Calls for Albanese Government to pull gas trigger amid fears of ‘apocalyptic’ price rises

Businesses in Australia are already collapsing thanks to an impending crisis with some now calling on the government to take extreme action to avoid ‘apocalyptic’ price rises.

Aussies will soon feel the pain of skyrocketing gas prices and fears of “apocalyptic rises” have prompted calls for the new Albanese Government to take an extreme response.

Pressure is growing, including from groups like Manufacturing Australia, for the government to pull the “gas trigger” to help bring down prices.

The Australian Domestic Gas Security Mechanism was introduced in 2017 to allow gas exports to be limited if there was a shortage of supply forecast in Australia.

But Treasurer Jim Chalmers has so far resisted calls to pull the trigger saying it was not something that would have an immediate effect and involved consideration of a whole range of issues.

National employer association Ai Group chief executive Innes Willox also told news.com.au that in its current form it would actually not be possible to pull the trigger and even if it was activated, it could not start before next January.

So what is happening and what can be done about rising prices?

Wholesale gas prices are rising

Australians may have seen headlines around “apocalyptic” rises in energy prices including a 50-fold spike in wholesale gas prices in Victoria.

The situation has seen the Australian Energy Market Operator (AEMO) step in, capping gas prices in Sydney, Melbourne and Brisbane to $40 a gigajoule — although this is still five times higher than prices last year.

In most cases this rise in wholesale prices has not yet been passed on in people’s power bills as many retailers signed long-term contracts for gas at much lower prices.

The Australian Petroleum Production & Exploration Association (APPEA) said around 85 per cent to 90 per cent of the gas market is covered by long-term contracts, known as gas supply agreements (GSAs), which were offered for this year – and locked in by many customers – at price levels of around $6 a gigajoule to $9 a gigajoule.

But higher prices will eventually flow to consumers and are already being felt by manufacturers reliant on buying gas at spot prices.

Mr Willox said households would likely feel the impact of higher default electricity prices from July.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

One natural gas wholesaler and distributor, Weston Energy, has already collapsed, after skyrocketing prices left it unable to fulfil contracts with businesses to supply gas at the price it had previously agreed to. Weston had gas contracts with more than 400 companies and government agencies along the east coast including in NSW, ACT, South Australia, Victoria and Queensland.

There are warnings other retailers could follow, as happened in the United Kingdom where 30 retailers collapsed due to soaring wholesale energy prices.

Our gas is being sent overseas

The rising prices are being blamed on a number of factors including outages at coal-fired power stations, relatively low levels of renewable power generation due to unfavourable weather conditions, and international demand for gas due to the Russian invasion of Ukraine.

APPEA Acting Chief Executive Damian Dwyer has rejected the idea that Australia’s gas exports are to blame.

“Gas price rises are not being driven by gas exports or shortfalls,” he said.

But other experts have pointed to the difference between prices on Australia’s east coast, compared to those in Western Australia, which has a gas reservation that sets aside a certain amount of gas for use domestically.

On the east coast, spot prices for gas around $30.38 last month and have risen by a staggering 529 per cent across two years, from an average of $4.83 a gigajoule on May 1, 2020, Gas Trading Australia data shows.

In comparison, the price in WA was forecast to be much lower — just $5.55 this month — and price increases have also been more modest, rising by around 160 per cent, from an average $2.13 a gigajoule on May 1, 2020.

The price rises in WA were also not thought to be linked to price hikes overseas.

“It’s primarily due to the expiry of long term contracts with North West Shelf Gas and reduced production from that facility,” Gas Trading general manager Allan McDougall told news.com.au.

