To buy or not to buy? Australian housing prices set to shift

Australia’s housing market is in a situation that can’t continue forever — and a seasonal change will gives us answers sooner rather than later.

Australia’s housing market is in a situation that can’t possibly continue.

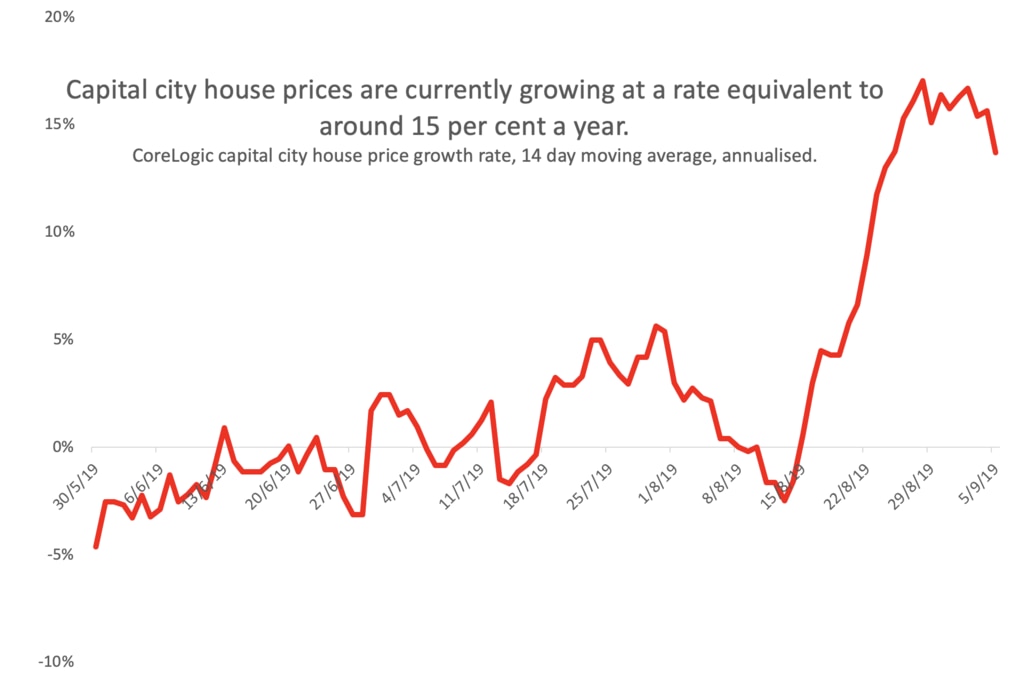

A high auction clearance rate and prices rising sharply, plus really low amounts of stock being put up for sale? That’s got to change one way or another.

If prices keep rising, more people will come to the table to sell their house. The other possibility is the recent lift in property market is a temporary blip.

So which is it?

RELATED: Australian house prices increased by 0.8% in August

RELATED: Reserve Bank’s ‘stark warning’ about house prices

Spring selling season is going to bring us the answer.

The next several months represent the usual peak of the housing market, when buyers and sellers come together en masse to trade homes. If buyers are excited, numerous and ready to borrow, house prices will likely rise. If sellers are excited, numerous and in a hurry to sell, then house prices could level off again, or begin to fall.

One theory is the weak state of the economy will soon take a hold in the housing market and buyers will get nervous.

Australia’s economy is in a precarious position. Yes, you can point to things that are going well — exports are strong, the federal budget has spare spending capacity, and employment growth has been high.

But unemployment isn’t improving, wages growth remains grim and our GDP growth rate is the lowest it’s been in a decade. Per capita GDP growth is negative.

It might make sense for Australian homebuyers to proceed with caution in this scenario. Our household debt remains at historically high levels (as the next graph shows), and trying to pay off debt in a weak economy would be a herculean task.

It sure doesn’t feel like there’s a lot of room for house prices to go up another 20 per cent — not while wages growth remains barely above inflation. If buyers think like this, the property market could soon revert to weakness.

ON THE OTHER HAND

Going off gut feelings about what the property market should do is a good way to be wrong. Yes household debt has already gone up. But the thing about “up” is there is always more of it available. Debt can keep going up for quite some time.

Especially when you look at the policy settings Australia has recently adopted. Two systemic factors have just changed and will make it easier for prospective home buyers to borrow big bucks for a house.

The first change is to do with lending policies. During the house price slip-and-slide of the last two years, several lending rules were changed. Relevant to higher house prices is the rule that banks had to assess borrowers ability to pay back loans assuming an interest rate of at least 7 per cent. Now banks can use their own assessment threshold, which should make it easier for some borrowers to get their hands on bigger loans.

