Housing market: Adani mine set to spark property boom in QLD town

Once, this humble Aussie town was booming. Then, one decision sparked a downturn which caused workers to be forced to live in carports.

After nearly a decade of fierce debates, protests and uncertainty, environmental approval for the Adani coal mine was finally passed last month.

The confirmation is the final hurdle seasoned property investors wanted to see covered before workers flock to the region, rentals fill and prices rise, realestate.com.au chief economist Nerida Conisbee said.

Many are still licking their wounds following property crashes throughout the area when the mining boom ended in 2013, but brave punters are now readying their finances.

RELATED: What the Reserve Bank decision means for housing market

RELATED: Mining towns jump in value

RELATED: RBA cuts cash rate to new record low of 1 per cent

The mine will be based in the Galilee Basin but property speculators are watching the coastal town Bowen, half way between Mackay and Townsville in North Queensland. The town is located near Abbot Point where the Carmichael Project plans to ship coal from.

It’s expected Bowen will be the home for many workers during the construction of a railway line as well as the mine later on.

“Usually what happens is we start to see rental growth happen first,” Ms Conisbee told news.com.au about the typical indicators of rising house prices in mining towns.

“As people will need to move into a town, the rental levels start to pick up.”

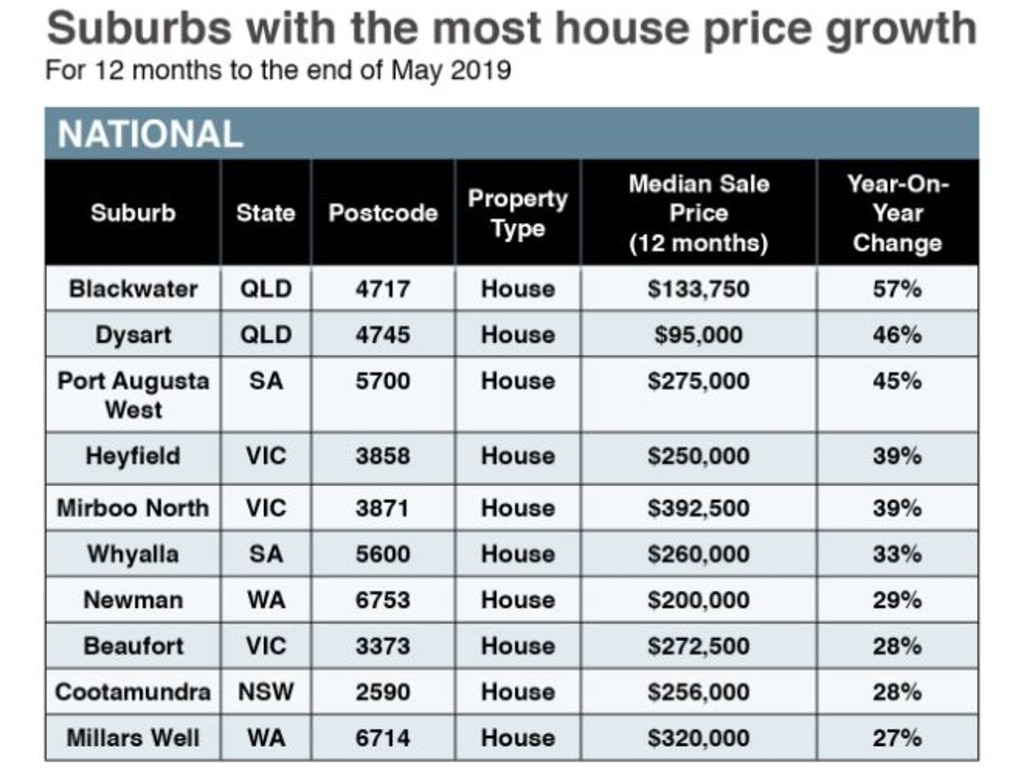

She referred to the recent 33 per cent surge in value at the South Australian town Whyalla where rental growth proceeded the price rise.

“Generally what drives the price increase is actually investment activity as opposed to owner occupier because people are able to get a fairly good yield in an area that is quite cheap and will also potentially see a pick up in capital growth,” Ms Conisbee said.

Bowen suffered significant median house price falls between 2015 and 2017, and rental prices followed a similar trajectory, but recorded a three per cent rise in 2017. In that year, dwelling prices were down 11 per cent.

In the 12 months to June 30, the value of homes in Bowen rose 10 per cent.

An emerging investor from the region, Norbert Kaess, bought his fourth house before the age of 23 and is bullish about the potential of the market as the Carmichael mine nears operation.

“Now that it’s been approved I think the trend of growth will continue and be even sharper over the next two years,” he told news.com.au.

“Investors can still pick up a lot of houses on sizeable blocks from $150,000 to $200,000.

“Most of these houses are cash flow positive and don’t require a large deposit.”

The young investor says the rental market will only get tighter as workers flock to the North Queensland town.

“It’s not uncommon to get a 10 per cent rental yield and with the current upwards trend you can also hope to see capital gains on top of that,” Mr Kaess said.

“With the relatively cheap cost of investment it’s not a big risk to take for younger investors and could be a good stepping stone for more property down the track if their research is done thoroughly.”

But Ms Conisbee warned would-be investors to tread carefully.

“You’ve really got to be a sophisticated investor when you’re going into these markets, you may see massive drops in value and you do need to be wary that things can change quite quickly,” she said.

The completion of a mining project will drag the market back down, as will the completion of stages along the way depending on the need for workers.

“That shift from construction to operation can lead to a big drop in employment,” Ms Conisbee said.

“Anything that affects the number of workers required on the mine can have a big impact.”

Whitsunday Regional Councillor Mike Brunker lives in Bowen and doubted there would be a surge in value.

He said workers were forced to bunk in car ports after the property crash at the end of the mining boom.

During the surge in value and demand last decade, the town ramped up development to cover housing and Cr Brunker said he is confident there’s sufficient accommodation to ensure prices don’t fluctuate dramatically in the future.

“When it gets closer to operation and the trains arrive you might see a spike then, but we’ve got enough housing stock in Bowen now that’s up for sale that will accommodate that,” he said.

“So it won’t be a mad rush in residential real estate development because we’ve already been through that.

“And me, as a councillor, certainly won’t be supporting any more residential real estate until the oversupply has been taken up.”

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au