Chinese economy recovering thanks to billions in Australian stimulus packages

Canberra has spent billions on stimulus packages this year but huge sums of it are going straight to China, helping its economy and not ours.

Back in January, factories and workshops across China fell eerily silent as Beijing sent most of its nation into what was then the most stringent and widespread lockdown in modern history.

A nation that has come to be called ‘The World’s Factory’ ground to a halt, leaving many wondering how the Chinese economy would recover from such an unprecedented shock.

Economic growth forecasts were cut, contracts were put on hold, and the world waited to see how the chips would fall.

RELATED: ‘Hollow bluff’: China’s swipe at Australia

Now, almost nine months later, China’s economy has seemingly undergone a miraculous recovery. On paper the Chinese economy is booming, even as other parts of the Northern Hemisphere face an economic battle that, based on current forecasts from the European Union, may take four or five years.

While there is a great deal of ongoing controversy over the accuracy of the Chinese government’s economic statistics, the enormous volume of container ships filled to the brim with Chinese made consumer goods, heading across the Pacific to the United States cannot be denied.

In fact, as a result of the record demand for trans-Pacific shipping, there is actually a global shortage of shipping containers, leading to container manufacturers facing order backlogs that run well into 2021.

RELATED: One thing we have that China needs

RELATED: Aussie industries that are hiring big

But behind the scenes of a booming manufacturing sector and record levels of construction, the Chinese consumer economy is not faring nearly as well.

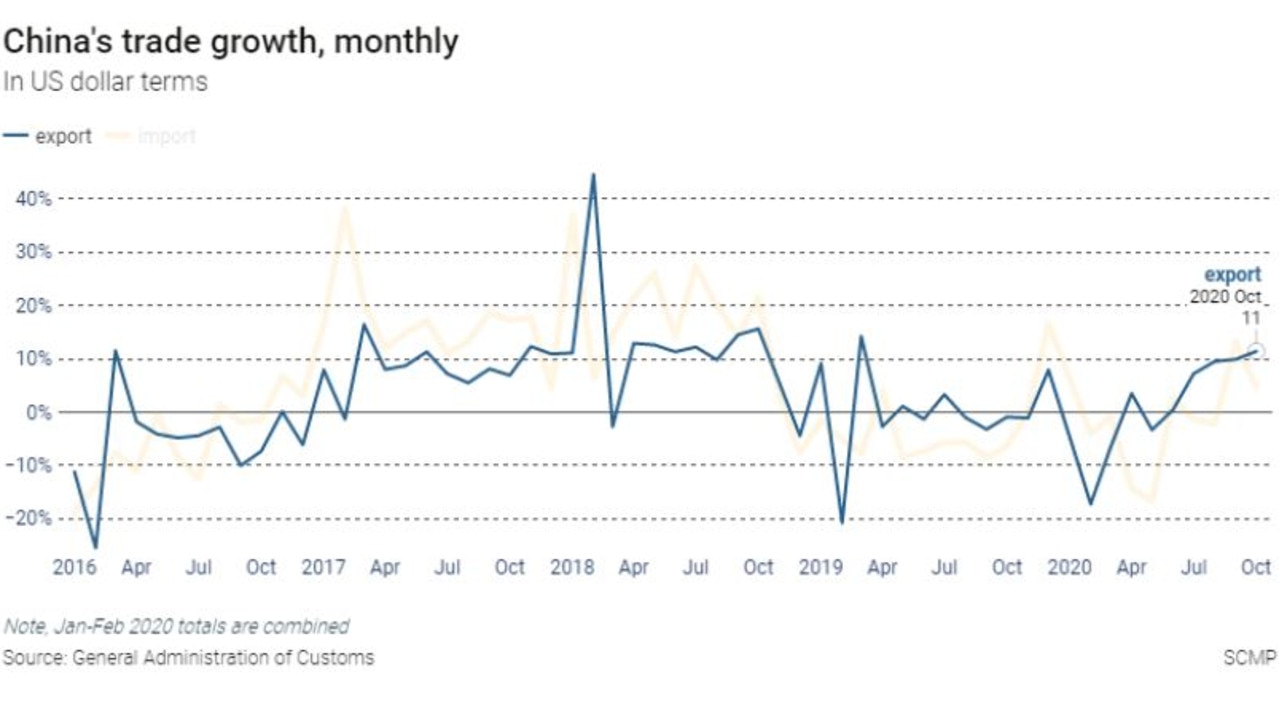

After the release of Beijing’s trade figures for October, China expert and Peking University Finance Professor Michael Pettis shared his view that it was clear that China’s economic recovery has been lopsided.

“Almost all the recovery is on the production side, and what little recovery on the consumption side has been indirect, as a consequence of supply-side measures,” said Pettis.

