‘Crisis’ for every day Russians as economic sanctions bite

Normal citizens have been scrambling to pull out their cash, with predictions the country is headed for a financial bloodbath as a result of the West’s boycott.

Every day Russians – outside the country’s political elite and super rich – are facing a grim reality as they scramble for cash as banking systems are shut down and food prices soar as a result of the West’s economic sanctions against the invasion of Ukraine.

The Russian currency has experienced a brutal drop in value, impacting ordinary people’s savings, and resulting in desperate citizens joining long ATM queues to pull their money out.

The sanctions include an unexpected move by the US to freeze the assets of the Russian central bank in Western jurisdictions but also the “nuclear option” of cutting off most Russian banks access to the SWIFT system, which processes trillions of dollars’ worth of transactions every day.

Washington also signalled it would fully block the Russian direct investment fund, with the sanctions aimed at stopping the country from accessing $US630 billion in foreign reserves that Moscow had hoped to rely on during the invasion of Ukraine.

The sanctions have created chaos in Russia and could see the country plunge into recession soon, according to experts.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Ð’ МоÑкве и других городах РоÑÑии перед банкоматами ÑобираютÑÑ Ð¾Ð³Ñ€Ð¾Ð¼Ð½Ñ‹Ðµ очереди. Фото Ñделано в 5 чаÑов утра. pic.twitter.com/lpSrIM4Ao9

— Oles Filonenko 🤷ðŸ¼â€â™‚ï¸ (@taxfreelt) February 27, 2022

Associate Professor Eliza Wu from the University of Sydney said Russians were facing a “crisis scenario”.

“You’ve got people basically being panic stricken so all the ordinary Russians are running to their banks, and investors locally and internationally are dumping Russians assets, so everyone is trying to get money out however they can,” she told news.com.au.

“But the sanctions in place are particularly limiting the exchange from rubles to any hard foreign currency, so at the moment even if you are trying to sell off your ruble denominated assets there aren’t many people who are willing to buy

“So there is a lot of fire sales going on meaning they are selling off their rubles for whatever they can get, so they are losing a lot of value.”

The plummeting value of the ruble is having a “huge wealth effect” with ordinary Russians facing skyrocketing prices for everything from food to fuel, while supermarket shelves will be emptied and unemployment will also “go through the roof”, she added.

“Russians are going to be pulling out whatever savings they have from the banks to try and purchase goods as soon as they can so they don’t lose any more purchasing power,” she said.

“And the economic costs are going to be huge – in due course unemployment is going to rise as money is pulled from the banks and the banks are faced with liquidity problems – they are going to be collapsing, so the Russian government is going to have bail them out.”

Professor of government at Wesleyan University in the US, Peter Rutland, said he had been surprised by the “speed and severity” of the “unprecedented" Western sanctions, which he said has had an “immediate impact”.

The ruble has lost 29 per cent of its value and exchange booths are offering 100 rubles to the dollar, while Russia’s central bank is doing everything it can to shore up the value of the Russian currency, he explained.

“The falling ruble pushes up the price of imports, which make up over half the consumer basket. Inflation in Russia was already a sensitive issue prior to the invasion of Ukraine, running at 8.7 per cent,” he wrote for The Conversation.

“In 2021, global food prices rose 28 per cent, and Russia imposed price caps and export duties on some basic food items. The new sanctions will severely impact the living standard of ordinary Russians.

“A survey conducted in July 2021 found that around 75 per cent of Russians spent around half their income or more on food, and that was before the recent price surge.”

Meanwhile, the Moscow Exchange remained closed on Tuesday for trading after failing to open on Monday, as the ruble tumbled to a record low plunging by as much as 40 per cent against the US dollar.

The central bank said it would make a decision on the Moscow Exchange by 5pm Sydney time, but any opening is expected to cause carnage as foreign investors scramble to sell Russian securities.

Russian President Vladimir Putin has made desperate moves to stem the financial bloodbath.

He banned sending cash abroad and ordered exporters to convert 80 per cent of their earnings into rubles, while the Central Bank of Russia has also hiked the interest rate from 9.5 per cent to 20 per cent.

“This should help stabilise the ruble but will make borrowing more expensive for businesses and thus increase the chance of a deep recession,” Prof Rutland noted.

Russia’s inability to manufacture the latest generation of microchips could also see things like smartphones and cars disappear from the country as the world’s biggest producer Taiwan also joined the sanctions, he added.

