‘Brazen fraud’: Adani shares plummet as company accused of major ‘con’

Adani – the company behind Australia’s most controversial mine – is facing a stock market bloodbath after it was accused of “brazen fraud”.

Adani – the company behind Australia’s most controversial mine – is facing a stock market bloodbath after it was accused of pulling off “the largest con in corporate history”.

The firm run by billionaire Gautam Adani – the founder and chairman of India’s $US218 billion Adani Group, and previously the third-richest man on the planet – has been slammed by US activist investment group Hindenburg Research, for purportedly carrying out fraud for years on end.

“We have uncovered evidence of brazen accounting fraud, stock manipulation and money laundering at Adani, taking place over the course of decades,” Hindenburg said in a note released on Wednesday Australian time.

Hindenburg also revealed it had taken a short position in Adani Group — meaning it is betting that the company’s stock price will plunge.

“The Adani Group has previously been the focus of four major government fraud investigations which have alleged money laundering, theft of taxpayer funds and corruption, totalling an estimated $US17 billion,” Hindenburg stated.

“Adani family members allegedly co-operated to create offshore shell entities in tax-haven jurisdictions like Mauritius, the UAE, and Caribbean Islands, generating forged import/export documentation in an apparent effort to generate fake or illegitimate turnover and to siphon money from the listed companies.”

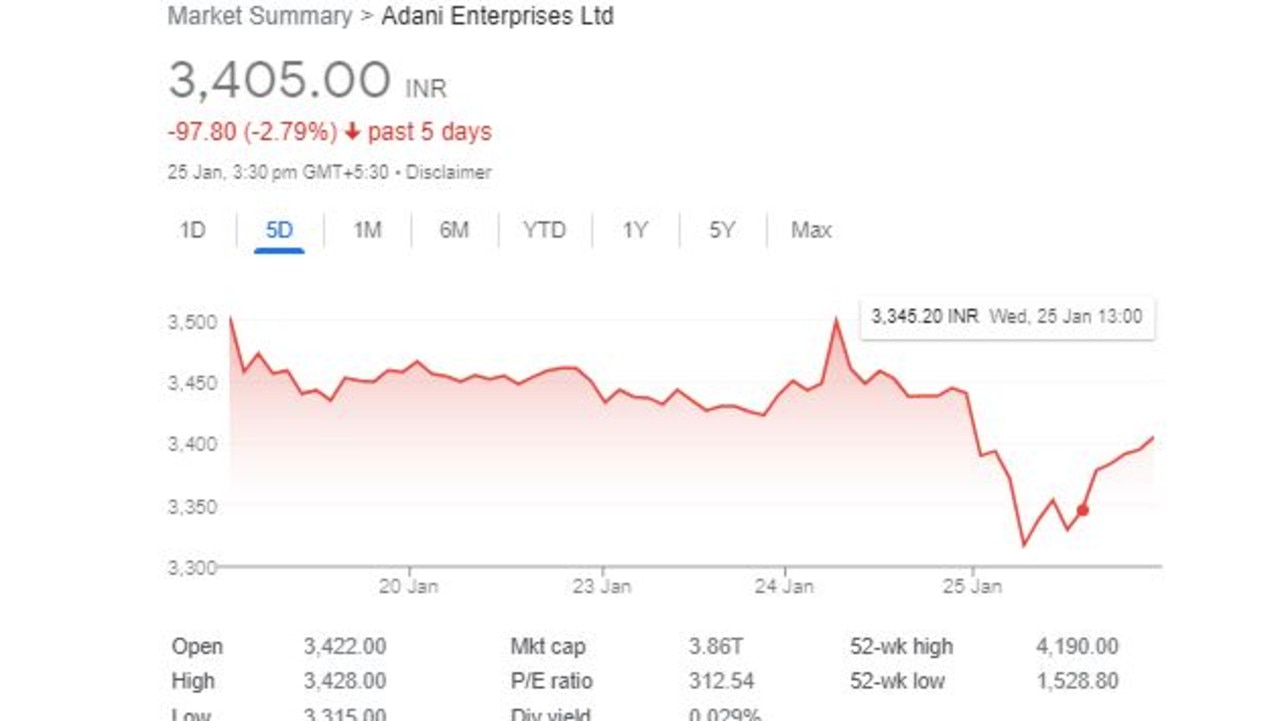

The claims immediately sent the share price of Adani’s companies into free fall, with Adani Enterprises falling by 2.5 per cent and Adani Ports and Special Economic Zone plunging by 5 per cent.

Food business Adani Wilmar’s stock also fell by nearly 5 per cent, while Adani Power dropped 4.7 per cent, Adani Transmission 5.19 per cent, Adani Total Gas 4.77 per cent and Adani Green Energy 3.55 per cent.

Hindenburg said its two-year investigation “involved speaking with dozens of individuals, including former senior executives of the Adani Group, reviewing thousands of documents, and conducting diligence site visits in almost half a dozen countries”.

The bombshell claims have seriously rocked the company, although Adani Group CFO Jugeshinder Singh issued a scathing statement rubbishing the claims as “a malicious combination of selective misinformation and stale, baseless and discredited allegations”.

Mr Singh also lashed the timing of the report – which came just as Adani Enterprises was preparing to carry out a multibillion-dollar follow-on public offering this week.

“We are shocked that Hindenburg Research has published a report on 24 January 2023 without making any attempt to contact us or verify the factual matrix. The report is a malicious combination of selective misinformation and stale, baseless and discredited allegations that have been tested and rejected by India’s highest courts,” the statement reads.

