Iconic Aussie brand under fire

One of Australia’s most well recognised chain left one dad despairing as he’s been left in a mountain of debt. WARNING: DISTRESSING

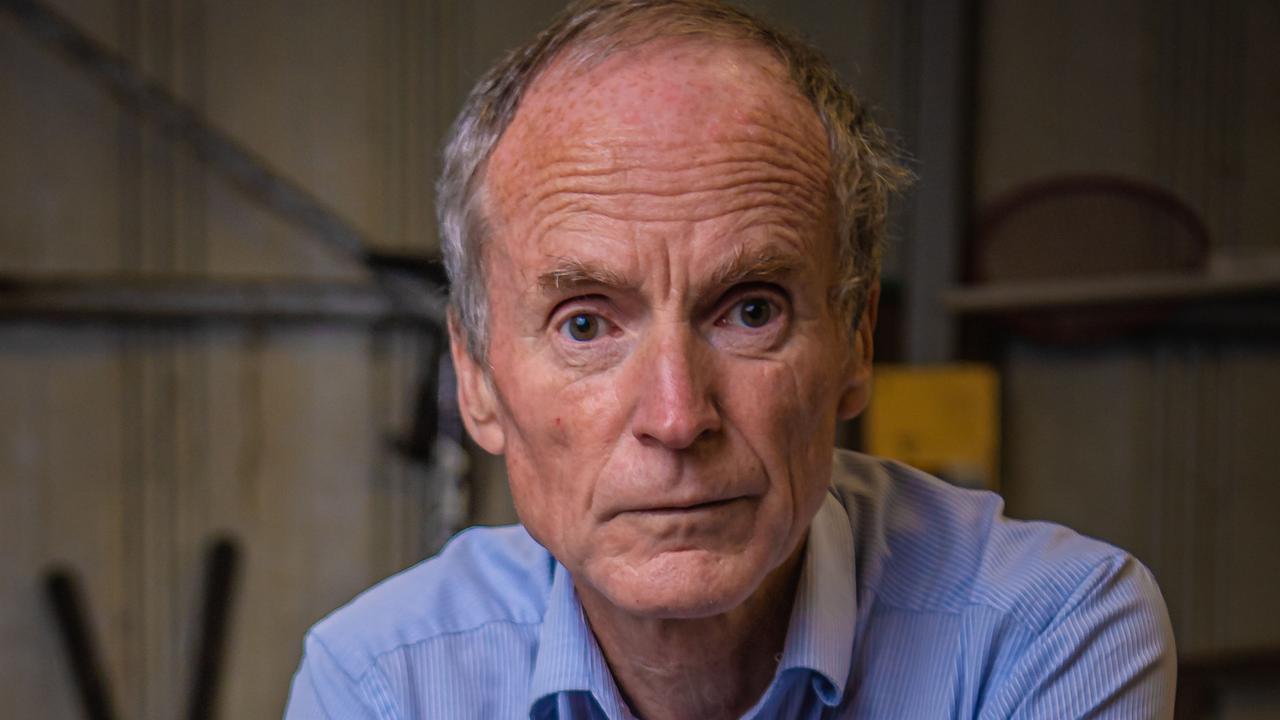

A man who borrowed $80,000 to buy into one of Australia’s most popular chains has revealed how the financial stress pushed him to the brink and how any “support you are promised comes with a price tag”.

News.com.au has been revealing some of the inner workings of Jim’s Group, which is Australia’s largest franchising outfit with more than 5000 franchisees across 52 divisions and a turnover of approximately $500 million.

A series of stories have revealed disgruntled current and former franchisees who signed up to Jim’s Dog Wash and claim they have missed out on thousands of dollars in a bitter dispute, while others spoke out about struggling to survive as they poured a large part of their earnings into fees and loans.

Now a franchisee of Jim’s Mowing, which would be the best known division within the group after being launched in 1989, is also speaking out about how he financially struggled and the mental toll it took on him.

Finn* purchased a Jim’s Mowing franchise in 2022 and only lasted seven months before giving it all up.

“To fund it I actually took out a bank business loan which I am still going to be paying off for the next seven to eight years,” he told news.com.au.