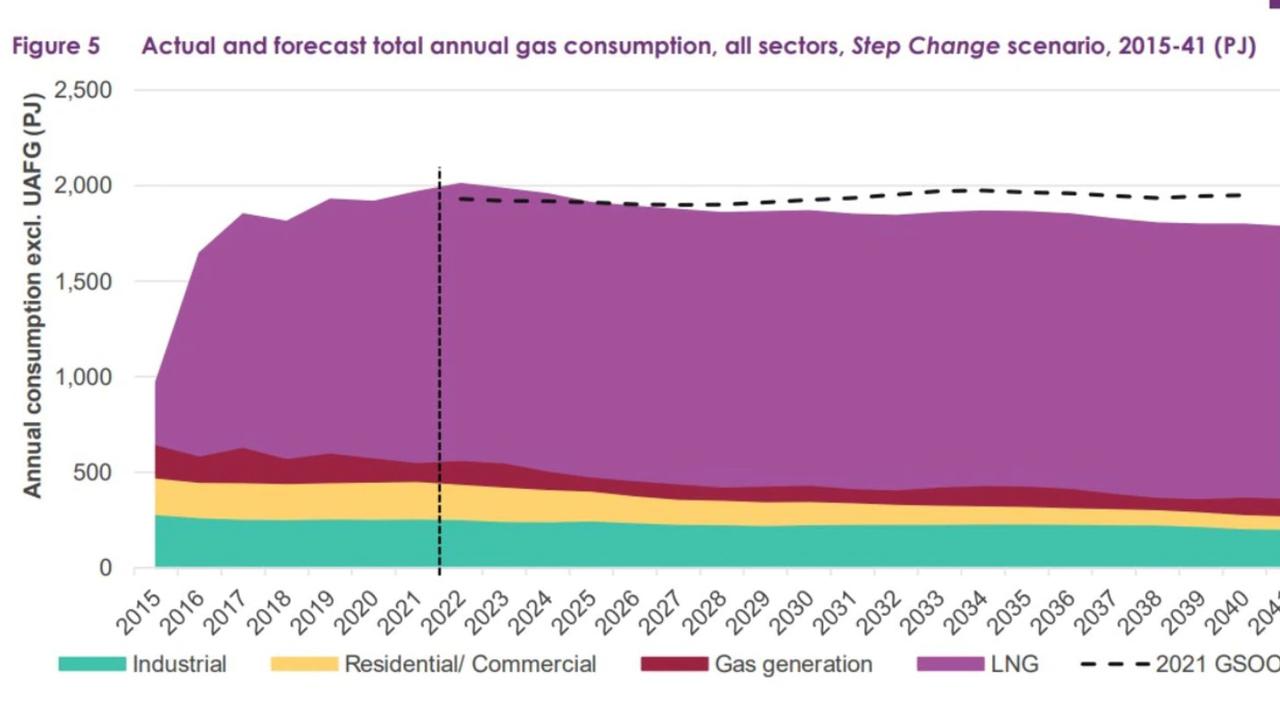

Australia is the world’s largest liquefied natural gas (LNG) exporter which sends 80 million tonnes of gas overseas a year.

Institute for Energy Economics and Financial Analysis (IEEFA) energy finance analyst Bruce Robertson said Australia should have cheaper gas prices because the industry is heavily subsidised and new areas for exploration have been opened for exploration.

“Yet still the gas industry returns the favour by charging Australians too much for gas,” he said.

“It will never end until we have introduced a domestic gas reservation policy just like Western Australia.”

Why can’t we pull the gas trigger?

The Australian Domestic Gas Security Mechanism can be triggered if there is a forecast shortage of gas — but it can’t be activated based purely on prices being too high.

Mr Willox doesn’t believe the gas export control power can be triggered as it is currently written.

“If triggered it could not start before next January; and if started, it is likely that it could not be applied to any current exporters,” he said.

“In short the rules would need to be totally rewritten to be of any use in this immediate situation.

“Whether it should be used is a separate and very difficult question given the global energy security situation.”

So what can we do?

Treasurer Jim Chalmers has said he would speak with Climate Change Minister Chris Bowen and Resources Minister Madeleine King, and engage with industries that were under the most pressure, as well as with gas companies.

“This situation is so serious for parts of our economy so dire, that we shouldn‘t pretend that flicking one switch or another will fix things overnight when they won’t,” Mr Chalmers told ABC Radio National’s Patricia Karvelas.

“We shouldn‘t pretend that there is necessarily a quick fix to this challenge. It’s been building for the best part of a decade. The only solution in the medium term is a decent energy policy and we are working hard to implement it.”

Victoria University Professor Bruce Mountain believes Australia should consider introducing a “windfall tax” on those companies that will enjoy enormous profits due to the shocks caused by the Ukraine war, including increased demand for gas.

“The gains they are getting are not of their own making,” Prof Mountain told news.com.au.

The money raised could then be provided as a buffer for affected industries and households.

While Prime Minister Anthony Albanese has previously rejected the idea of introducing a windfall tax, Prof Mountain said British and European leaders had also dismissed the idea initially before changing their minds.

He said Australia did not want to lose its gas-reliant manufacturing or processing businesses.

“The government needs to make tough choices one way or another and I don’t think it’s reasonable that it falls to taxpayers shoulders,” he said.

Mr Willcox acknowledged the complexity of the task saying new energy options – from renewables and storage to biogas, hydrogen and energy efficiency – were hard to accelerate amid global supply chain woes, skills constraints and unease from communities around energy megaprojects.

“The most sensible steps on both the supply and demand sides to build for the future and reduce our exposure to fuel costs will take time to deliver,” he said.

“Short term responses to help vulnerable industry and households will also be needed. They should be swift, targeted and have a clear handoff as the benefits of longer term measures are achieved.

“The new Albanese Government has an unenviable but urgent task in responding to this crisis. It is not one they can or should take on alone. The States hold many relevant levers, as do the energy market authorities, energy suppliers and energy users.”

Mr Willcox said the first task was for the Commonwealth to bring everyone together.

“Apocalyptic rises in energy prices threaten chaos for industry and pain for households. They demand a national, integrated and strategic response.”