“The timing of the report’s publication clearly betrays a brazen, mala fide intention to undermine the Adani Group’s reputation with the principal objective of damaging the upcoming Follow-on Public Offering from Adani Enterprises, the biggest FPO ever in India. “The investor community has always reposed faith in the Adani Group on the basis of detailed analysis and reports prepared by financial experts and leading national and international credit rating agencies. Our informed and knowledgeable investors are not influenced by one-sided, motivated and unsubstantiated reports with vested interests.

“The Adani Group, which is India’s leader in infrastructure and job creation, is a diverse portfolio of market-leading businesses managed by CEOs of the highest professional calibre and overseen by experts in various fields for several decades. The Group has always been in compliance with all laws, regardless of jurisdiction, and maintains the highest standards of corporate governance.”

Hindenberg has successfully taken on dozens of other companies in recent years, including Twitter and electric vehicle maker Nikola, leading to similar stock plunges.

The company brings down targets by thoroughly researching the company in question, placing a bet that its shares will fall, and then creating as much noise as possible about its research, including via social media.

Australia’s most controversial mine

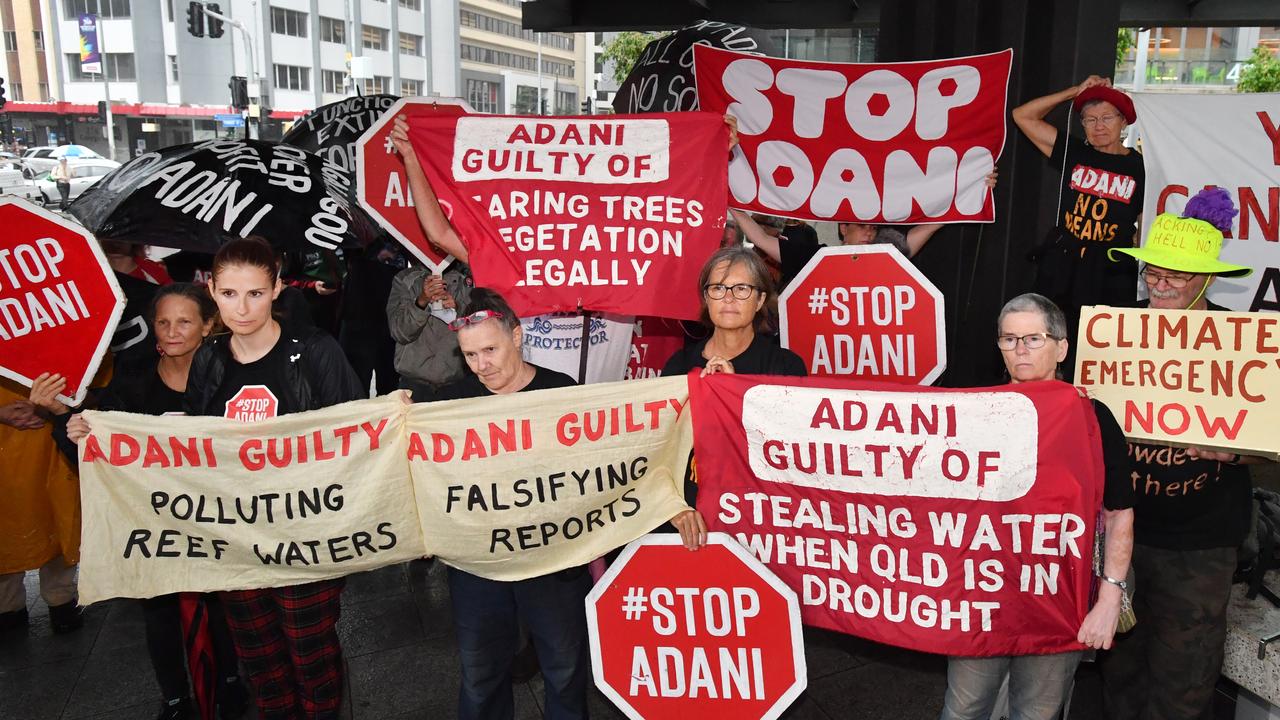

In Australia, Gautam Adani is known for being the backer of the $21 billion Carmichael coalmine in Queensland’s Galilee Basin.

After nearly a decade of fierce debates, protests and uncertainty, environmental approval for the Adani coal mine was finally passed in 2019.

Adani had claimed that the mine would deliver “thousands” of jobs in Queensland, and would also help to safeguard the Great Barrier Reef – despite claims by environmentalists to the contrary.

However, the mine faced serious opposition over the years, with entrepreneur and philanthropist Michael Myer, of the prominent Myer retailing family, telling news.com.au in 2017 that the mine was “an outrage”.

“It’s a stranded asset … and the proponent Adani is basically doing a very good job at conning our politicians at all levels of government,” he said.

“The whole line that this is good for Queensland jobs is farcical and delusional.

“It doesn’t stack up economically and as time goes on the economics get even worse.”

Over the years, a slew of companies withdrew their support from Adani after being targeted by protesters, with the well-known #StopAdani campaign claiming the project would destroy the ancestral lands of Indigenous people, increase traffic around the Great Barrier Reef and add billions of tonnes of carbon pollution to the atmosphere.

Major blow for Asia’s richest man

Meanwhile, the allegations have also been a major blow for Gautam Adani personally, with Asia’s richest man immediately seeing his net worth plunge by billions.

The 60-year-old has an estimated fortune of approximately $US119.1 billion – now sitting behind Bernard Arnault and family, Elon Musk and Jeff Bezos – and on Wednesday, around $US6.5 billion was wiped from his fortune as investors raced to sell Adani shares.

As a result, he dropped into the fourth position in Forbes’ real-time billionaire’s list, after previously sitting in third place.