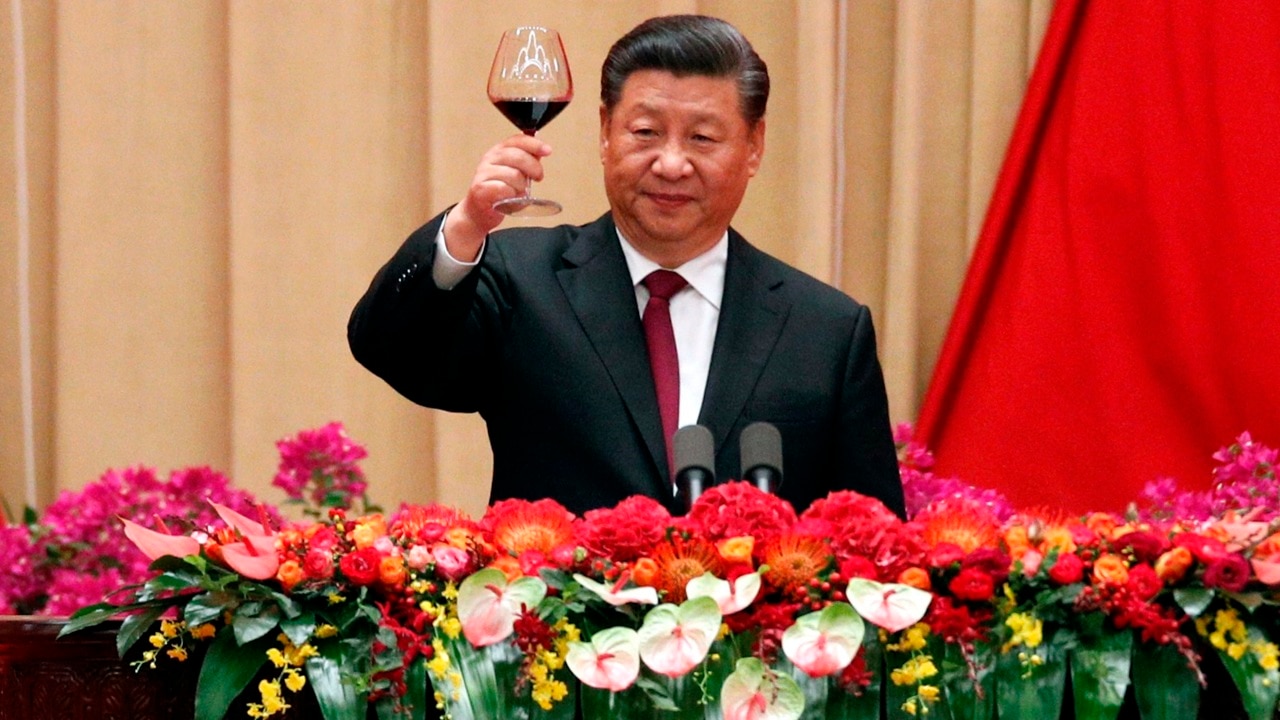

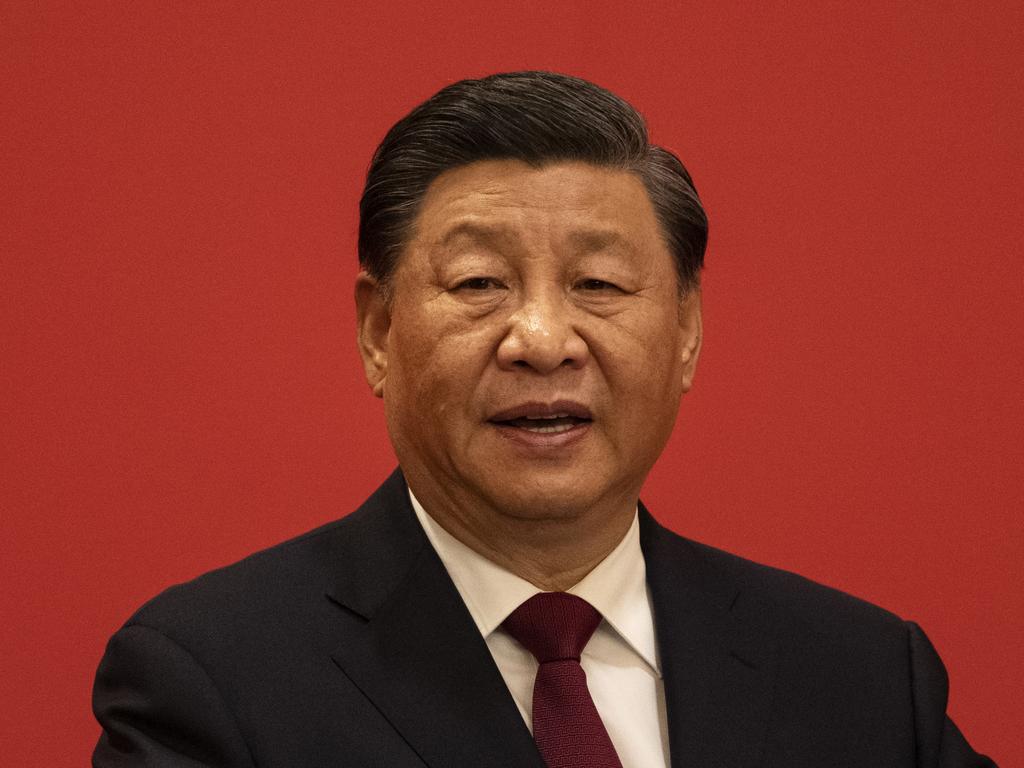

Hong Kong stock market plunges after President Xi Jinping’s power grab

Hong Kong stocks have been smashed as fears grow about the long-term impact of Chinese President Xi Jinping’s power grab.

Chinese President Xi Jinping’s power grab has spooked investors and sparked a huge sell-off in Hong Kong.

The Hang Seng China Enterprises Index, which measures Chinese stocks listed in Hong Kong, sank 7.3 per cent. That’s the worst plunge after a Chinese Communist Party congress since 1994.

Fears grew after Mr Xi’s decision to hand key economic posts to loyalists who back his zero-Covid strategy.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The Hang Seng Index ended the morning session down 4.99 per cent, or 809.48 points, to 15,401.64 by the break, its weakest level since 2009 during the global financial crisis.

The rout was described as a “panic selling moment” by Dickie Wong, executive director of research at Kingston Securities Ltd, who warned tensions between China and US had dragged down sentiment.

Stocks on the mainland were also down, with the Shanghai Composite Index slipping 0.89 per cent, or 27.19 points, to 3,011.74, while the Shenzhen Composite Index on China’s second exchange lost 0.35 per cent, or 6.88 points, to 1,960.04.

It's getting worse. A day after #XiJinping reveals his new leadership team in #China, the #HongKong markets are going down down down... https://t.co/cr3gbNqWdz

— Stephen McDonell (@StephenMcDonell) October 24, 2022

Mr Xi’s move to pack his leadership with supporters as he tightens his grip on power suggests the government will not likely shift from its strategy of fighting Covid outbreaks with lockdowns and other strict measures.

The policy has been blamed for the sharp drop in growth in the world’s number-two economy and, while data showed Monday that it expanded more than forecast in the third quarter, traders remain on edge.

“The more centralised power becomes, the more the risk of overzealous policy implementation based on directives from the top,” Duncan Wrigley, at Pantheon Macroeconomics, said.

“This happened in some of the lockdowns in the second quarter.”

