‘Inverted yield curve’ a signal of looming financial collapse, expert warns

The US is hurtling towards a recession with a financial apocalypse on its way. And it’s not a question of if Australia will be affected, but when.

A once-in-a-generation financial disaster is looming — and everyday Aussies will be caught up in the fiasco, an Australian economist has warned.

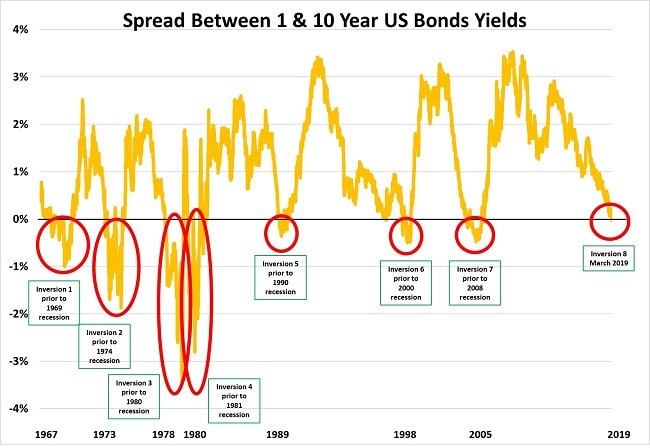

Former Coalition policy adviser John Adams made the grim prediction today after the US bond market experienced an inversion of the “one year to 10 year” yield curve.

Mr Adams said that inversion followed two or more quarters of negative economic growth — the most telling sign of an impending US recession.

And he told news.com.au it was not a question of if Australia would be affected — but rather when and to what extent.

• Kid’s ‘inexcusable’ act on plane slammed

• Surprising suburbs we can’t get enough of

• ‘Just full of it’: TV host roasts Trump

The yield curve is inverted when the yield or interest rate on short-term bonds is higher than that on long-term.

In other words, in this case it means the demand for short-term, one-year US government treasury bonds has dropped while demand for longer-term bonds has increased — which means it’s harder for institutions to lend profitably, which causes a credit squeeze.

According to Mr Adams, it’s usually a sign of overly restrictive policies occurring at the same time as economic growth slowing.

He said it was the direct opposite of what usually happens in healthy economies, when bonds with longer maturity periods tend to pay investors higher interest rates.

Mr Adams said an inversion of the “one year to 10 year” yield curve had been the most accurate prediction of a coming recession since the 1960s — a phenomenon also recognised by the US Federal Reserve.

Since 1955, it has occurred in the lead-up to nine economic recessions and has only produced one false-positive reading in September 1965.

On Friday, it flipped again. A Treasury bill that matures in three months is yielding 2.46 per cent — 0.03 percentage points more than the yield on a Treasury that matures in 10 years.

Mr Adams said that meant the official countdown to “economic Armageddon” had now begun, with a US recession, based on the historical experience, likely to commence in the next three to 27 months.

He said a recession in the US was likely to have global consequences as America still had the world’s biggest economy — and that the impact on Australia would depend on government decisions.

In a previous news.com.au interview, Mr Adams said in the event of a crisis, everyday Aussies would likely experience severe financial difficulty given that many Australians hold “excessive debts” and would likely suffer “loss of income and unemployment” which would potentially lead to a spike in mental health, addiction and relationship problems for many people.

But he said there were things Australians could do to prepare for a collapse. These include researching previous economic crises, managing cash flow, reducing debt, holding onto “good” money that will retain its purchasing power, diversify income sources and skill set, improve personal and home skills, strengthen relationships, become as physically and spiritually healthy as possible and engage with politics to fight for good public policy.

“In all likelihood, the coming economic crisis will be worse than the Global Financial Crisis because global debt is more than $US85 trillion higher than in 2007,” Mr Adams told news.com.au.

“Think of a bomb with a detonator with a timer that has been shown in many Hollywood movies. The inversion of the yield curve is when the bad guy in the movie turns on the detonator with the timer ticking down.

“In the movies the hero is always able to come and rescue the situation before the bomb goes off. Unfortunately, since 1969, no one has been able to turn off the detonator before the bomb goes off.”

He said ordinary Australians were “completely exposed” to a global downturn which could morph into a “systemic economic crisis”.

