Should Australia start its own cryptocurrency?

AUSTRALIA could’ve flush with its very own bitcoin craze. The reason we’re not speaks volume about the future of bitcoin.

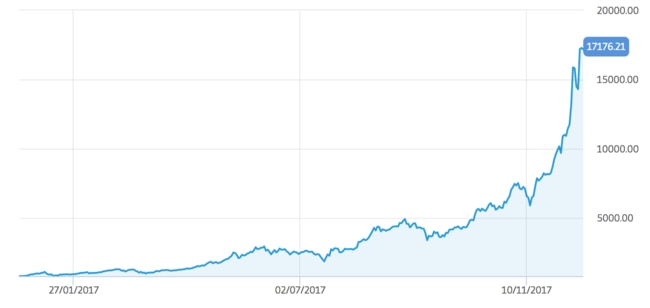

BY NOW we all know about Bitcoin and its very good year. It has gone up around 2000 per cent and at the time of writing a single Bitcoin was trading for more than $US17,000 ($22,500).

What you might not know is that Bitcoin is not the only digital currency out there. There are now many. A few of the more popular ones are Ethereum, Monero and Litecoin. But many more are starting. Nothing prevents anyone from inventing their own.

This next part may surprise you even more — the Australian government has been thinking about starting one.

On Wednesday, the head of Australia’s Reserve Bank said the normally staid and boring institution had been looking into these digital currencies and was even considering creating its own — a digital currency version of the Australian dollar.

An Australian digital currency would be a wild and fascinating experiment but the reason they decided against it may be even more interesting still.

An electronic Australian dollar would be money held electronically, but not in a bank account. You would simply have a wallet app on your phone with cash in it. You could send the cash to other people or to businesses. The big difference with the current payment system is it would not be moved to and from an identified bank account but be anonymous, like cash.

But because there would be no record of it, it could be lost or stolen, just like cash. Drop your phone in the river and the cash may be gone.

Electronic cash would be anonymous but it would have to be secure. Like banknotes, the computer code that comprised eAUD would have to have features that made it hard to replicate and counterfeit.

It sounds like a good idea in theory. But the Reserve Bank has decided for now not to go ahead with the plan and the reason is somewhat disturbing. They’re worried it could hurt Australia’s banks.

Governor of the Reserve Bank Philip Lowe actually raised the prospect of people starting a run on Australia’s banks. If you’ve seen Mary Poppins you know what a run on a bank is — everyone tries to get their money out at once in a panic.

Because a bank can’t pay back all its depositors at once (it doesn’t just sit on the money, it makes loans too) a run on a bank can be a dangerous situation.

“If we were to issue electronic banknotes, it is possible that in times of banking system stress, people might seek to exchange their deposits in commercial banks for these [electronic] banknotes,” he said. “In other words, it might be easier to run on the banking system. This could have adverse implications for financial stability.”

This is an extraordinary prospect for the Reserve Bank Governor to raise.

It may even be reckless. If the RBA’s digital currency would be so much better than being with the banks, wouldn’t that mean there’s a risk of a run on the banks even if the Reserve Bank doesn’t set up its own digital currency?

Lowe points out that in a time of crisis, people don’t want any old asset. They want safe assets backed by government. After all, Australian bank accounts are backed by a government guarantee, which is in turn backed by a $400 billion dollar annual budget, which is in turn backed the power to make people pay taxes or be put in jail. No digital currency has that.

It might be that no other digital currency is ever as safe as an official digital Australian currency. But the world of digital currencies is changing so fast you wouldn’t bet on it.

After all, in the same speech, the governor pointed out that banks do not have a monopoly on payment services.

“If financial institutions do not respond to customers’ needs, others will,” Lowe said.

Bitcoin is only the first big digital currency. It is not perfect. The fees for actually using it to buy small things are prohibitively high. I heard a story of someone paying $20 in fees for a $13 purchase. Fees can be as high as $26 per transaction.

Its value keeps wobbling around which also prevents it being a good payment method, and it uses a ridiculous amount of electricity — by one estimate, more than New Zealand, every day.

These factors can change — Bitcoin is open source software and it may be adapted over time. Before that, another digital currency could rise up and win us all over.

What would stop that new digital currency being a safe harbour that Australians flee to “in times of banking system stress”? By raising the prospect of this systemic stress and a bank run to digital currencies, the Reserve Bank governor has me worried. And it should be his job to keep us all calm.