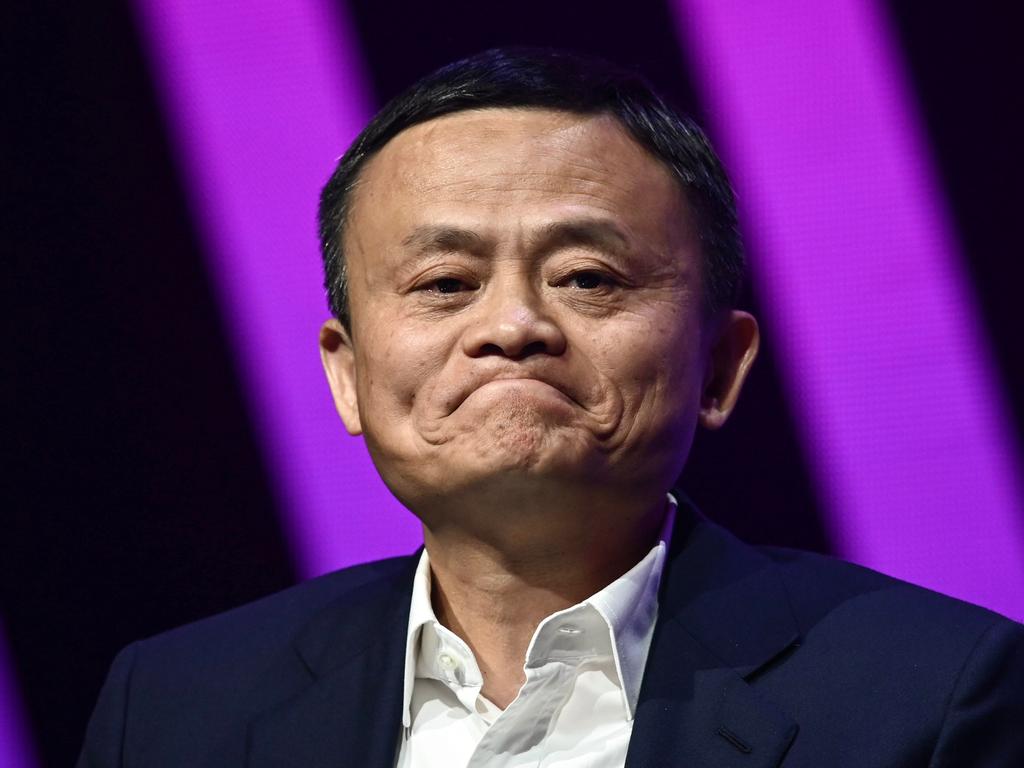

Tech firms were hammered, having already endured years of turmoil after Mr Xi’s crackdown on the sector that has cut profits and wiped billions off valuations.

E-commerce giants Alibaba and JD.com tanked around 10 per cent each, while Tencent lost more than eight per cent. The Hang Seng tech index was 6.7 per cent down.

Hong Kong stock market tanked, and Hang Seng Tech tumbles 6% to below 3,000.

— CN Wire (@Sino_Market) October 24, 2022

Hang Seng Chinese Enterprises tumbles 5.3%.#HongKong#stockmarketpic.twitter.com/cKwJFBr26Y

China’s GDP

China’s economy grew at a faster pace than forecast in the third quarter, official data showed Monday.

Mr Xi secured an expected third term as leader at a party Congress over the weekend.

After delaying the release of economic data last week, the government announced Monday that the economy grew 3.9 per cent year-on-year in the third quarter.

China had been expected to announce some of its weakest quarterly growth figures since 2020, with the world’s second-biggest economy hobbled by Covid-19 restrictions and a real estate crisis.

But investors instead focused on the political developments, which raised fears Mr Xi and his allies would continue with gruelling virus lockdowns and other policies that have punished the economy.

China’s currency slumped and stocks nosedived in Hong Kong.

On Monday, the onshore yuan dipped more than 0.4 per cent to 7.2633 per dollar — its weakest since January 2008.

“The market is concerned that with so many Xi supporters elected, Xi’s unfettered ability to enact policies that are not market friendly is now cemented,” said Justin Tang, head of Asian research at United First Partners.

One of the most pressing concerns is Mr Xi’s zero-Covid policy, which continues to put tens of millions of people under rolling lockdowns that also shutter factories.

China is the last of the world’s major economies to hew to the strategy.

“There is no clear sign of a significant easing of the zero-Covid strategy,” Nomura’s Ting Lu said, noting that, if anything, the opposite had happened.

In a speech to close the Congress on Saturday, Mr Xi insisted China’s Covid response has been a success.

And he promoted Li Qiang, the architect of a two-month lockdown in Shanghai that crippled the financial hub’s economy, to the second most powerful post in the Communist Party.

Real estate sector in crisis

China is also battling an unprecedented crisis in its real estate sector — which makes up more than a quarter of the country’s GDP when combined with construction.

Following years of explosive growth fuelled by easy access to loans, Mr Xi oversaw a crackdown on excessive debt.

Property sales are now falling across the country, leaving many developers struggling and some owners refusing to pay their mortgages for unfinished homes.

Still, the economic data released on Monday gave some cause for optimism. The third-quarter growth was higher than the 2.5 per cent predicted by a panel of experts surveyed by AFP.

“Many economic indicators have actually recovered reasonably well from the mass lockdowns of March and April,” according to analyst Thomas Gatley of Gavekal Dragonomics.

Car sales held strong in September, driven by strong demand for electric clean vehicles.

August exports increased 7.1 per cent compared with the previous year, and Beijing has invested in infrastructure to support activity.

In the second quarter of the year, growth had collapsed to 0.4 per cent on-year, the worst performance since 2020.

The country posted 4.8 per cent growth in the first quarter of 2022. Many economists continue to think China will struggle to attain its 2022 growth target of around 5.5 per cent, and the International Monetary Fund has lowered its GDP growth forecast to 3.2 per cent for 2022 and 4.4 per cent for next year.