‘Australia is not immune’: $63 billion warning sign recession is looming

Investors are panicking as it is becoming increasingly likely another financial bubble is about to burst, potentially plunging the world into recession.

Last week’s panic from the $63 billion selloff in the Australian stock market is subsiding. But if the bond-market fiasco continues, and it will, that’s a drop in the ocean of what’s to come, which means it’s worth considering investment alternatives like gold and bitcoin.

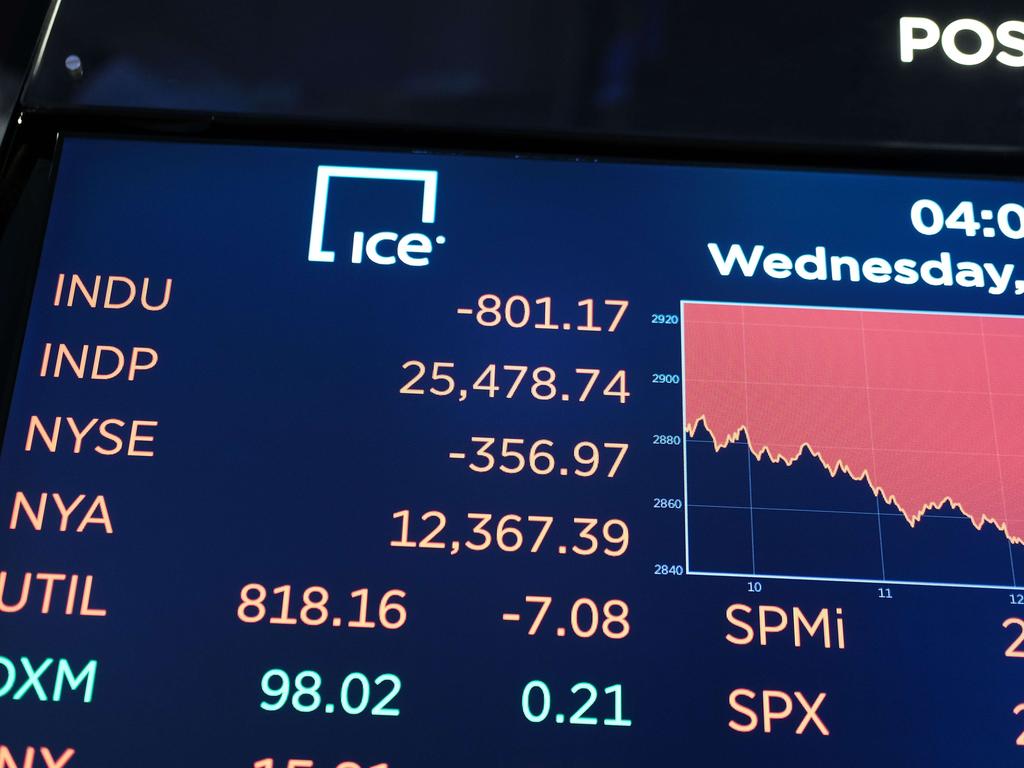

Australian stocks are coming off their worst trading day in 18 months after the US bond market indirectly warned of a looming recession for the world’s largest economy.

For the first time since the Great Recession, and for only the sixth time since 1978, long-dated US Treasury bonds — which have a holding period of at least 10 years — traded at lower interest rates than their short-term equivalents. This so-called “inverted yield curve” occurred when the 10-year yield fell below the two-year yield.

This means the interest rate that investors earn for investing in a 10-year bond was lower than the return on a two-year bond. Each time that happens, recession follows about 22 months later, according to Credit Suisse, because demand for Treasuries grows when investors are worried about the economy.

Some have argued the yield-curve recession signal is “distorted” by what’s happening overseas — namely, negative policy rates in Europe and weak economic growth in developed markets. But it’s because of those reasons investors are fleeing stocks and entering the perceived safety net of government bonds.

This environment has pushed the global stockpile of negative-yielding bonds to a staggering $US16 trillion ($A23.6 trillion). That’s roughly a quarter of the entire government bond market. In other words, $US16 trillion ($A23.6 trillion) worth of bonds pay negative interest rates, so investors are losing money instead of earning a return. For instance, if I invested $1000 in a government bond today, I might get back $980 in one year.

People usually give the Government their money with the promise of being paid back over time with interest. Negative yielding bonds mean governments are getting paid to borrow money. If you’re a bond investor (lending the Government your money), this doesn’t make any sense. Why would anyone voluntarily give their money to the Government knowing they are going to end up with less of it? Interest payments are supposed to reward you for your time.

If the last financial crisis was about a housing bubble that went haywire, the next crisis is shaping up to be a bond implosion. It’s not enough to say the bond market is in a bubble; rather, the bond market is full of bubbles.

For many investors, the writing is already on the wall, and that largely explains why gold has become one of the best-performing asset classes of 2019. Bullion — a natural hedge against recession, inflation and uncertainty — is up nearly 20 per cent this year and is currently trading at more than six-year highs.

It’s not just gold that’s rallying. Bitcoin, the largest and most influential cryptocurrency, has more than tripled in value since December. Bitcoin is sometimes called “digital gold” because it possesses many of the same characteristics as the precious metal.

Both assets are “mined,” both are available in limited quantities and both have demonstrated superior risk-adjusted returns over time. Although it’s far too early to say whether bitcoin can match gold as a safe-haven asset, the cryptocurrency has vastly outperformed every major asset since the first block was mined back in 2008.

Bitcoin and gold not only share similar characteristics, they’ve traded in lock-step with one another for the past three months. Since May 8, both assets have traded in tandem 58 per cent of the time, according to Bloomberg.

Bloomberg analyst Tim Culpan concluded: “The evidence is growing that investors — rightly or wrongly — see bitcoin as a refuge in times of turbulence.”

The bond-market fiasco, as it continues, will make $63 billion sell-offs in the ASX all the more common. Already in the span of just two weeks, the US stock market has recorded its worst two trading days of the year. Australia is not immune to these shocks, and investors should prepare accordingly for more to come.

Fred Schebesta is the co-founder of cryptocurrency broker HiveEx.com and Australia’s biggest financial comparison website finder.com.au. Fred is a keynote speaker at the Gold and Alternative Investments Conference on October 24-26.