Why Sydney and Melbourne are up for a record house price correction

If the Reserve Bank continues lifting the cash rate, Sydney and Melbourne are staring at their biggest house price corrections in living memory.

Earlier this month, the Reserve Bank of Australia (RBA) thrust a dagger into the heart of mortgage holders when it lifted the cash rate by another 0.5 per cent – the third consecutive monthly increase.

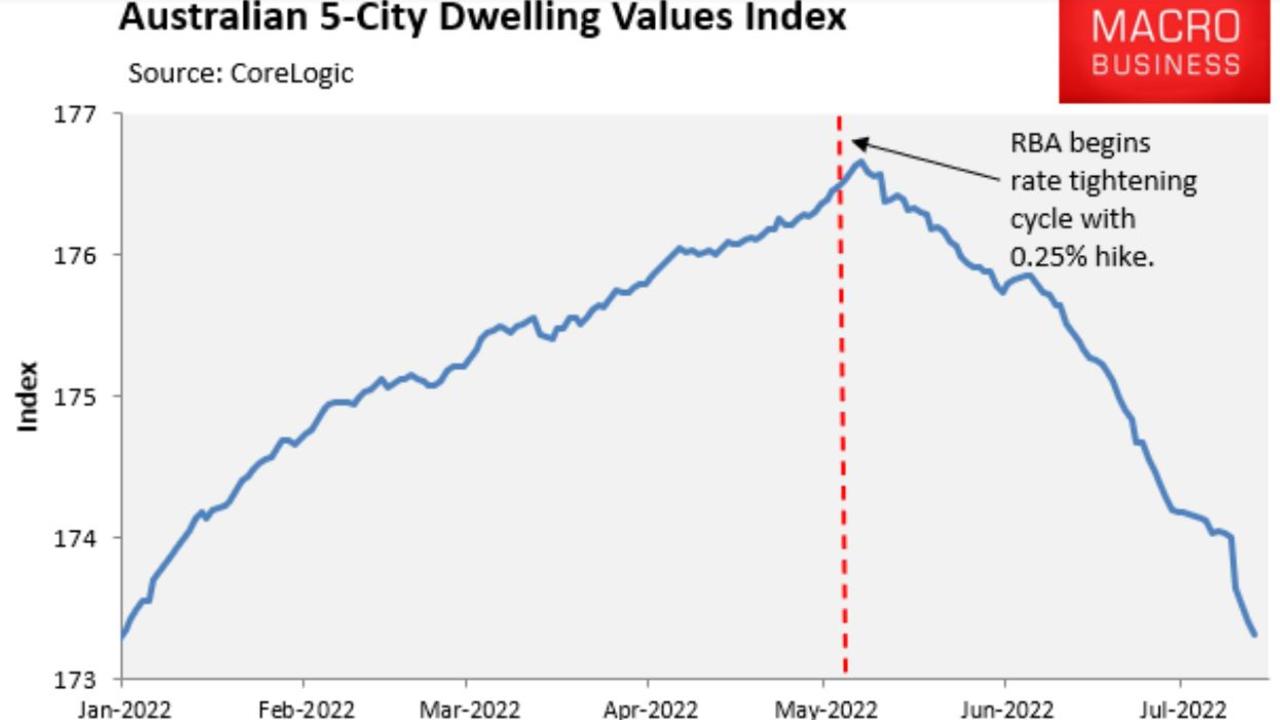

Dwelling values across Australia’s five major capital city markets began falling shortly after the RBA’s initial 0.25 per cent rate hike in May, and have so far fallen by around 2 per cent from their peak, according to CoreLogic.

