Chinese businesses issue ‘IOUs’ instead of cash amid trade war, slowdown

Cash-strapped Chinese businesses are turning to one risky tactic to pay their debts — and it could have catastrophic effects on Australia.

“Desperate” businesses in China are feeling the pinch of the nation’s economic slowdown and the escalating trade war with the US.

But one alarming strategy they’re using to get by could cause chaos for Aussies and the wider world alike.

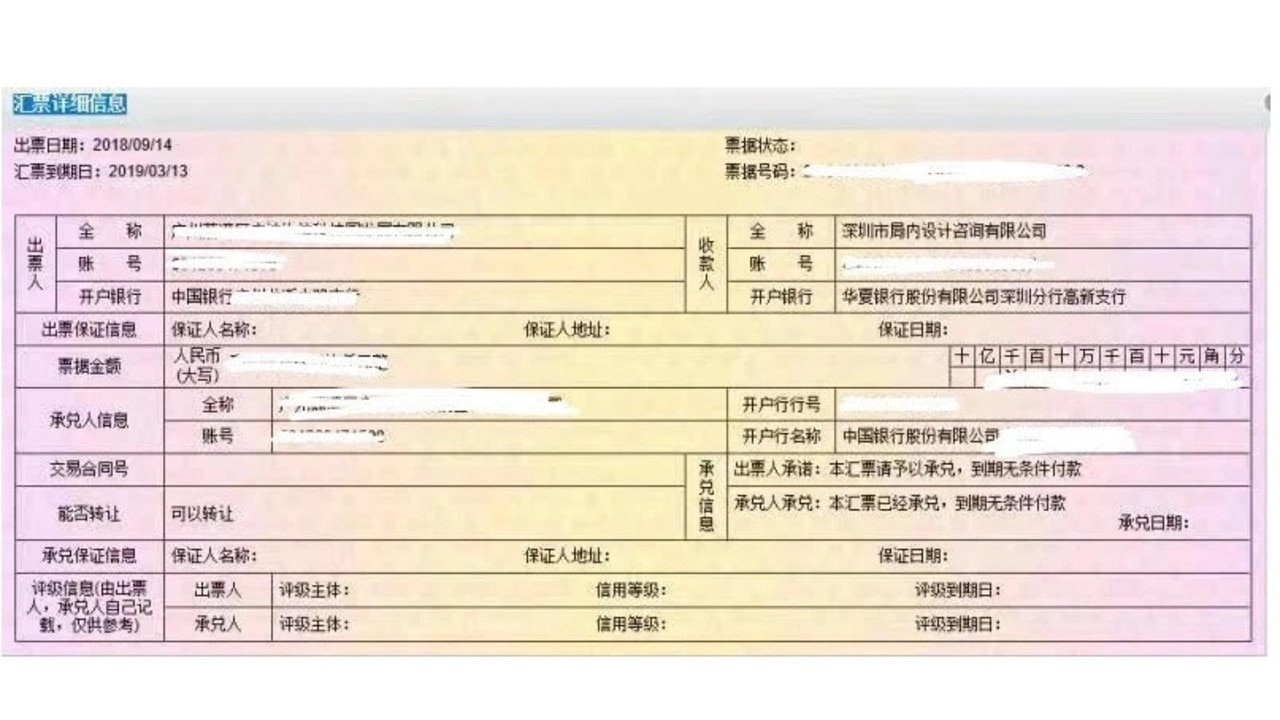

According to The New York Times, cash-strapped Chinese companies are increasingly turning to “IOUs” to pay their debts instead of cash.

Those IOUs — also known as commercial acceptance bills — are now so widespread they are believed to be worth “more than $200 billion” in total, and they have increased by more than a third compared with last year, the publication reports.

That spike in unofficial lending is due to a clampdown on lending to smaller, private businesses, which are seen as more risky.

“A growing number of companies are issuing IOUs to their suppliers. Some suppliers turn around and use the notes to pay another supplier. And then — in a sign of how desperate some Chinese companies have become for money — they sell the notes for less cash than they are worth,” the Times reports.

And alarmingly, “recent Chinese history suggests these financial dealings could end badly”.

That’s because just 20 years ago, IOUs were so rife they totalled almost “one-fifth of China’s economic output” — and caused China’s business world to “seize up”, sparking a massive government intervention to restructure debt and write much of it off.

Former Coalition policy adviser and economist John Adams told news.com.au the “explosion” of these IOUs was a grim warning for Australia.

“Of all the debt bubbles in the world, the largest globally is in China on a relative basis to the size of its economy. The Chinese debt bubble is concentrated in its corporate sector and is completely unsustainable,” he said.

“Reports about exploding IOUs within the China corporate sector are not surprising given how indebted they are. Many Chinese corporates have flawed business models and cannot generate sufficient cashflow and profits that would allow existing debts to be serviced on time.

“Commercial acceptance bills are just a fancy ‘pretend and extend’ financial instrument that will allow the Chinese corporate debt bubble to expand but will result in the build-up of very dangerous levels of systemic risk that can impact not only China but the global economy including Australia.”

He said the risk to Australia was clear.

“The explosion of Chinese corporate IOUs should be another warning to Australians and Australian policy makers that Australia risks experiencing the greatest economic crisis in over 200 years,” he said.

“I remain convinced that Australia is headed for economic armageddon given that we have the biggest statistical debt bubble in Australian history at the same time we have the biggest debt bubble in the history of the world.”

According to AMP Capital chief economist Dr Shane Oliver, this massive increase in Chinese IOUs is a sign of bigger economic crises — and there could be a worrying overall impact on the wider global economy, including Australia’s.

“The risk is fairly obvious — the businesses might default, which causes problems to the Chinese economy, and if the Chinese economy gets into trouble, it affects the rest of the world as it’s the second-biggest economy,” he said.

“China takes 30 per cent of our exports in Australia, so the question becomes, will this be a major issue?”

While Dr Oliver said it was “certainly a risk” worth keeping an eye on, he believes Chinese authorities are now adept at managing the threat.

“Shadow banking and companies defaulting on their debts create a lot of concern about the Chinese economy, but it is still very much centrally managed compared with Australia, so it’s unlikely the Chinese will let this become a major problem,” he said.

“It’s a symptom of a wider problem — China’s economic growth boom years are over and there’s three main reasons why.

“It can’t grow forever, and it had to slow down eventually. Secondly, they’re tightening credit conditions … and the hardest hit were small businesses. And thirdly, there’s the trade war which has only just started to impact China, although it’s been going on for a while.”

He said China’s economic woes could impact Australian industries, with the mining sector set to take the first and biggest hit. Agriculture was also likely to suffer, along with higher education and tourism to a lesser extent.

It comes as former treasurer Peter Costello warned that retirees’ savings would be hit if the US-China trade war continued unchecked after the S & P/ASX 200 share index experienced two-day losses totalling $86 billion.

“Australian retirees have lost money,” Mr Costello told The Australian.

“Superannuation funds have lost money. If this were to continue, this will affect Australian savings and ultimately will affect the budget.”

Continue the conversation @carey_alexis | alexis.carey@news.com.au