“I borrowed $80,000 to purchase all the equipment. I look back on it now and I see there probably were a few red flags that I should have picked up on at the time but it was new and exciting.

“It was the big hope that it was going to be the good money earner for the family – all the good stuff you hear about owning a Jim’s franchise. We got sucked into that more by the end of it and didn’t pick up on the red flags we should have.”

He said the business loan included $16,000 to purchase the trailer, an appropriate vehicle to tow it, the equipment, uniforms and Jim’s start-up packs.

Borrowing money off family to survive

The 41-year-old said at no point during the seven months he owned a Jim’s mowing franchise did he ever “break even”.

Yet he still had to fork out $1200 a month in fees to Jim’s Group.

“I had to be earning $2000 a week as my break even point. The best week I ever did was $1800 so at that point through the nearly seven to eight months I had the franchise did I ever achieve my break even point during the week,” he said.

“I was averaging probably around the $1500 mark a week, so $6000 a month. I was coming in around that $2000 short a month of what I needed to be earning.

“For the third month in a row, I had to use money off family to pay the fees, which I knew wasn’t sustainable “

Founder of Jim’s Group Jim Penman said the “great majority” of franchisees make enough money to live and cover their fees.

Do you have a story? Contact sarah.sharples@news.com.au

‘How the hell am I going to get out of this debt?’

Then Finn told news.com.au what happened next – something he hasn’t even ever shared with his wife.

“I was actually sitting on a roof cleaning gutters and was half thinking of jumping off because I had so much stress going through my head,” he said.

“I had my wife and two kids, that I was essentially robbing them of their life as well, and I was just thinking how the hell am I ever going to get out of this debt? And I thought if I jump at least my wife can cash in my life insurance and then the only reason I didn’t do it is because the client came home from work.”

Finn said he was visibly upset and ended up “spilling his guts” to the client. He said it helped being able to talk to someone about what was going on.

The dad said when he initially purchased the franchise, the administration team would check in every week and offer handy tips but that all stopped after three months.

“The only way I could actually contact my franchisor was to basically keep ringing and leaving voice messages and by not actually paying my fees for a month and waiting for him to call,” he said.

“Definitely by the five month mark I was really starting to struggle financially with the sheer amount of travel I had to do to find work.

“Because of where I am based and to pick up jobs, I was travelling between 800km to 1200km a week driving up to an hour from my home for some jobs. So I was spending easily between $300 to $450 worth of diesel in my ute each week which was becoming an issue.”

Claims his customer service skills were blamed

But what ultimately hurt was a string of clients failing to pay his invoices, despite accepting the quote he gave, he said.

“I was continuously sitting with $3500 to $4000 worth of invoices at any one time and obviously when you are struggling financially you really can’t afford to have that much owing to you,” he said.

“That’s where I started to need the support from the franchisor to actually either help with the clients and talk to the clients but they weren’t really forthcoming with any support in that area.

“To the point where I was actually told that I might have to revisit my customer service skills. I was like I’m pretty much treating every customer the same way, yet you got some customers that rave about me and are recommending me to other people so I don’t know that is the issue.”

Mr Penman said support by franchisors is ongoing, including responding promptly to franchisee calls, regular meetings and at least one proactive call a month.

“We carefully monitor this through franchisee surveys and in other ways,” he added.

Most franchisors are easily to get a hold of, according to Jim’s Group surveys, Mr Penman said.

“If a franchisee is doing poorly, which is the case for about nine per cent, the franchisor is responsible for providing coaching to help them improve,” he said.

“Possible reasons may include poor customer service, charging too much and those losing most quotes, and not working enough hours. A franchisor who failed to provide proper coaching and advice in such circumstances would be considered grossly negligent, and the franchisee would be more likely to fail.”

‘Red flags’

Meanwhile the dad – who said he put his house on the line to get approval for the $80,000 business loan – said the “red flags” really kicked in when he would ring the franchisor a week before Jim’s fees were due to say he couldn’t afford them.

“I was actually looking for just a bit of assistance and I was basically told in no uncertain terms that if I didn’t pay then I would have debt collectors chasing me for the money and I would lose all my Jim’s entitlements,” he said.