“Similarly, about 66 per cent of medicines are imported, and it is not yet known if a mechanism will be created to enable Russians to pay for imports of medicines,” he wrote.

While revenue from oil and gas will allow Putin to pay for security measures and “push down unpopular unrest” he could still face an uprising from ordinary citizens, warned Prof Rutland.

Putin has raged against the sanctions and called the West an “empire of lies”.

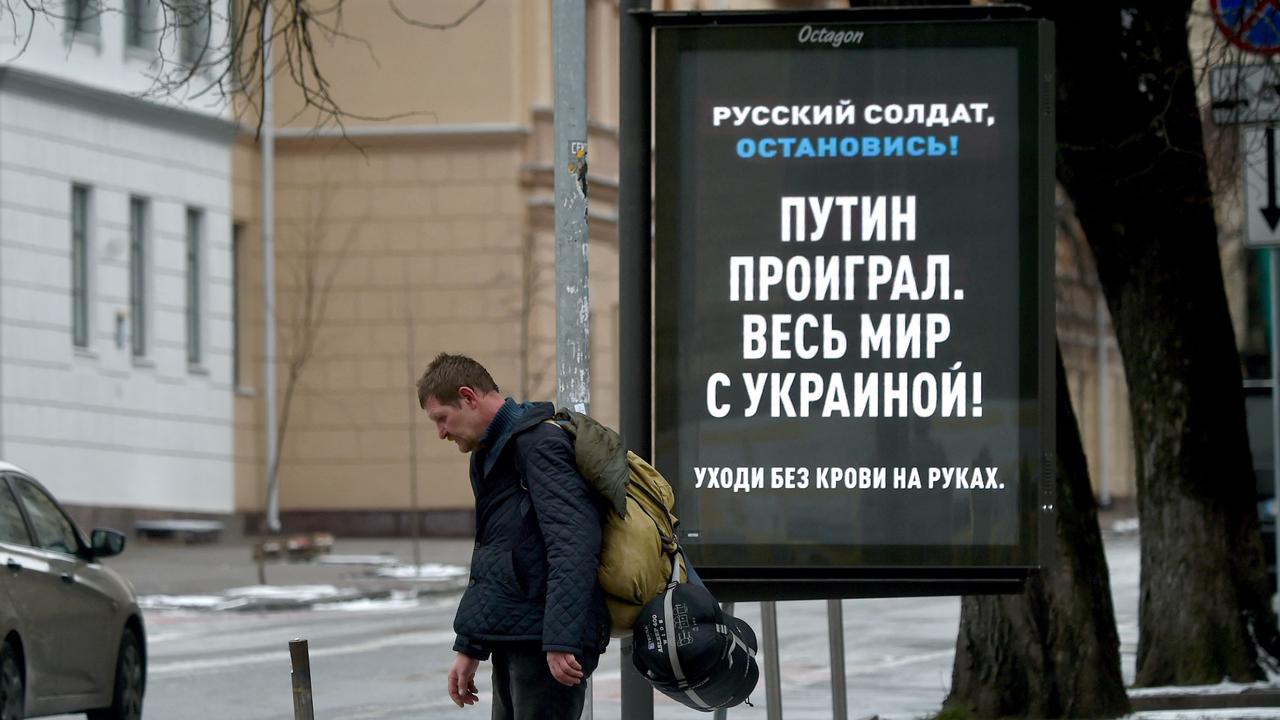

“Worsening personal economic circumstances might affect how Russians view the war,” Prof Rutland said.

“In the past, Putin has tried to pass the blame for economic pain on to the West, but there is a chance that this time around, Russians might hold him to account.”

But the sanctions were not just costly for the Russians but also for the rest of the world with escalating prices as international trade is disrupted, Assoc Prof Wu said.

Whether more economic sanctions will be imposed by the international community depends on how long the conflicts continues as the world looks for a peaceful resolution, she added.

“I think the it depends on the effects of the current sanctions, if there not hitting quickly enough, the sanctions will progressively ratcheted up further,” she said.

“But I think the ban from the SWIFT system has already been as its been called a nuclear option that the world economic powers have chosen to implement, so I think it’s a wait and see situation.

“It depends on the duration of the conflicts and how badly that escalates and also how hard the economic sanctions are hitting as well.”