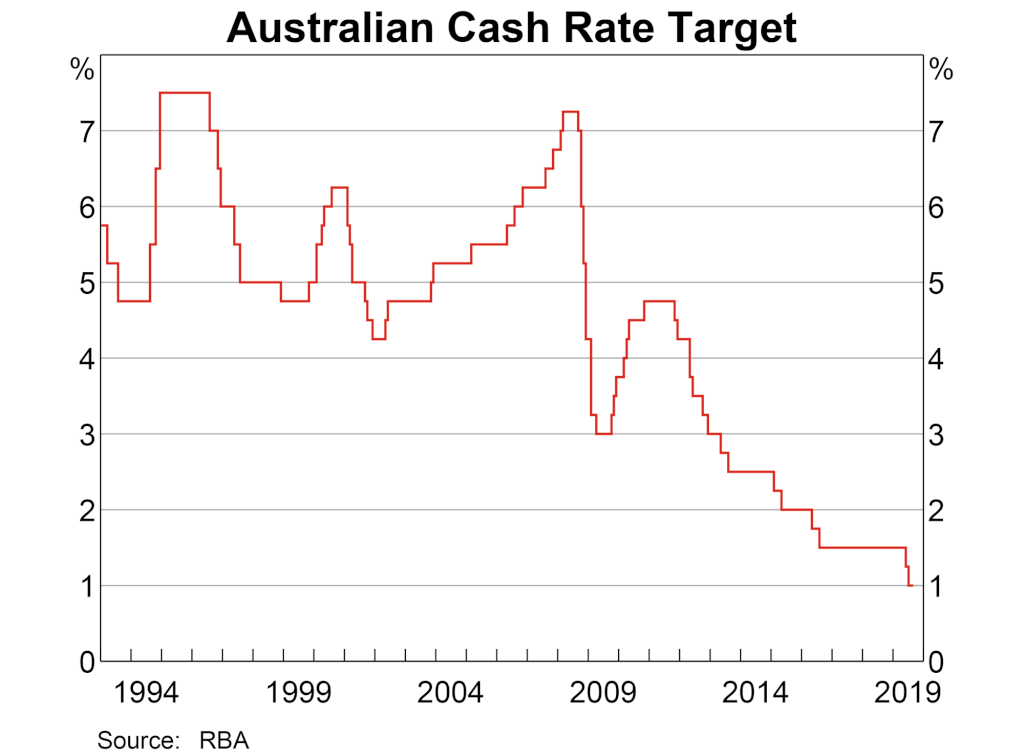

The second big change is in interest rates. In the last few months, the RBA cut interest rates from 1.5 per cent to 1 per cent, as the next graph shows. The market expects them to keep on going, maybe all the way down to 0.25 per cent. The cuts have already translated into much lower mortgage interest rates. You can now find advertised mortgage interest rates below 3 per cent. That’s an extremely cheap loan, and buyers have good reason to hope that if they get a variable rate loan it could fall further.

(By the way, if you already have a home loan, please ring the bank and get a new lower rate. If they won’t budge, refinance it. You’re going to save a fortune, and if you spend that extra money at the shops, the economy could potentially begin to recover. Which is, after all, the whole point of the interest rate cuts.)

It would be wrong to assess the housing market without considering these two policy changes — changes that should make buyers feel they can afford a property more easily. They suggest buyers could come flooding back, and that the sellers with the confidence to put their home on the market this spring will find buyers to be ebullient.

SPRING

That is why Spring selling season is so important. The number of houses for sale usually peaks in Spring, with the busiest weekend of the year for house sales usually found in October or November.

Relatively few homes were auctioned last year when the real estate news was so bleak. It felt like the houses that were open for inspection were mostly deceased estates, i.e. if people were able to avoid selling, they did. After enough time, that pent-up desire to sell has to be released.

But the big release has not happened yet.

At the moment, the number of houses for sale is even fewer than last year. There were 1605 houses for sale last weekend, down from 1748 on the same weekend in 2018, according to CoreLogic data. As a result of this mismatch of seller caution and buyer enthusiasm, clearance rates are now much higher — 78.9 per cent in Sydney compared to 53.8 per cent this time last year.

Buyers are squabbling over the few houses that are for sale. If homeowners want to sell in Spring, they need to be getting their skates on now. It takes time to get a house ready for sale. Whether enough vendors are doing so may well determine if house prices go up or down for the rest of the year.

Jason Murphy is an economist. He is the author of the new book Incentivology. Continue the conversation @jasemurphy