But to Finn the entitlements were worthless as he said there was no franchisor support and another scheme that tried to address money flow problems would just leave him with less cash.

The scheme was where Jim’s would pay for a completed job, which might cost $100, and then chase the client for the money.

“But then they take a 15 per cent fee out of that $100 for their time and effort for chasing the client so everything you do through Jim’s comes with a price tag attached to it,” he said.

“I didn’t learn about that until I went to Melbourne for the week’s training session that you have to do before you go off and start your franchise. It’s a double edged sword you sign up to that.”

Finn said Jim’s had also already taken a cut from the job anyway as every lead from the call centre cost $12, even if there is no guaranteed work at the end of it.

“Some jobs I travelled up to an hour to get to from my house, which I also had to quote those jobs as well. I spent just as much time driving around just quoting jobs that didn’t always get accepted,” he said.

“I did try to book in quotes when I was roughly around the same area doing jobs so I wasn’t just driving around not earning money at the same time but sometimes it was unavoidable.”

Mr Penman said Jim’s Group had a contracts division, which organises large-scale contracts and takes a fee, with around 10-15 per cent of turnover being normal.

“Franchisees can choose to take or refuse such jobs. This gives franchisees tens of millions of dollars a year worth of revenue, which they would otherwise miss out on,” he claimed.

‘Comes with a price tag’

Finn said now just seeing a Jim's Group ad on TV “triggers off a bit of anxiety” just a few years later.

“They say now in the ad you get $2000 guaranteed a week and that is what triggers it for me, as that’s another scheme in the whole system that you don’t know about until you actually sign up for it,” he said.

“That guaranteed $2000 a week is something you can get from your franchisor but then if you do surrender your franchise and go to sell it – for every week you have claimed that $2000 you have to pay it back.

“Everything inside the Jim’s Group always comes with a price tag attached to it and you don’t get all the support you are promised that comes with that price tag.”

Mr Penman said it was correct that ongoing support comes with the price tag of paying ongoing fees but this is the case with every franchise system.

“The only difference is in how the fee is calculated. Retail franchises take a percentage of turnover, other service franchises take a flat rate per month,” Mr Penman said.

“We charge a generally lower flat rate with a small fee for each lead provided, typically around $20. This encourages franchisees to take only leads they really want and to follow them up. It also means that franchisees who take more leads to feed multiple employees, pay slightly more fees. We believe this is fair.”

Mr Penman also denied that the pay for work guarantee payments are taken from the sale price of a franchise.

“If a franchisee sells a business with regular customers, they normally get 80 per cent of the sale price. But if not enough customers pass through to get the buyer past pay for work guarantee, then some of the money is held back to pay for advertising to rebuild the business,” he noted.

“We also hold back money if more than 10 per cent of the clients fail to transfer. Otherwise, the buyer may have paid a lot of money for non-existent good will. Buyers have 45 days to determine if clients are genuine.”

‘Don’t suggest failure is an option’

Finn said he was in a more country-based area rather than a metropolitan region, which he thinks contributed to the failure.

“I feel they have to a have a responsibility for the area that I signed up for. They have to have a realistic grasp of what the demand is in that area. It’s really the business model they roll out at the training but its very metropolitan based to succeed,” he added.

“They like to tell you all about the success stories but they don’t even suggest that failure is an option, which is why it hit so hard when it actually did crumble.

“And because my actual franchisor, he put a fair bit of blame back on myself as to why it didn’t work, which at the time was pretty hard.”

Mr Penman said if new franchisees don’t get enough leads, they can do free services and claim pay for work guarantee.

“For this reason, franchisors need to be careful who they put on. No other service franchise system in Australia has the system, that I know of,” he added.

Finn counts himself lucky that he was able to pick up work quickly after he gave up his franchise but it’s back to shift work, which is far less family friendly and one of the big reasons joining Jim’s Group had such a big appeal.

“I’m still living pay cheque to pay cheque with the cost living,” he added.

“That’s the mess I’ve got myself in so that’s mess I have to get myself out of.”

News.com.au has also revealed franchisee complaints from Jim’s Dog Wash, with some shocked by being asked to pay $1000 for their own mobile numbers and forking out $22,000 for customer lists.

sarah.sharples@news.com.au