Housing market: Australian house prices increased by 0.8% in August

The downturn that wiped billions of dollars off Aussie homes appears to be over, but experts warn more policy is needed to stimulate the economy.

The national property market has recorded its largest monthly increase in more than two years as Australians capitalise on low interest rates, tax cuts and a slight loosening in lending standards.

The national market lifted 0.8 per cent over the last month.

Sydney had been at the centre of the downturn, but the New South Wales capital appears to be once again on the rise.

It was the best performing capital city in the three months to August, with its median price rising 1.9 per cent according to new Corelogic data.

Melbourne’s recovery is also in full swing with a quarterly rise of 1.8 per cent although both major cities are still more than 6 per cent lower year-on-year.

Hobart was the only other capital to lift over the three months, rising 1 per cent, while Perth led the losses, falling 1.8 per cent, followed by Darwin, down 1.7 per cent.

“The significant lift in values over the month aligns with a consistent increase in auction clearance rates and a deeper pool of buyers at a time when the volume of stock advertised for sale remains low,” Corelogic research director Tim Lawless said.

“It’s likely that buyer demand and confidence is responding to the positive effect of a stable federal government, as well lower interest rates, tax cuts and a subtle easing in credit policy.”

The market had been showing signs of turning around, with improving rates of decline and a more modest recovery trend recently.

“But August has really seen that accelerate much more than we would have expected a few months ago,” Mr Lawless told news.com.au.

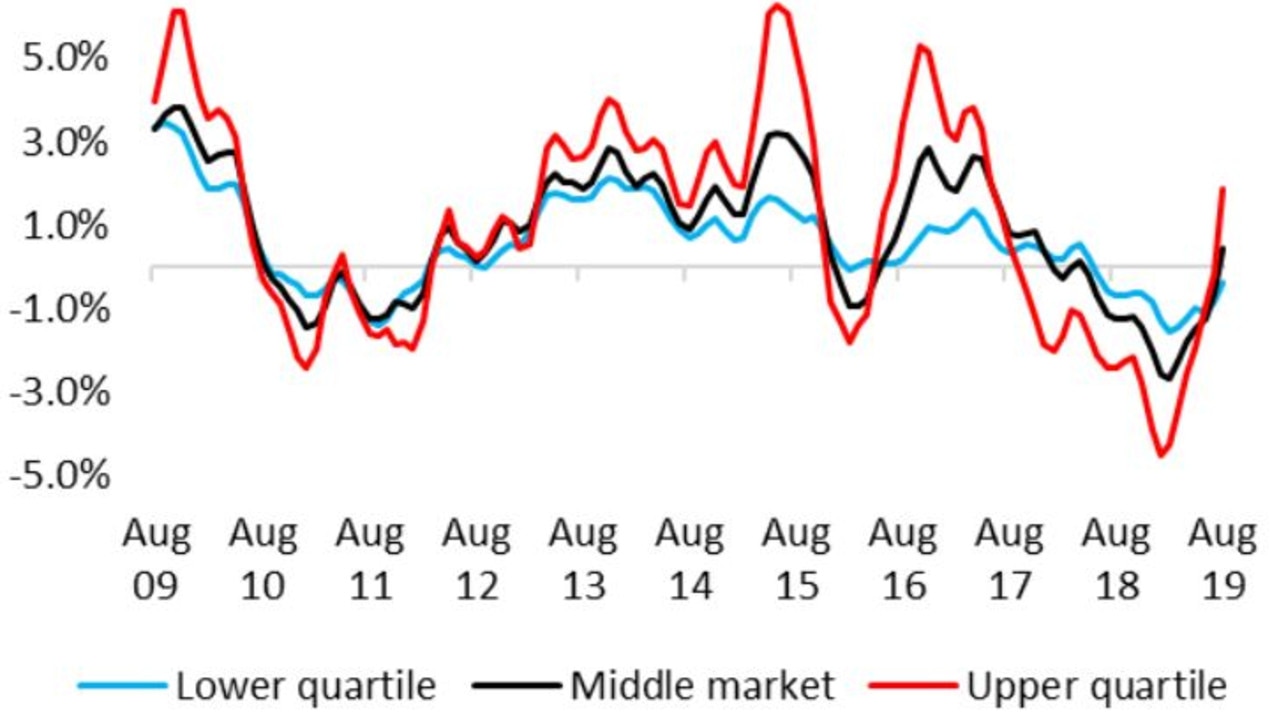

National dwelling values reached their largest annual falls in May, down 7.3 per cent, and by August the yearly loss had trimmed to 5.2 per cent.

The national value increased in the quarter, recording the first rise over a three-month period since November 2017.

Mr Lawless said it was the third successive month of capital gain in Sydney, Melbourne and Hobart as well as the second successive month of increases in Brisbane.

“While the ‘recovery trend’ is still early, it does appear that growth trends are gathering some pace, particularly in the largest capital cities,” he said.

Auction clearance rates are also rising and are now at the highest levels since early 2017 in both Melbourne and Sydney.

If the housing market continues to rise at the levels documented in August, Mr Lawless said the Australian Prudential Regulation Authority will be forced to limit lending exposure against debt-to-income ratios.

“Generally speaking, most property growth cycles are heavily correlated with wide trend in credit,” he told news.com.au.

“One of the key considerations for policymakers is household debt levels remain around record highs, around 90 per cent of disposable income.

“That will be one of the key concerns in a reinflation of the housing market.”

The number of listings has been low for the last few months, but stock is lifting as the market heads into the traditionally busy spring season.

Mr Lawless predicts the next month will be a timely test of the market’s depth.

“A key contributor to the housing recovery has been the increase in buyers but also a lack of advertised stock,” he said.

“As stock levels continue to rise throughout spring, we will get a much better understanding of the depth of the current recovery.

“As listing numbers and auction volumes rise, clearance rates may soften if buyer demand doesn’t lift to match the increase in supply.”

Mr Lawless said Corelogic had predicted a conservative recovery for the market, but with more easing of lending and mortgage rates reducing further, the rebound could bounce faster and more dramatically.

“No doubt, policy makers and regulators will be monitoring the housing market indicators very closely over the coming months,” the property expert said.

“At the outset, it appears that a rapid recovery would confirm that low interest rates and a loosening in credit policy is reigniting some market exuberance despite housing affordability remaining a significant challenge, rising unemployment, low wages growth and near record-high levels of household debt.”

LOOKING AHEAD TO TUESDAY’S RATES DECISION

Mr Lawless expects the Reserve Bank to leave the cash rate at 1.00 per cent when it meets on Tuesday.

“The housing market would be weighing on their deliberations,” he told news.com.au.

“The fact that we are seeing such strong growth conditions in housing, particularly in the two most expensive housing markets Sydney and Melbourne, is probably one barrier to a rate cut tomorrow.”

He said tomorrow’s meeting is likely to follow an agenda of monitoring the economy ahead of growth data released on Wednesday as well as watching the impact of the housing recovery.

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au