‘Won’t be able to afford’: 20yo’s crushing debt reality

A young Aussie has shared the common debt nightmare she’s living with – and the grim reality she’s “accepted” because of it.

Libby Barrett is worried she’ll never be able to own a home because of her HECS debt, which she’s concerned she’ll never pay off.

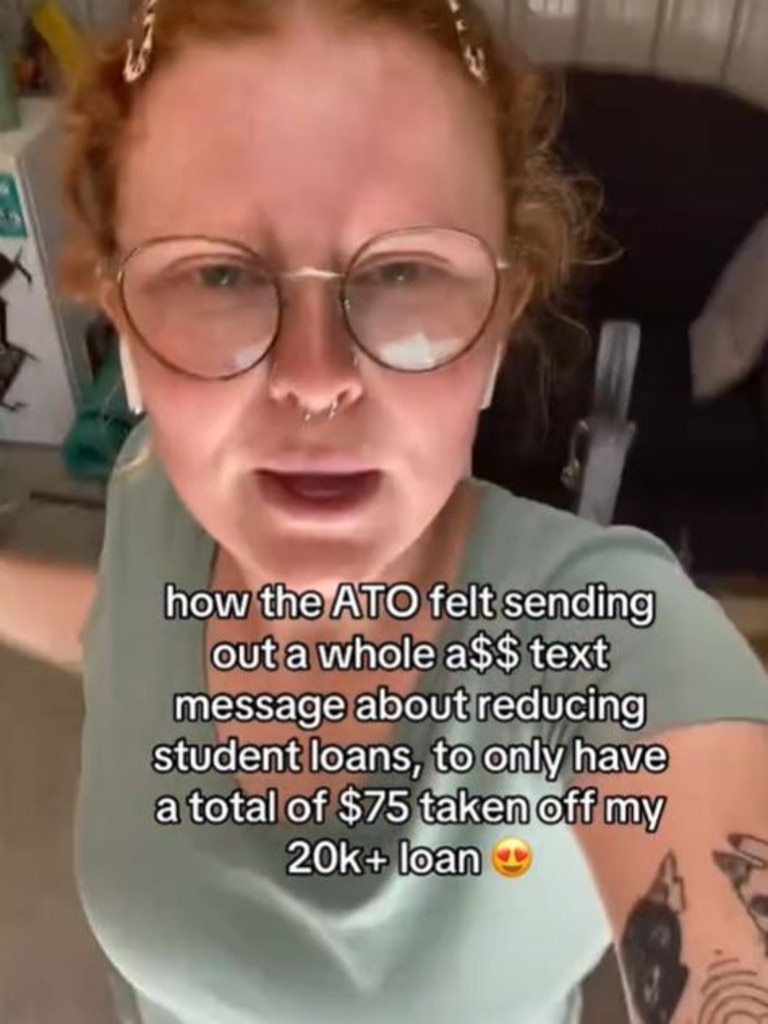

The 20-year-old went viral in December for sharing that she was “extremely disappointed” with the amount of money she got rebated on her HECS-HELP debt.

Aussies with HECS-HELP debt received a text in December letting them know that indexation accrued between 2023 and 2024 would be partially wiped.

The Australian Taxation Office (ATO) sent out a text that read, “Our study loan balance has changed. We have reduced any 2023 and 2024 indexation”.

Higher education loans in Australia don’t charge interest, but are subject to inflation indexation.

In 2023, millions of Aussies saw their loans increase by a whopping 7.1 per cent — the biggest jump in 30 years. In June 2024, the indexation rate was 4.7 per cent.

In 2023 and 2024, young people routinely went viral for being shocked by their ballooning HECS debts, and in December, the Labor government offered some relief.

Around $3 billion has been wiped from more than three million student debts after the government announced that the 2023 and 2024 indexation rates would be reduced to 3.2 per cent and 4 per cent, respectively.

People who paid off their loans after the June 1, 2023 hike will receive a refund to their nominated bank account, provided they have no other existing tax debts.

It comes after the government announced that, from June 1 next year, HECS loans will be indexed in line with either the Consumer Price Index (CPI) or the Wage Price Index (WPI), depending on which figure is smaller, to ensure the rates are not outpaced by wage growth.

It was good news for most people with loans, but for Ms Barret, her hopes were dashed when she only received $75 off her $20,000 student loan.

Online she admitted she thought it was going to be a “Christmas miracle”, but the amount was less than she anticipated.

That admission amassed over 200,000 views, and other Aussies were quick to share how much had been taken off their loans – but for Ms Barrett, the $75 was an unwelcome reminder that she may never be able to wipe the debt.

The 20-year-old, who works as a teacher assistant and at a pub, said that even though she’s working two jobs, she’s still “barely making a living wage”.

Besides the daily cost of living pressures, she’s also convinced that her loan will increase rather than decrease in the next few years.

“Currently I have a $20k+ debt and am expected to gain at least another $5k interest over time,” she said.

Ms Barrett said she was disappointed by the $75 because she’d “already paid” $500 in interest in 2024.

And the fact that her loan keeps increasing and not decreasing worries her, because she fears it will impact her future.

“I honestly say to everybody that I’ve basically accepted the fact I won’t be able to afford a home with the debt I’ve already accumulated,” she said.

“I try not to think about it too much, but I do worry that if I ever need a loan in the future, that it may affect the process.”

According to the ATO, 14 per cent of Australians are riddled with student debt. This is down from just over 3 million in 2021–2022.

Outstanding HELP debt has risen to just over $78.2 billion for the 2022–2023 financial year, up from $74.3 billion in 2021-2022.

More than half of debtors owe up to $40,000, 21 per cent owe between $40,000 and $100,000, and just over 1 per cent owe above $100,000.

The research also found that 12 per cent don’t think they’ll ever be able to repay their student debt.

Money expert Sarah Megginson said that HECS debt can “impact your home loan” – but that doesn’t mean young people have to give up on their home ownership dreams.

“It just means you need to be more aware about what the impact is, so you can take steps to make your loan more attractive,” she told news.com.au.

“In the past, HECS debt didn’t impact your home ownership goals because it wasn’t formally included as a debt on your loan application.

“In 2022, that changed when APRA – the Australian Prudential Regulation Authority – published a directive that HECS-HELP debt should be included in working out your debt-to-income ratios.

“What this means in practice is that your borrowing power will reduce by a maximum of 10 times the value of annual HECS repayments. So, if your annual payments amount to $5000, your borrowing power will be reduced by $50,000.”

Ms Megginson said that you can “balance out” your HECS debt in other ways when applying for a home loan.

“If you know you have a HECS debt to include on your application, then working to pay off other debts like a credit card, personal loan, buy now pay later or car loan could add some borrowing power back to your application,” she advised.