Essentially, the miraculous recovery of the Chinese economy is being heavily supported by Western consumer spending, driven by government stimulus.

Much like during the GFC when Aussies buying flat screen TVs and other consumer goods with their stimulus payments helped support Chinese manufacturers, this time that is occurring on a far larger scale.

During the GFC the Rudd government injected $12 billion into the economy through cash handouts. This time between cash handouts to welfare recipients, superannuation withdrawals and other forms of government stimulus, well over $150 billion in support has flowed through the economy.

This is clear when looking at the total of Australian imports from China. After dropping earlier in the year due to the initial Chinese lockdown to its lowest level since 2016, it has since risen by as much as 80 per cent, as Aussie retailers scramble to restock their shelves amid record demand.

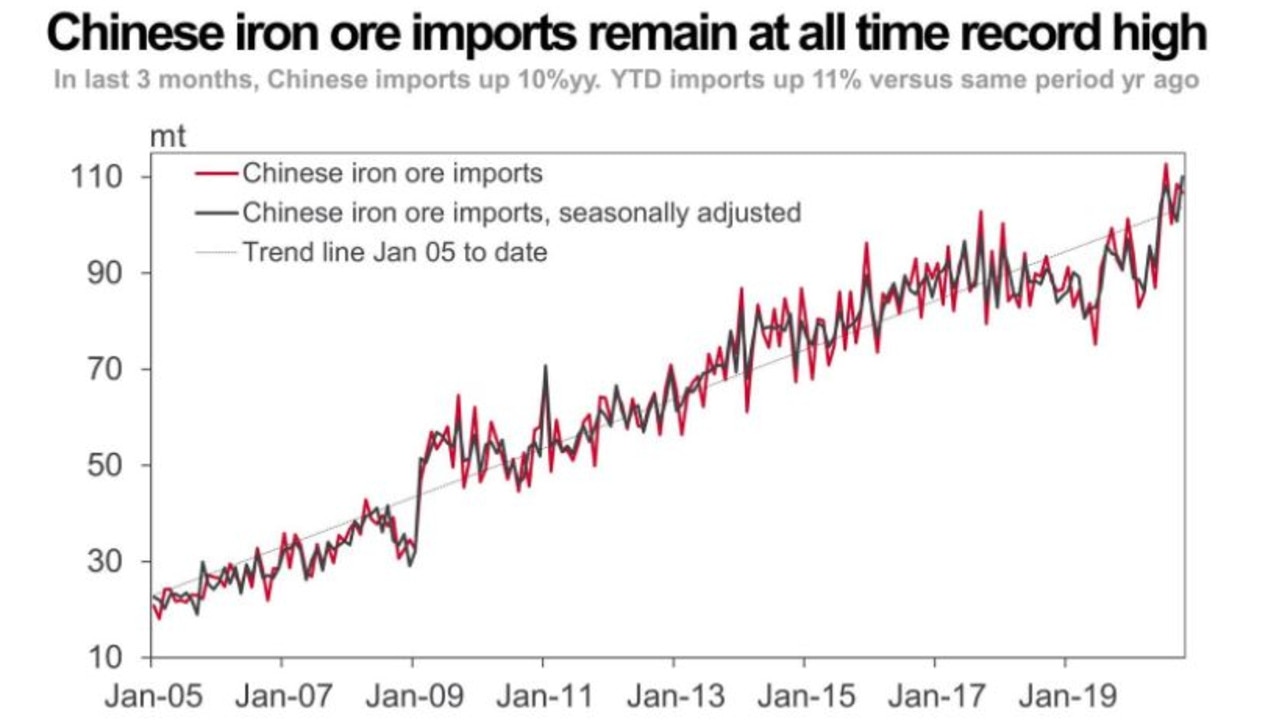

Another factor driving China’s economy is high levels of construction of both infrastructure and real estate. As a consequence, Chinese imports of iron ore, which are overwhelmingly sourced from Australia, have skyrocketed off into the stratosphere, consistently breaking record after record since Beijing reopened after the lockdown.

Despite almost a decade passing since former President Hu Jintao pressed his Chinese Communist Party colleagues to rebalance the economy away from export and fixed asset investment growth, it appears Beijing has fallen back into old habits.

The push toward a domestic consumer driven Chinese economy has seemingly been placed on the back burner.

While the move back toward export driven growth has helped secure Beijing’s immediate economic future, it has also left it increasingly vulnerable to further shocks to global consumer demand.

Amid the current global uncertainty, that potential shock could take any number of forms.

With much of Europe in varying degrees of lockdown as coronavirus case numbers continue to surge, there are rising risks there could be long term damage to European consumer demand.