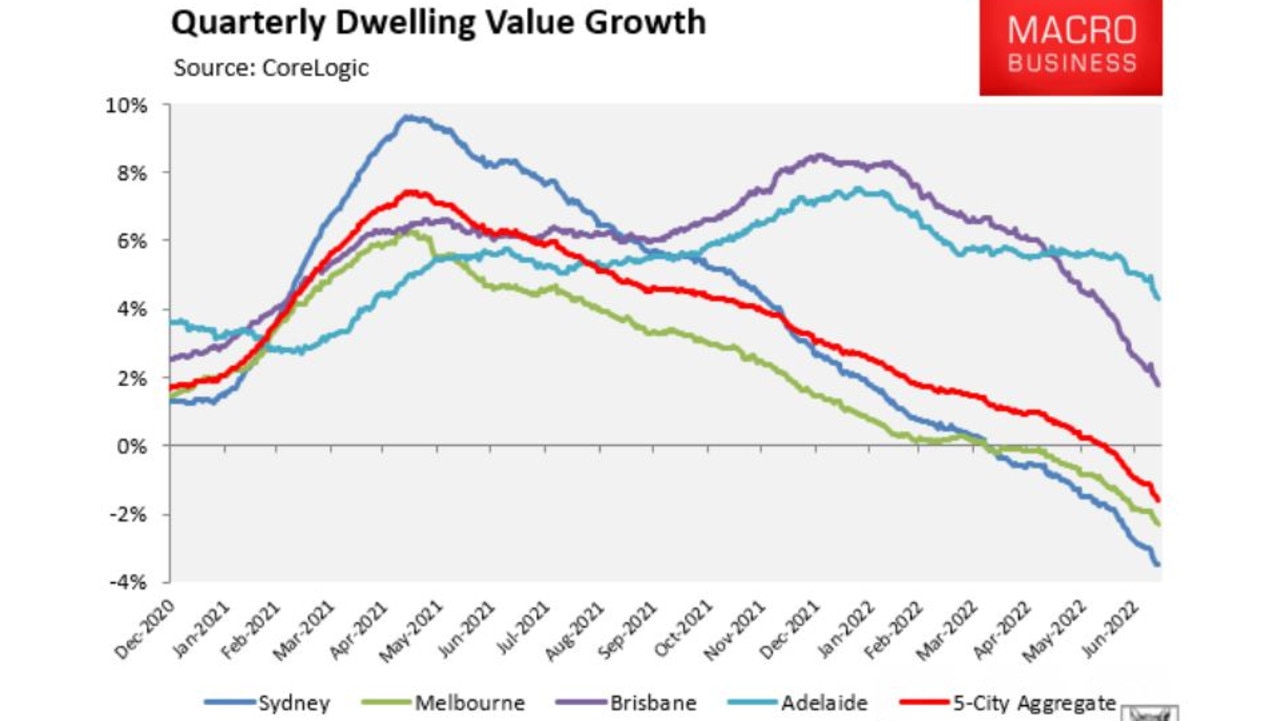

The decline at the five-city aggregate level has been driven by Sydney and Melbourne, where quarterly values have fallen by 3.5 per cent and 2.3 per cent respectively – more than offsetting growth across the smaller markets:

Concerned about falling house prices? Check out Compare Money's guide >

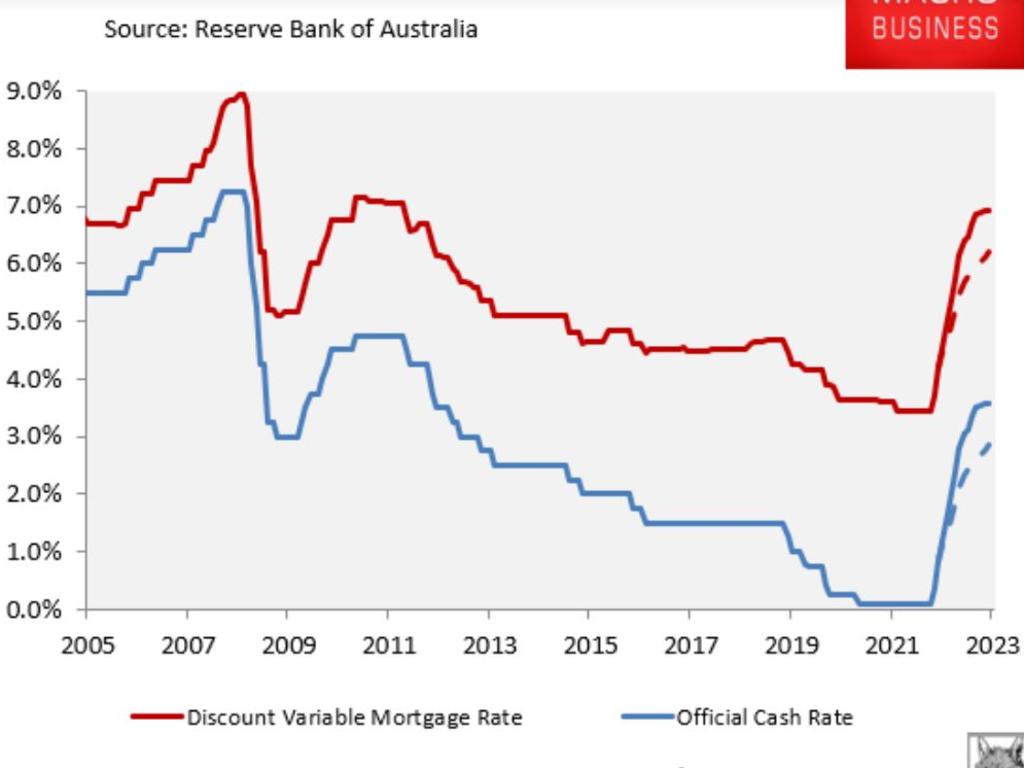

AFR’s latest survey of 31 economists revealed a median forecast for the official cash rate (OCR) of 2.85 per cent by mid next year. If true, Australia’s OCR would rise another 1.5 per cent from its current level.

The futures market remains even more hawkish, tipping a peak OCR of 3.5 per cent by May 2023.

If either interest rate forecast came true, it would see Australian mortgage rates soar. Australia’s average discount variable mortgage rate would climb to 6.2 per cent under the economists’ forecast (dashed red line below) and to 6.8 per cent under the market’s forecast (solid red line below):

The market’s OCR forecast would mean that the discount variable mortgage rate would climb to roughly double its level (3.45 per cent) before the RBA’s tightening cycle began.

Under either scenario, Australian mortgage holders would face a massive rise in repayments, which would plunge many borrowers into severe financial stress at the same time as the value of their properties falls sharply.

In its latest Financial Stability Review, the RBA estimated “that a 200-basis-point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period”.

Therefore, the economists’ forecast 2.85 per cent OCR suggests a peak-to-trough fall in real Australian house prices of around 20 per cent.

The futures market’s forecast 3.5 per cent OCR would drive Australian housing prices down by around 25 per cent in real terms under the RBA’s modelling.

