‘Cannot be ruled out’: RBA’s big rates call

The RBA has made its first rates call of 2024, but there’s a big reason Australians should still be worried.

BREAKING

The Reserve Bank of Australia has warned Australians that another interest rate hike is still on the cards, despite keeping it on hold at 4.35 per cent.

Making its first interest rate call of the year, the RBA’s decision on Tuesday afternoon led one big four economist to declare the battle with inflation is over.

Alan Oster, chief economist at NAB told news.com.au that the RBA was “pretty much done” with interest rate hikes and that the cash rate would now remain “on hold for quite a while”.

But in the statement accompanying its announcement today, the RBA board said that “a further increase in interest rates cannot be ruled out”.

The board added that it remains “highly attentive” to inflation, which “remains high” particularly for services.

“The outlook is still highly uncertain,” the RBA board said.

Last year, the RBA kept rates on hold for the four months from July to October, after an aggressive cycle of increases, only to lift the cash rate again in November, as inflation remained stubbornly high.

However, Mr Oster ruled out the possibility that today’s decision would be another false dawn for struggling households.

While financial markets are pricing in cash rate cuts from August, Mr Oster said the call is “probably a bit early” – with NAB expecting rates to start falling in November.

“As inflation comes down they’ll be able to start cutting rates” he said, forecasting the RBA’s interest rate cuts to be “modest” and the cash rate to fall to three per cent by the end of 2025.

Head of Australian economics at the Commonwealth Bank (CBA), Gareth Aird said today’s decision was “straightforward” for the RBA, after inflation fell to 4.1 per cent for the three months up until December 31.

That was below the RBA’s forecast of 4.5 per cent.

Announcing today’s decision, the RBA board also added that conditions in the labour market “remain tighter than is consistent with...inflation at target”, expressing concerns that the low unemployment rate may slow the return of inflation to its two to three per cent target band.

In a note, Mr Aird said “the RBA is now on the home straight” in its fight against inflation, and CBA expects it will start cutting the cash rate from September.

Australia’s biggest bank is forecasting 0.75 per cent of cuts in 2024 – which would see the cash rate at the end the year at 3.6 per cent. It predicts another 0.75 per cent of cuts in the first half of 2025, which would bring the cash rate to 2.85 per cent by mid-2025.

But whenever the RBA starts to cut the official cash rate, one analyst has warned there’s a “real possibility” the banks won’t pass the cuts on in full.

Fidelity International analyst and portfolio manager Zara Lyons told The Australian that the major banks may not pass on the upcoming rate cuts in full, but instead lower the interest rates they charge on home loans by less than the RBA cut.

“It is a real possibility that we could see that,” Ms Lyons said.

“It’ll be a game of chicken on who is the first bank who wants to upset everyone by being out of cycle in terms of not passing on rate cuts.”

She said that in the event that the RBA cuts the cash rate by 0.25 per cent, the banks may only reduce their mortgage interest rates by 0.15 per cent.

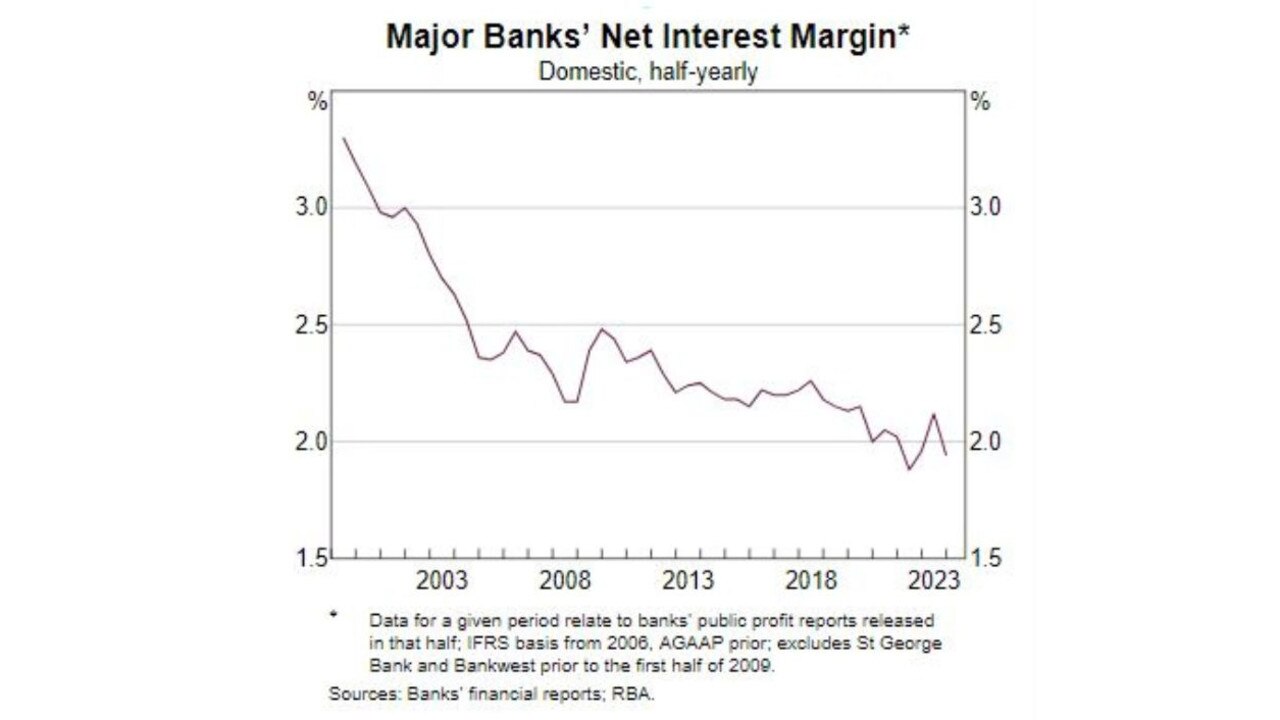

Ms Lyons said the reason the major banks may not pass on any future RBA cuts in full is due to a desire to protect their net interest margins – or the difference between the amount of money the bank earns in interest on loans and what it pays out in interest on deposits.

As the RBA increased the cash rate over the past 18 months, the banks passed on the rises to mortgage customers.

But they also increased the amount of interest they are paying on deposits – such as money in savings accounts and term deposits – competing aggressively to attract funds from cashed-up Aussies, particularly Baby Boomers.

This has seen the average net interest margin of the major banks fall below two per cent, compared to a long term average of between two and 2.5 per cent.