‘Unprecedented’: 34 Aussie banks trying to lure customers amid $478 billion boom

Amid fierce competition as interest rates soar and new customers dry up, some banks are using unusual methods as they fight for business.

With a whopping $478 billion worth of fixed rate mortgages due to expire by the end of 2023 and a slowdown in new borrowers, banks are scrambling to entice customers away from their current banks with cash deals.

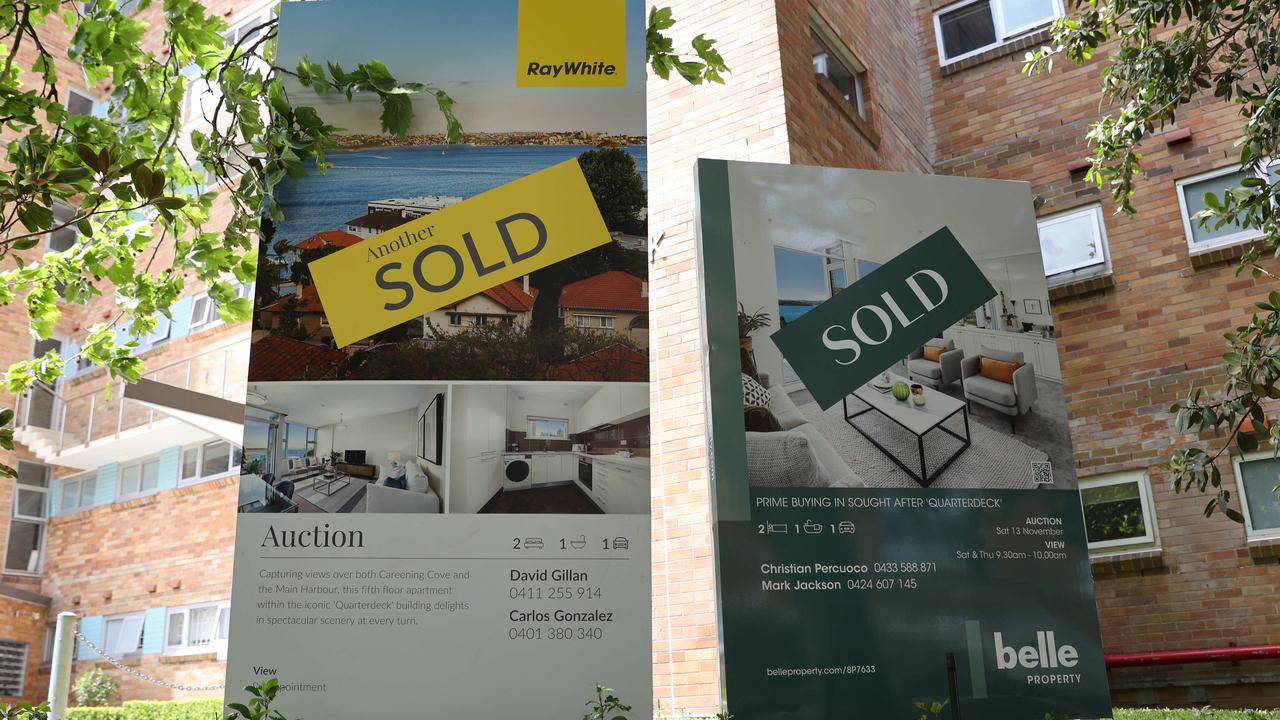

Competition in the home loan market is the hottest it has been in years as house prices plummet and interest rates skyrocket, dampening demand for new loans.

Instead banks and lenders are working to tap into the refinancing mega boom as Australians seek out a better deal.

Lenders are being forced to fight for business as many Aussie homeowners are set to come off ultra-low interest rates this year and face variable rates above 3 per cent after the Reserve Bank of Australia (RBA) jacked up rates for eight consecutive months.

With 34 lenders offering cashback in the mortgage market, according to RateCity, the sweetener to attract new customers is almost at record levels.

However, this news isn’t so sweet for new borrowers, with only AMP, Heritage Bank, Reduce Home Loans and National Australia Bank-owned Ubank offering a cashback deal to those new to the market.

Cashback deals are when a lender offers cash, generally between $1000 to $5000, when a loan application is approved.

Home lending growth slowed to 4.5 per cent in November, from 5.5 per cent in October, and is set to fall to 2 per cent in 2023, according to Morgan Stanley, with many seeing hundreds of thousands slashed from their borrowing power.

David Bailey, the chief executive at mortgage aggregator Australian Finance Group, said he had never seen the refinancing market so competitive.

“The number and volume of cashback offers is just unprecedented and it seems to be the new norm,” he told The Australian.

“My view is that banks, rather than offering a cashback, should just put it into the rates to the customer,” he said.

“The refinance market is probably going to be the [most competitive] space until such time that house prices settle, bringing new customers back into the market again.”

While further rate rises are tipped from the RBA this year, there are also warnings homeowners could be slugged with even higher costs as funding expenses soar and banks must repay $188 billion of emergency money borrowed during the pandemic.

It’s already happened with a number of smaller lenders.

This includes the likes of Athena, Freedom Lend, Homeloans.com.au, Nano, Pepper Money and Well Home Loans, which have all increased their lowest variable rate by more than the RBA’s 3 percentage points, according to RateCity analyst Sally Tindall.