Crypto is crashing and could slump further — what should you do?

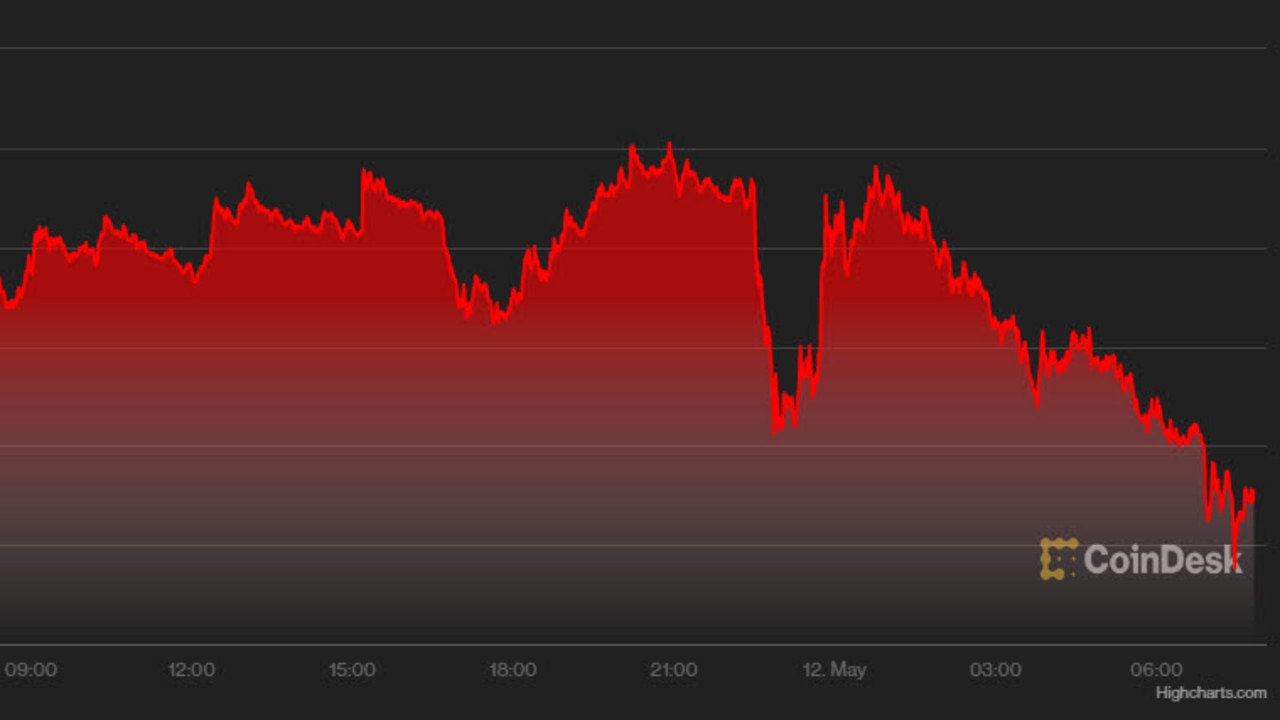

Bitcoin and other cryptos have slumped to their lowest price since 2020 and there’s reason to believe they could plummet even further.

Every morning seems to bring new pain for crypto owners as they wake to open Binance, Coinbase and other trading apps only to be greeted by a sea of red.

On Thursday morning the price of many major cryptocurrencies hit their lowest marks since late 2020, including bitcoin which fell as low as $40,602.04.

Bitcoin had been worth more than $63,000 as recently as March 29 and almost $90,000 in November last year.

Second most popular coin ethereum hasn’t fared any better, falling as low as $2909.78 overnight — miles off its high above $6300 during the same November peak in 2021.

‘Crypto is dead’

The slump in the crypto market has seen monumental losses in the wallets of owners — but there's predictions it could get worse.

There have been four previous major bitcoin crashes since 2014 and each time the price has reached the 200-week moving average.

This time that lies close to $29,000, suggesting the price could still fall by a further 25 to 30 per cent before the bleeding stops.

The Spectator’s Ross Clark went as far as declaring “Crypto is Dead”.

“The warning sign for cryptocurrencies is not so much that they have crashed ... but that they have become boring,” Clark wrote.

“Bitcoin has suffered many a crash before, yet bottom-feeders quickly rushed into the market and sent the price rebounding. This time around there is little sign of any enthusiastic speculation.”

“Many thought that Bitcoin and other cryptocurrencies could turn out to be a hedge against inflation. Those hopes have been dashed. While most currencies have been devaluing against real-world assets, cryptocurrencies have been falling in value faster,” he added.

Stay up to date with the latest in crypto currency on Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

So what should you do?

While countless owners have been shedding their crypto in recent days in an attempt to limit the damage, others are still to pull the trigger.

Financial advisers say it’s not time to panic but is time to rebalance your portfolio and consider selling any coins that may not have long-term value.

“Bear markets are typically a great time to accumulate the coins you have long-term conviction in,” Gritt Trakulhoon, lead crypto analyst at investing app Titan, told Bloomberg. “It’s a tough market for sure, but it’s a good time to strategise.”

Trakulhood predicts 90 per cent of coins “won’t recover” from the current crash.

“At this point, being slightly more concentrated on the coins you have strong conviction in is better than being diversified in altcoins that you don’t really understand,” he said.

“They will simply die — but the ones that do survive will thrive.”

As for those considering buying the dip, they should tread carefully.

Oleg Giberstein, co-founder of automated crypto trading platform Coinrule, told Forbes the market could remain challenging for up to two years and get worse during that time.

“Many a novice investor has been burned trying to catch falling knives,” he said.

Not even the stablecoins are stable

One of the major shocks this week has come from the increase in volatility of so-called stablecoins.

Terra UST, a cryptocurrency whose value is supposed to be pegged to the dollar, has lost half its value this week, sparking panic in the already febrile world of crypto assets.

Terra UST is supposed to track at roughly $1 per coin but at one stage was trading at 30 cents on Wednesday before recovering to around 75 cents.

So-called stablecoins like terra are meant to be less volatile than cryptocurrencies such as bitcoin or ethereum.

Their peg to traditional currencies is meant to offer investors more certainty and security.

But terra and several other stablecoins are not backed by any revenue streams, instead relying on algorithms to rapidly move funds between cryptocurrencies as they rise and fall in value.

Luna Foundation Guard, which backs terra, said on Monday it had deployed the equivalent of $1.5 billion in cryptocurrencies to stabilise the coin.

The coin’s founder Do Kwon said on Twitter on Tuesday he was about to present a recovery plan.

But terra continued to crash, perhaps caught up in a broader sell-off of cryptocurrencies that saw bitcoin plunge this week to its lowest value since last July.

US Treasure Secretary Janet Yellen told a Senate committee on Tuesday that the terra episode illustrates “that there are risks to financial stability and we need a framework that’s appropriate”.

Anto Paroian of ARK36 hedge fund, which specialises in crypto assets, said regulation in the long term would be a “net positive for the crypto space”.

“But if stablecoin issuers get regulated as strictly as banks, it could suffocate one of the most innovative, thriving, and important sectors of the crypto market,” he added.

— with AFP