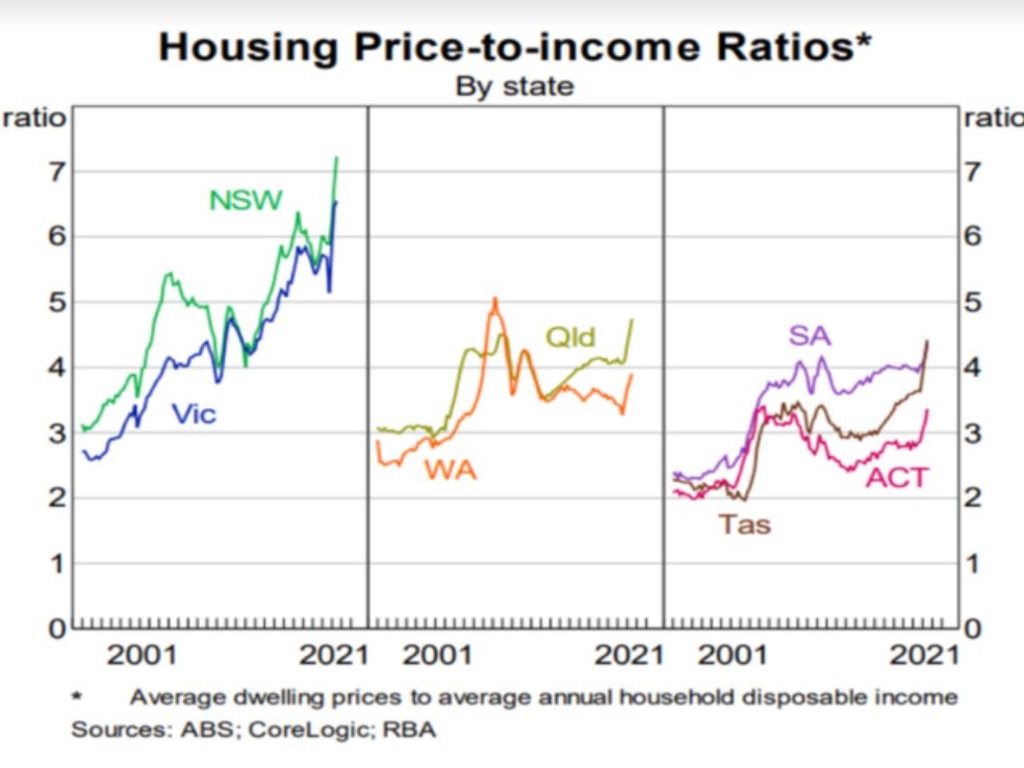

Sydney and Melbourne would likely face even bigger price falls than the national average because they are the most expensive housing markets with the most mortgage-indebted households.

As illustrated in the next chart, the house price-to-income ratios for NSW (read: Sydney) and Victoria (read: Melbourne) are far higher than the other Australian jurisdictions:

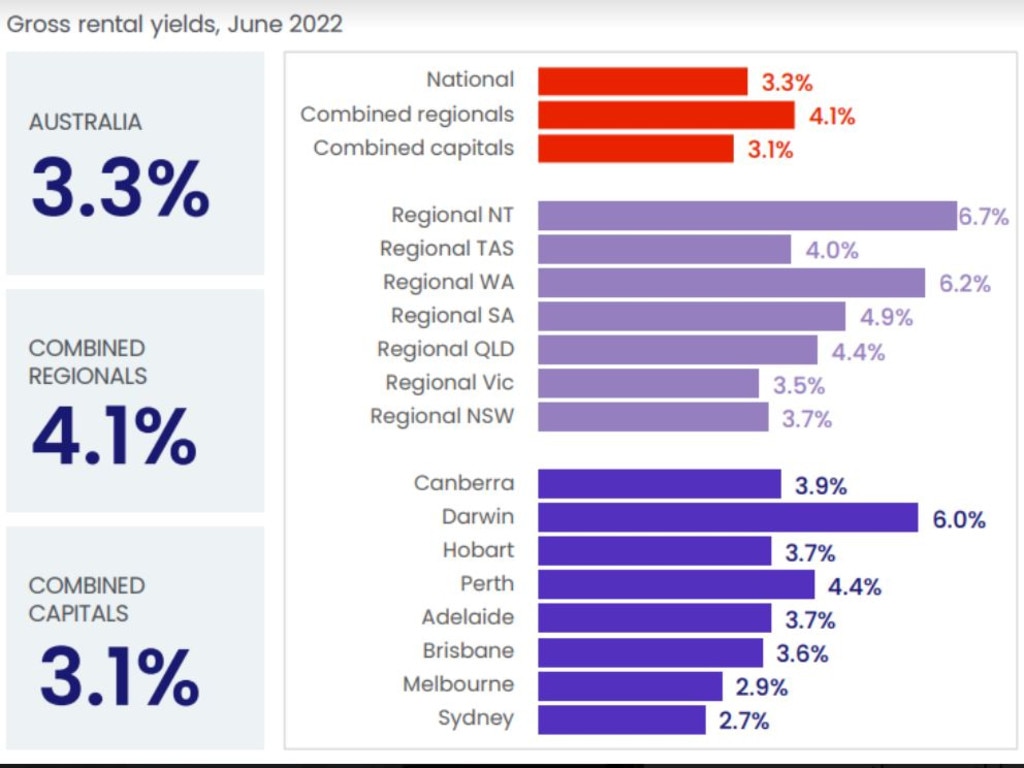

Sydney and Melbourne are also the nation’s most expensive housing markets relative to rents, as illustrated by their anaemic gross rental yields of 2.7 per cent and 2.9 per cent respectively, according to CoreLogic:

Their extreme valuations make Sydney and Melbourne more sensitive to the RBA’s rate hikes, meaning their prices should fall further than the national average under either the economists’ or the futures market’s OCR forecast. The fact that these two markets are leading the current downturn is evidence enough.

Mortgage-holders in our two largest cities better hope neither the economists nor the market is correct, and that the RBA stops well short in its monetary tightening.

Otherwise, Sydney and Melbourne are staring at their biggest price corrections in living memory.

Leith van Onselen is chief economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.