Resilient consumer sector lifts Aussie shares

Bumper results from a bellwether retail giant injected renewed confidence into the Aussie sharemarket on Monday.

Bumper results from a bellwether retail giant injected renewed confidence into the Aussie sharemarket on Monday.

A man at the top of the Reserve Bank of Australia has warned Aussies against “false prophets” who claim to know what will happen in the future.

The last 10 days have seen global markets experience the most jarring rollercoaster ride since the pandemic. Here’s what’s really going on.

With the American stock market suffering its worst one-day fall in years and global markets faring even worse, one name keeps coming up.

New US jobs data has just dropped and it’s not great reading with a key indicator of a recession being imminent.

The sharemarket retreated on Tuesday on the back of a sharp mining slump.

Aussie shares booked a positive session on Monday on the back of a relief rally from Wall St on Friday.

It’s a problem across the world and government’s are struggling to solve it. It could mean a drop in living standards for everyone.

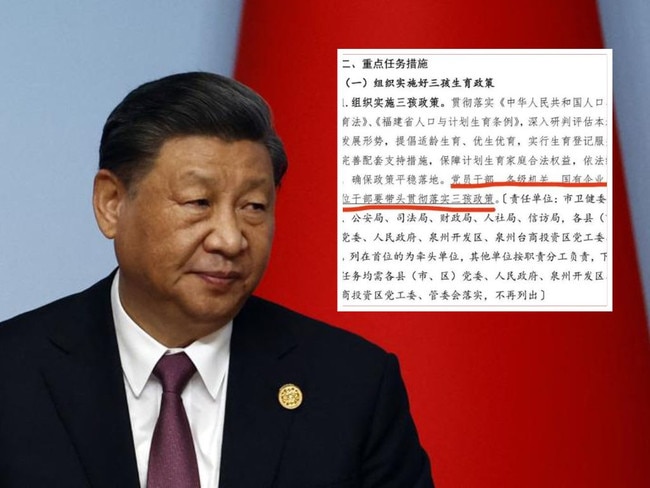

One tiny detail in a leaked government document has revealed China’s massive backtrack in one key area, setting alarm bells ringing.

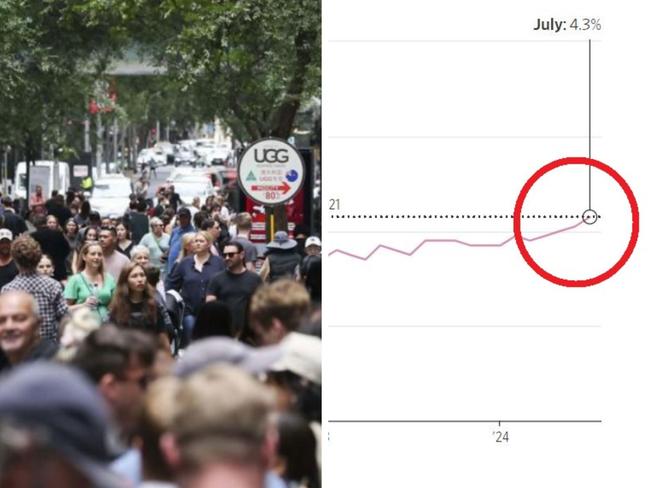

More pain could be on the way for mortgage holders and the Albanese government, with an all-important data release tipped to show ‘persistent inflation’ in the economy.

The Australian sharemarket slumped into a sea of red on Thursday as a gruesome tech rout on Wall St crippled confidence.

There are increasing warnings that Australia could be plunged into a nightmare scenario if Donald Trump becomes president and a battle emerges with China.

The Australian sharemarket edged lower on Wednesday as investors opted for caution following days of political chaos.

The Australian sharemarket has lifted to break a three-day losing streak on Tuesday on the back of an tech-led Wall St rebound.

The eSafety Commissioner has officially put the tech giants on notice: Do more to protect Aussie kids or cop massive fines.

The fallout from the CrowdStrike global tech outage and US President Joe Biden’s decision not to run again have helped push down the Australian sharemarket on Monday.

A run-up in Aussie shares came to a halt on Friday, with a Wall St rout and mining sell off pushing the market into a sea of red.

A day after setting a new 52-week high, the Aussie sharemarket retreated at the closing bell on Thursday.

The Australian sharemarket lifted on Wednesday on the back of a rising Wall St bull run.

The latest numbers on new home starts are out and it isn’t good news for battlers struggling to live the Australian dream.

Some dark economic data out of China triggered a sell-off in heavyweight mining stocks on Tuesday, pulling the Aussie market down from record highs.

Aussies shares continued to rally higher on Monday, crossing the 8000 threshold for the first time in history on speculation of imminent rate cuts in the US.

The Aussie dollar surged this month in multiple countries, giving travellers the confidence to head overseas to spend their hard-earned cash.

The Australian sharemarket has closed out the week on a record high as investors position themselves for imminent US Federal Reserve rate cuts.

Australia’s largest company will suspend its vast nickel mining operations, putting up to 2500 jobs in limbo.

The benchmark ASX200 has flown close to record highs on Thursday following a huge night of trading on Wall St.

There’s a growing crisis in Australia’s trucking industry, and shoppers everywhere will be the losers.

Mining stocks have weighed down the sharemarket again this week, with the benchmark ASX200 dipping into the red on Wednesday.

Treasure Jim Chalmers has called on major Aussie banks to continue servicing Australia’s closest international neighbours, pledging $6.3m to help.

The sharemarket has started the week on a low note after a retreat in iron ore and oil prices over the weekend.

Original URL: https://www.news.com.au/finance/economy/world-economy/page/9