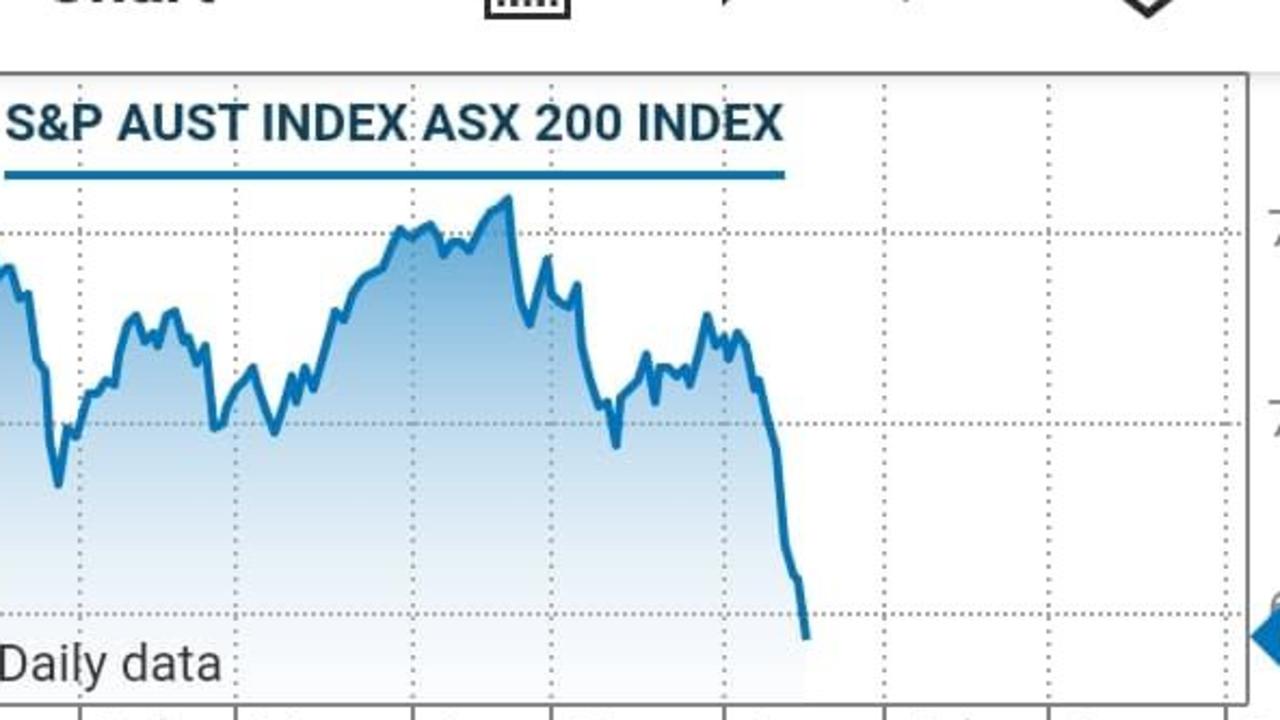

ASX smashed with a 2.5 per cent drop after horror week as recession fears deepen

Any hope of recovery after a horror week for the economy is being dashed, as the nation’s biggest companies are seeing their values drop again.

Any small hope of recovery after a horror week for the Australian economy will be dashed today, after global markets saw heavy losses and the Australian Stock Exchange took a dive in early trading.

In what looks to be a very difficult Friday, Australian shares have dropped 2.5 per cent in the first 30 minutes of trading as rising interest rates in the US, the UK and Switzerland in the last 24 hours stoked recession concerns.

The Australian market had steadied after Tuesday’s bloodbath, but a small amount of optimism looks to have vanished this morning — with the top 200 companies on the ASX now worth 8.36 per cent less than they were just five days ago.

All sectors are lower — with tech faring the worst. That sector has dropped 3.8 per cent as shares in Afterpay-owner Block sank 7.2 per cent in early trade.

The big four banks are all in the red - CBA falling 3.3 per cent, ANZ down 2.2 per cent, NAB 2.8 per cent and Westpac 2 per cent.

Stay up to date with the latest market moves with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

This follows on from a difficult day on Wall Street.

The US market dropped sharply overnight, a day after the Federal Reserve made an aggressive move to bring down inflation and instil confidence in the markets and other central banks followed.

The top 500 companies, the S&P 500 entered a “bear market” — meaning it is retreating — earlier this week following the latest red-hot inflation data, and fell 3.3 per cent to 3,666.78 at the closing bell this morning Australian time.

In a grim sign of what’s to come, the S&P 500 results now shows an 85 per cent chance of a US recession, according to JPMorgan Chase & Co. strategists.

The warning is based on the average 26 per cent decline for the S&P 500 during the past 11 recessions.

“In all, there appear to be heightened concerns over recession risk among market participants and economic agents, which could become self-fulfilling if they persist prompting them to change behaviour,” the strategists led by Nikolaos Panigirtzoglou wrote in a note. “Market concerns of a risk of policy error and subsequent reversal have increased.”

The general public seems to be aware something nasty is brewing too, with searches for the word “recession” approaching an all-time high.

Google searches for 'recession' are on pace to approach a record high. pic.twitter.com/aLWXmyGgIQ

— Bespoke (@bespokeinvest) June 16, 2022

Binance boss bullish despite crypto crash

Cryptocurrencies are here to stay and their dramatic recent crash is just part of an economic cycle, Changpeng Zhao, one of crypto’s most influential figures, told AFP in an interview on Thursday.

The China-born Canadian entrepreneur heads Binance, the biggest exchange in the market that boasted $32 trillion in transactions last year and 120 million customers.

“It does cause worries,” Zhao said of a slump that has wiped $2 trillion from the value of crypto assets in the past seven months.

“But we expect this, it’s not unusual, the markets go up and down, stock markets go up and down.”

- with AFP