Central banks investigate digital currencies following bitcoin boom

THE RBA is just one of several central banks actively investigating issuing a digital currency following the bitcoin boom.

NO STATEMENTS, no accounts, no fees, and definitely no waiting for your money to arrive.

That could be your financial future in a world where banks have been replaced by a single, unique “key” which would let you directly transfer and receive money instantly from anywhere in the world.

It’s something central banks from the UK to Israel and Australia are actively assessing as they consider whether to develop their own cryptocurrencies to mirror the benefits of bitcoin, while minimising the ability to launder money or evade taxes.

Head of the Cyber Academy at Edinburgh Napier University, Bill Buchanan said many are now putting their “toe in the water” to investigate how the blockchain technology that underpins bitcoin could improve the financial system by providing instant, secure transactions.

“Governments are worried that they won’t be able to trace transactions of businesses and individuals because it all happens in this digital space,” he told news.com.au about the recent bitcoin boom that has sparked a flurry of investor activity.

“Banks are extremely worried because it’s a completely disruptive force. The transaction is between me and you and doesn’t actually involve any other intermediate party involved in that.”

Now, the Bank of England is investigating the potential for a cryptocurrency linked to the British pound that would allow people to purchase large assets like property within seconds. A major report on the subject is due this year, while a previous study with PricewaterhouseCoopers noted a cryptocurrency using a similar blockchain technology could make the financial system more resilient if doubts about security, data storage and scalability are overcome.

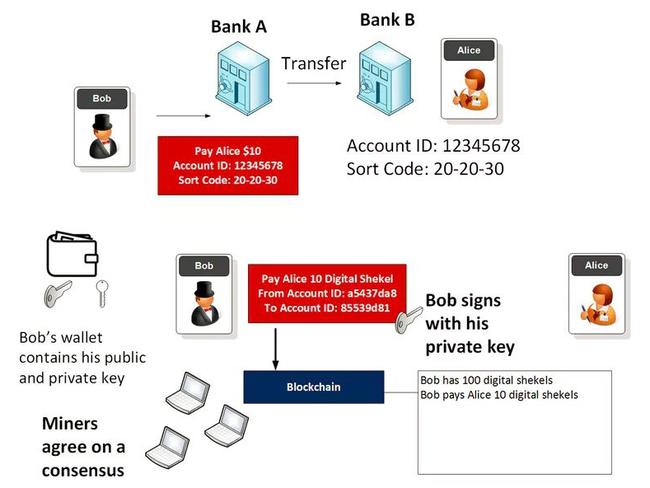

The blockchain is essentially a public, encrypted record of all transactions which anyone can make using a public and a private key — rather than using intermediaries as in the current financial system.

Bank of England governor Mark Carney has previously said it could “transform” financial infrastructure and allow for “significant gains” in terms of accuracy and efficiency which could save tens of billions.

The Reserve Bank of Australia (RBA) is also investigating the “pros and cons” of establishing a digital currency. Governor Philip Lowe said in a speech last month that while going into direct competition with retail banks is not something they’re planning to do, the RBA is working to see if a system to “issue Australian dollars in the form of electronic files or tokens” for specialised situations is a good idea.

“The tokens could be exchanged among members of a private, permissioned distributed ledger, separate from the RBA’s Real-time Gross Settlement (RTGS) system, but with mechanisms for the tokens to be exchanged for central bank deposits when required,” he said.

“This seems to be the general model that some people have in mind when they talk about ‘putting AUD on the blockchain’, although other technologies might be able to achieve similar outcomes.”

BYE BANKS?

So with a $75 million Royal Commission into the banking sector due and cash playing an increasingly small part in the Australian economy, is it time to ditch your bank?

Not quite, said Mr Buchanan, claiming that the fundamental issue is one of trust in a system where there is effectively no recourse if money is stolen.

“This private key is the thing that actually defines you,” he said about the way bitcoin’s blockchain ledger operates.

“So you don’t have a bank account number anymore, sort code, PIN number or a user login for your bank. Basically you have a single encryption key and it’s like having the keys for your house. But if somebody makes a copy of that key they can get into your house and you can’t stop them from getting in there unless you change the locks.”

Instead, he envisages a future in which mobile phones and a “crypto-token” system are used with various retailers to replace cash, with individuals identifying themselves via biometric technology.

“The mobile phone and things like biometrics, fingerprints, scanning and face recognition is a good way forward. A system that involves a financial transaction that includes your fingerprint is a much safer way to transact than something like bitcoin where there are so many risks that you could be personally liable for,” he said.

“What’s more likely to happen in the future is that we’ll buy bitcoin tokens or Amazon tokens and these’ll be crypto-tokens stored by an entity that we trust. Then we’ll trade in those tokens and they might go up or down and eventually we might cash them in.”