falling. That means it has a chance of being more aggressive.”

That’s particularly problematic considering the next few months are prime time for Chinese steel production.

“Typically September and October are your peak steel construction months in China,” Mr Dhar said.

The weather means it’s ideal for production and also the best time to start making steel to be used for winter.

“People thought ‘maybe we’ll have some recovery’ because it’s post summer,” Mr Dhar added.

However, the dropping prices have effectively put an end to that.

The China Iron and Steel Association announced that the communist country would cut its steel capacity by 236 million tonnes by 2025.

China produces more than one billion tonnes of steel a year, more than half of the global total, sitting at around 55 per cent.

Despite iron ore’s drop, experts remain optimistic as Australia’s trade as a whole is still smashing records.

Australia’s trade surplus widened to $12.12 billion in July, a record high, from $11.11 billion in June, according to analysis released on Thursday by Barclays Bank.

Exports to China rose 13 per cent in that time compared to the previous month.

However, the analysis noted that the export price of iron ore dropped from July 20 onwards.

By the end of August, ore prices had plunged 26 per cent compared with the June all-time high.

Trade data from China shows that imports of iron ore fell 21 per cent in July compared to the previous year.

“A softer Chinese economy further casts doubt for Australia’s exports — a slowdown in China’s infrastructure investment will weigh on Australian exports, with iron ore exports slowing and coal exports already banned,” the report noted.

Other commodities are buoying the Australian market, with prices for coal exports from Australia in July the highest they had been since March 2019 – despite China “virtually stopping” all imports of this kind.