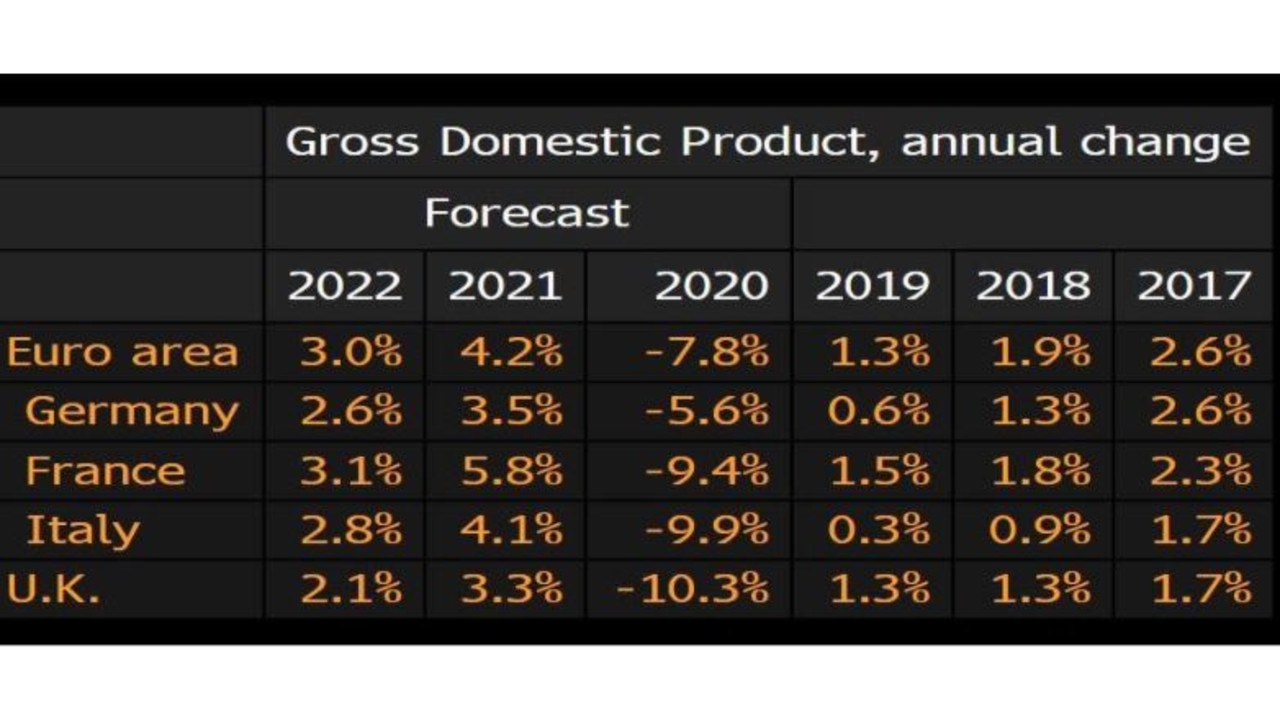

Looking at the existing forecasts from the European Union, it’s clear that several of the world’s largest economies face very long roads to recovery.

If the lockdowns persist for longer than anticipated, which is certainly possible given the scale of infections many European nations currently face, the possibility of long term damage to multiple European economies becomes even greater.

It’s not just Europe facing potential long term economic damage from the pandemic. With over 130,000 cases per day in the United States, over 20 million unemployed and policymakers currently refusing to come to a compromise on a stimulus package, the US too faces a challenging future.

If a lasting blow is dealt to global consumer demand and Beijing is forced to confront a world in which one of the pillars of its economy is heavily impacted, it will no doubt fall back on the other, construction.

In recent months, Chinese steel production has hit record highs, as Beijing tries to repeat its global financial crisis era strategy of building its way out of economic trouble. This fixed asset investment led construction boom, drives a currently nearly insatiable demand for Australian iron ore.

This effectively leaves Beijing in the unenviable position of being reliant on America and the West for their consumers and on Australia for its iron ore.

Despite all the chest thumping, aggressive overtones and threats, the very nature of the current global economy means Beijing needs the Western consumer to recover and Aussie miners to keep digging.

As we head further into an uncertain future, Beijing isn’t nearly as secure or as self-sufficient as it would like or as it was envisioned under the leadership of former President Hu Jintao.

In the long run that may change as Beijing seeks to diversify the supplies of raw commodities such as much needed Australian iron ore. But that takes time.

As does the slow and very gradual shift from an export and construction led economy, to one based on domestic consumer consumption.

Ultimately, until Beijing can finally wean itself of debt fuelled fixed asset investment and its reliance on exports of consumer goods to the West, its dreams of one day attaining global supremacy may remain just that, dreams.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator