Paradise Papers leak exposes the tax secrets of the world’s super rich

SOME huge names have been exposed in a leak of 13 million files, which has revealed the rich and famous's favourite tax tricks.

THE biggest leak in history, the Paradise Papers, is more than a giant dump of documents with a 007-worthy name.

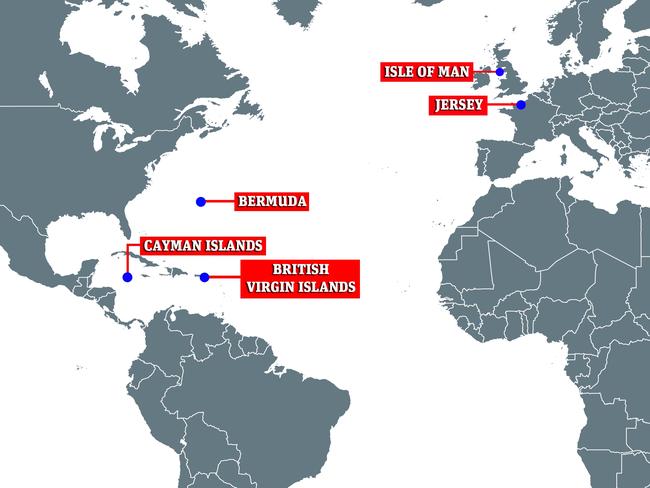

Containing more than 13 million files from offshore tax haven providers, the leak exposes rampant tax avoidance by major companies, politicians, royalty, and rock stars who have been investing in notorious tax havens including the Cayman Islands and Bermuda.

Perhaps most alarmingly, it exposes financial ties between the highest levels of the Trump administration and associates of Russian President Vladimir Putin.

The papers were obtained by the German newspaper Sueddeutsche Zeitung and were shared with the International Consortium of Investigative Journalists (ICIJ), which includes ABC’s Four Corners.

The names of more than 120 politicians in nearly 50 countries appear in the 1.4 terabyte data leak, along with figures from the worlds of sports and business.

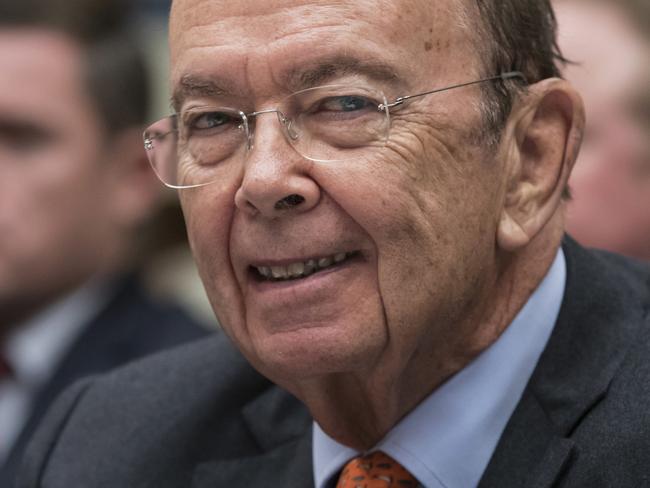

The documents show that US Commerce Secretary Wilbur Ross, the Trump administration’s point man on trade and manufacturing policy, has a stake in a company that does business with a gas producer partly owned by the son-in-law of Russian President Vladimir Putin.

According to the ICIJ, Ross is an investor in Navigator Holdings, a shipping giant that counts Russian gas and petrochemical producer SIBUR among its major customers.

Putin’s son-in-law Kirill Shamalov once owned more than 20 per cent of the company, but now holds a much smaller stake.

Commerce Department spokesman James Rockas said Ross “never met” Shamalov and has generally supported the Trump administration’s sanctions against Russia, according to the ICIJ report.

At the time of his appointment, Ross attracted criticism for his connection to another shipping company, but his stake in Navigator, via Cayman Island registered companies, was not picked up by the Senate committee that oversaw his confirmation hearings, the ABC reports.

A former White House ethics lawyer, Richard Painter, told German broadcaster NDR the connection made Ross’s position “untenable”.

“That would make it very difficult for him to participate in discussions about those sanctions and he may actually violate the criminal conflict of interest statute if he participates in discussions about sanctions that affect his own financial interests,” Mr Painter told German broadcaster NDR,” Mr Painter said.

“We would not have allowed a Commerce Secretary to hold some of the holdings that Wilbur Ross apparently held on to, particularly his shipping company ... there is too much that can happen in trade that could have an economic effect on a shipping company.”

While there is nothing to suggest that any investments are illegal, some of the investments and connections exposed in the document dump raise questions about the financial conduct of various public figures.

WHERE THE QUEEN STASHES HER CASH

Millions of pounds from the private estate of Britain’s Queen Elizabeth II have been invested in offshore tax haven funds, the Paradise Papers reveal.

Around $17 million of the Queen’s private money was placed in funds held in the Cayman Islands and Bermuda, according to the leaked papers, which were first reported in Britain by the BBC and the Guardian newspaper.

They reported the funds reinvested the money in an array of businesses, including controversial rent-to-buy retailer, BrightHouse, which has been accused of exploiting the poor, and a chain of alcohol stores which later went bankrupt.

The investments, which were entirely legal, were made through the Duchy of Lancaster, which provides the monarch with an income and handles investments of her vast estate and remain current, the media outlets said.

There is no suggestion that the Queen’s private estate acted illegally or failed to pay any taxes due.

But the leaks may raise questions over whether it is appropriate for the British head of state to invest in offshore tax havens.

A spokeswoman for the Duchy of Lancaster said: “All of our investments are fully audited and legitimate.

“We operate a number of investments and a few of these are with overseas funds.”

The spokeswoman added that one of the fund investments represents only 0.3 per cent of the total value of the Duchy.

Meanwhile the money put into BrightHouse “is through a third party”, and equates to just 0.0006 per cent of the Duchy’s value, she added.

WHO IS BEHIND THE INVESTMENTS?

London Appleby, an offshore law firm founded in Bermuda in 1898, is at the centre of the leak of 13.4 million documents known as the Paradise Papers.

Appleby advises “global public and private companies, financial institutions, and high net worth individuals”, according to its website.

It has offices in Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey, the Isle of Man, Jersey, Mauritius, and the Seychelles.

The International Consortium of Investigative Journalists (ICIJ), which led the reporting into the leaked trove of documents, said Appleby’s clients have included global financial institutions such as Barclays and Goldman Sachs, as well as Nike, Apple and Uber.

Appleby helps clients with a range of legal issues, including setting up shell companies, establishing trusts, drafting wills and settling divorces. The company admitted in October to being hacked but said no evidence of wrongdoing would be found in the documents.

The company has been ranked as one of the largest offshore legal service providers in the world and employs more than 470 people, according to its website.

The massive leak of documents from Appleby and other firms eclipses the 2015 Panama Papers release, which was also exposed by the ICIJ.

WHAT HAPPENS NOW?

Along with agencies around world, the Australian Taxation Office will analyse the trove of more than 13 million leaked documents covering a complex offshore web of financial dealings.

The ICIJ investigation has uncovered documents relating to the movement of billions of dollars through Bermuda by the Australian arm of the global mining giant Glencore, as well as details from INXS frontman Michael Hutchence’s disputed estate.

An ATO spokeswoman said the tax office would analyse the data as part of a wider investigation into complex tax structures.