“Now that the yield curve has inverted, based on historical experience of the last seven recessions going back to 1969, the first quarter of negative economic growth could commence in the United States anywhere between three and 27 months,” he said.

“In the interim, economic conditions in America and around the world will become progressively worse in 2019 and 2020 as we head towards the day of reckoning.

“Australia currently has the largest debt bubble in its history at the same time when the world is experiencing the largest global debt bubble on record.”

He said the inversion of the US yield curve was just the latest market signal that Australia was on track for an “economic crisis”.

“The end game for Australia is either our private sector debt becomes unserviceable or the Australian dollar doesn’t hold its value. Both outcomes spells disaster for ordinary Australians,” he said.

POTENTIAL RECESSION SIGNAL

— Associated Press

One of the most closely watched predictors of a potential recession just yelped even louder.

The signal lies within the bond market, through which investors show how confident they are about the economy by their level of demand for US government bonds.

It’s called the “yield curve”, and a significant part of it flipped Friday for the first time since before the Great Recession — a Treasury bill that matures in three months is yielding 2.46 per cent — 0.03 percentage points more than the yield on a Treasury that matures in 10 years.

It seems illogical. Economists call it an “inverted” yield curve.

Normally, short-term debt yields less than a long-term debt, which requires investors to tie up their money for a prolonged period.

When a short-term debt pays more than a long-term debt, the yield curve has inverted.

And when the yield curve is inverted, it shows that investors are losing confidence in the economy’s prospects. Fear about the inverted yield curve contributed to Friday’s 1.9 per cent tumble in the S&P 500 index — its worst day since January 3.

WHY CARE?

This warning signal has a fairly accurate track record.

A rule of thumb is that when the 10-month Treasury yield falls below the three-month yield, a recession may hit in about a year.

Such an inversion has preceded each of the last seven recessions, according to the Federal Reserve Bank of Cleveland.

The last time a three-month Treasury yielded less than a 10-year Treasury was in late 2006 and early 2007, before the Great Recession made landfall in December 2007.

WHY DID THE YIELD CURVE INVERT?

Longer-term Treasury yields have been falling this year, in part on worries that economic growth is slowing around the world.

When investors become nervous, they often abandon stocks and other risky assets and flock to Treasurys, which are among the world’s safest investments.

High demand for bonds will, in turn, send yields falling. Accordingly, the yield on the 10-year Treasury has sunk to 2.43 per cent from more than 3.20 per cent late last year.

Shorter-term rates, by contrast, are influenced less by investors and more by the Federal Reserve, which raised its benchmark short-term rate seven times over the past two years.

Those rate hikes had been forcing up the three-month yield, to 2.46 per cent from 1.71 per cent a year ago. This momentum will likely slow now that the Fed foresees no rate hikes in 2019.

But if longer-term Treasury yields continue to weaken, the curve could remain inverted.

IS IT A PERFECT PREDICTOR?

No, an inverted yield curve has sent false positives before. The yield curve inverted in late 1966, for example, and a recession didn’t hit until the end of 1969.

HAVEN’T WE HEARD THIS BEFORE?

Other parts of the yield curve inverted late last year, as when the five-year Treasury’s yield dropped below the three-year yield. Those parts of the yield curve, though, aren’t as closely watched.

And not every part of the yield curve is inverted.

Many traders on Wall Street also pay close attention to the difference between two-year and 10-year Treasurys. That part of the curve is still not inverted.

The 10-year yield of 2.43 per cent is still above the two-year yield of 2.31 per cent.

SO IS A RECESSION COMING OR NOT?

It’s too soon to say. Economic growth is slowing around the world, but the US job market remains relatively strong.

“This is a signal that we should take seriously,” said Frances Donald, head of macroeconomic strategy at Manulife Asset Management.

“However, it’s too early to tell whether this is indeed a harbinger of a recession or a blip. For me to feel confident to say this is a predictor of recession, I would need to see it persist for at least one to two months.”

Potentially more concerning, Donald said, is how businesses and consumers react to the inverted yield curve. If they were to cut back on hiring or spending, that could trigger a self-fulfilling prophecy that leads to a recession.

“We’re so accustomed to this telling us a recession is ahead that my concern is businesses and households get so scared they effectively create one,” she said.