Russia bank sanctions could lead to ‘Lehman Brothers moment’

Russia is facing its own Lehman Brothers moment as sanctions put a chokehold on the country – with signs its economy could collapse.

ANALYSIS

There is an apocryphal tale of an Australian banker who went to New York to sell assets to a Wall Street firm in 2008. He arrived on Friday to prepare for his Monday meeting. Did some pleasant sightseeing over the weekend. But when he turned up to the bank on Monday morning, it had vanished. There was nobody to meet, let alone negotiate a deal with. He was back on the plane home by lunchtime.

That fateful weekend happened in 2008 when first Bear Stearns went belly up – later followed by Lehman Brothers. What followed was the Global Financial Crisis as assets considered safe by financial markets on Friday were suddenly unable to be valued at all come Monday.

The collapse of trust was a nuclear detonation that spiralled out into every bank in the world.

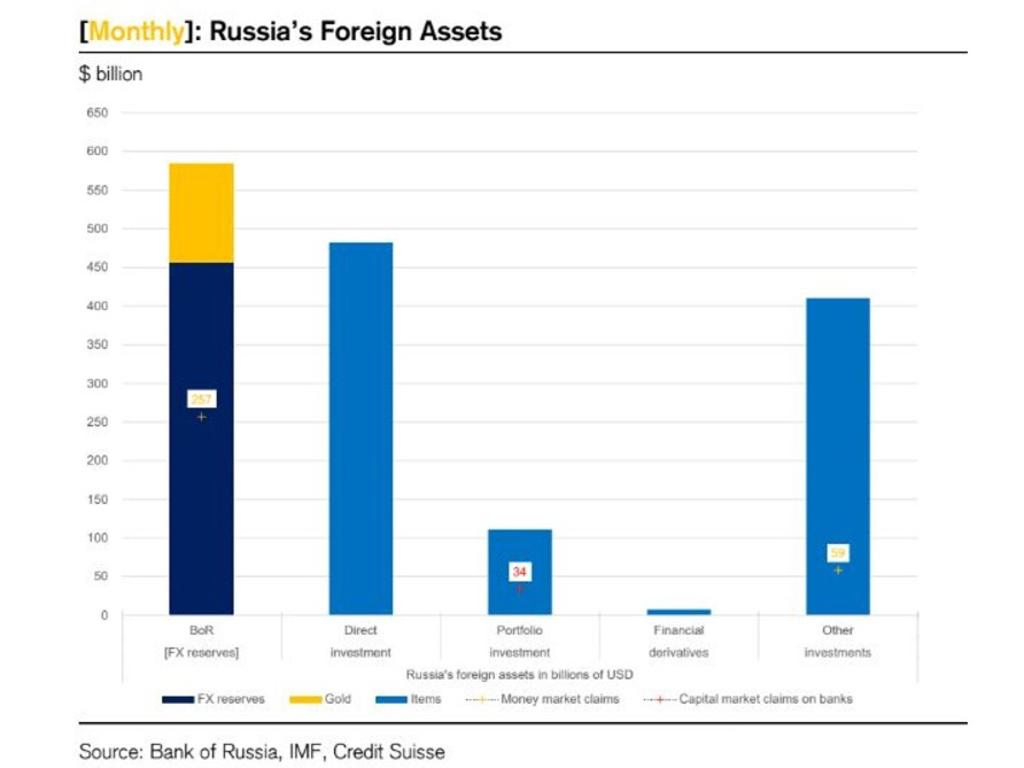

Something similar happened over the weekend in Russia. On Friday, its banks were solid. Its budget was in surplus. Its external accounts were in the best shape they’d been in years with nearly $600 billion of forex reserves stashed offshore.

But come Monday, Russia was effectively insolvent. The currency was crashing. There was a run on its banks by its own citizens and 40 per cent of the celebrated reserves had effectively evaporated.

How did it come to this?

The how of it is that Europe and the US lost patience with Russia over its Ukraine invasion and kicked select banks out of the SWIFT payments system.

SWIFT is the global banking messaging system that enables transactions everywhere. Being kicked out is a severe blow for any bank, leaving it unable to process payments with each other or overseas in any useful time frame.

Energy banks and flows were excluded, meaning Russian banks can still process the sale of oil and gas, but not much else.

This is a nasty blow to the Russian economy as trust is shaken and citizens seek to withdraw their funds from banks. It will also land on a few international banks that do business with Russia in due course. But they will quietly be bailed out and the global financial system likely absorb the shock.

Sanctions on the Bank of Russia

But, booting Russian banks from SWIFT is not all that Western authorities did. They also sanctioned the central bank, Bank of Russia (BoR), and effectively blocked it from being able to repatriate the 40 per cent of its $600 billion in forex reserves that it holds in their jurisdictions.

That means that not only are the Russian banks in trouble, but the Russian central bank is also being severely inhibited in helping them.

Roubles could become worthless

If the BoR can’t get its hands on reserves to protect the currency, backstop bank deposits and fund critical government operations, then the entire economy risks an imminent spiral into insolvency since printed roubles will quickly become worthless.

Moreover, for everybody else, the sudden moves that Russia makes to its reserves in response might be enough to deliver a Lehman-style shock to markets. For instance, Credit Suisse estimates that the BoR has some $300 billion in reserves deployed in the money markets that grease the wheels of daily global commerce.

If that is pulled out in a rush to fund Russia’s problems at home, then there is every chance that we will see interest rates dislocate in unexpected locations of global finance. This is often what happens right before and during periods when large speculative players like hedge funds and bond funds can go bust, manifesting systemic risk.

What is Russia doing to save its economy?

Russia appears to have anticipated these outcomes for a few years. It has created its own SWIFT system, though nobody uses it. It has dumped a lot of the forex reserves it used to hold in the US and replaced them with gold. So the BoR can probably find the money it needs to prevent economic implosion at home in the short term.

But there is no doubt that Western authorities have just dramatically shortened the period over which Russia can afford to go it alone in its war. The stakes are now immense at home with a young demographic that has a taste for the better lifestyles of the West and who will not respond favourably to a Soviet-style depression.

More Coverage

What impact will this have on the world?

As for the rest of us, we will just have to wait and see if some Wall Street master of the universe is on the wrong side of a bet on Russia’s forex reserves. If so, then, we will see another Lehman moment in global finance that freezes all kinds of assets, blows out credit spreads, sinks stocks, and evaporates the hawkish dreams of central bankers, who, try as they might, just can’t get interest rates off zero.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.