‘Hurricane’: US billionaire Jamie Dimon warns of looming economic bloodbath

A billionaire finance expert has sounded the alarm over a terrifying economic “hurricane” which he claims is “coming our way”.

A US billionaire has raised the alarm over a looming economic “hurricane” as prices continue to skyrocket.

JPMorgan Chase CEO Jamie Dimon – whose financial insights are well respected by Wall Street insiders – told attendees at a conference this week that Russia’s invasion of Ukraine, skyrocketing inflation and interest rate rises by the US Federal Reserve were working together to cause a financial disaster.

Mr Dimon – who has lead the largest of the big four American banks since 2005 and who boasts a staggering net worth of $1.8 billion – said he was expecting “bad outcomes” on the horizon.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

“They’re big storm clouds here. It’s a hurricane,” he said.

“That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy … And you better brace yourself.”

Mr Dimon also said the Fed’s decision to pursue “quantitative tightening” – a monetary policy tool designed to decrease the amount of money supply in the economy – as it simultaneously hiked interest rates could prove disastrous, claiming people will be “writing about [this] in history books for 50 years”.

He also warned that the conflict in Ukraine could see the price of oil soar to $US175 a barrel, and not enough was being done to protect Europe from the ramifications in the years ahead.

Bad news for Aussies

While Mr Dimon was speaking specifically about the situation in the US and Europe, his claims also spell bad news for Australia.

In April this year, Deutsche Bank predicted a “major recession” was looming for the US, claiming the US Federal Reserve’s attempts to quell inflation would lead to a more serious downturn than previously anticipated.

“We will get a major recession,” Deutsche Bank economists wrote in an alarming report, arguing that it would take a “long time” before inflation falls down to the target goal of 2 per cent, which therefore meant interest rates would likely be jacked up significantly, and in turn would harm the economy.

At the time, AMP chief economist Shane Oliver told news.com.au that while a US recession wasn’t yet a certainty, a downturn in the US would be “bad news” for Aussies.

“It might not really be apparent until later next year, and there are a lot of questions marks over whether we will see a recession, but if it does happen, it will be bad news for Australia,” he said.

“The US is the world’s biggest economy … and it does affect business and consumer confidence, and it does affect demand for our exports simply because the US is part of the global economy, although it’s not the same as China which is our biggest export market.”

It was a sentiment echoed by Peter Martin, visiting fellow at the Australian National University’s Crawford School of Public Policy, in a recent article for The Conversation.

“Australia’s biggest economic threat isn’t homegrown. It’s a recession, originating in the United States,” Mr Martin wrote.

While he claimed “there’s a chance we could escape” the fallout from a “yet another US-led global recession”, it “will require being prepared to change our budget and interest settings in a heartbeat”.

Inflation out of control

Meanwhile, Australians are already feeling the pinch after inflation grew by 5.9 per cent in the past year – the largest single-year increase since 2001.

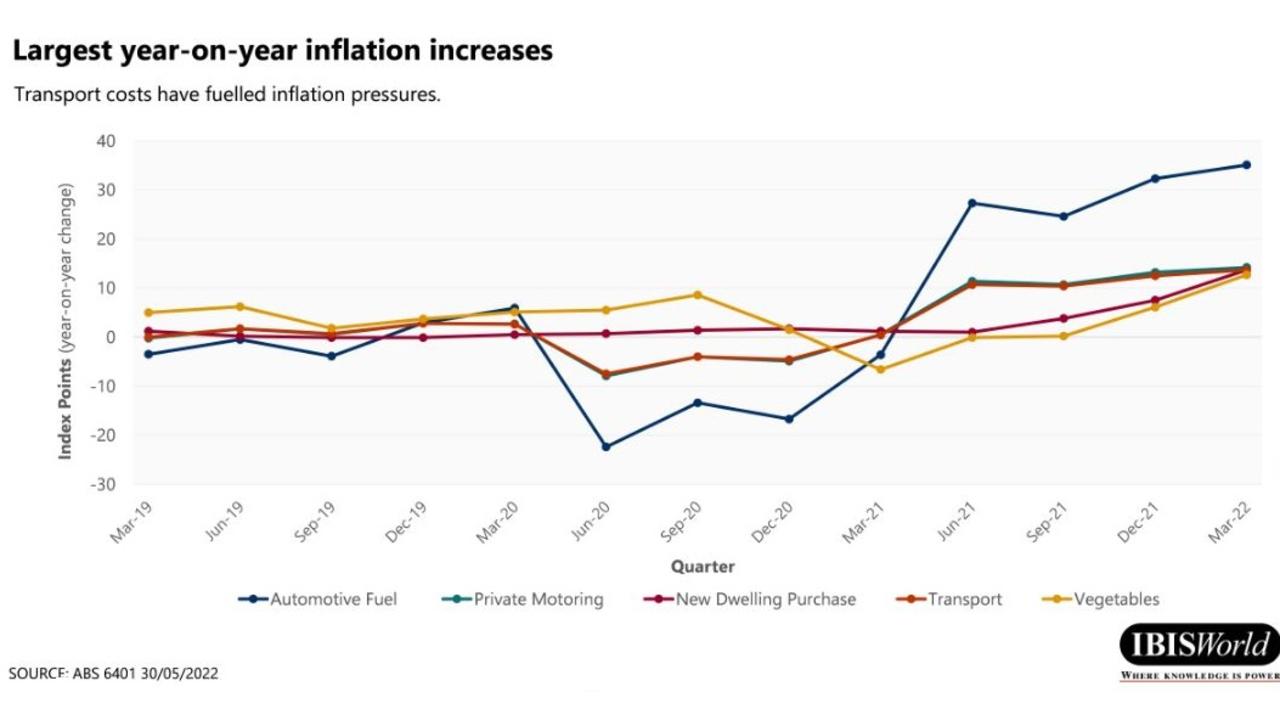

According to IBISWorld, the biggest factor has been rising fuel prices, which “increased by an average 35.1 per cent over the year through March 2022”.

That has in turn pushed up freight costs for businesses that depend upon the transportation of items, and at the same time, the world has seen “significant supply chain disruptions, coupled with high global and domestic demand”, which have caused “considerable price increases in fuel and food”.

According to Senior Industry Analyst Victoria Baikie, “consumers and businesses have had to fork out much more at the pump for the same quantity of fuel, which has been a leading contributor to a spike in inflation”.