‘Trigger a rate rise’: Fears for inflation

Economists are divided on what happens next with interest rates with some saying they need to go as high as 5 per cent.

What may be the most important information in the past two years to give an insight into the cost of living crisis drops on Wednesday and it could “trigger a rate rise” in August, economists are warning.

Some traders have put an August rate hike currently at a one-in-five chance but inflation data could be a make or break moment for homeowners hoping the cash rate won’t hit 4.6 per cent.

An increase of 0.25 per cent from the 4.35 per cent would add $100 to the monthly repayment on a $600,000 loan over 30 years, although a number of Australians would have much larger mortgages.

So far all the major banks are still forecasting a rate cut as the next move from the RBA and just three months ago that looked likely when March quarter inflation came in at just 3.6 per cent, plummeting from the December 2022 quarter peak of 7.8 per cent.

But then the monthly consumer price index, a measure of goods and services cost across the economy, jumped to 4 per cent in the year to May – putting a rate hike back on the agenda according to economists.

The data released on July 31 will be the “key piece in the puzzle” for the Reserve Bank of Australia (RBA) at its interest rate meeting next week, said KPMG senior economist Michael Malakellis.

It is forecasting annual inflation to be sitting at 3.8 per cent — the same figure as the RBA.

“So anything over that figure would lead to strong guidance relating to a potential rise in rates,” said Mr Malakellis.

“The RBA will be very concerned about falling behind the curve in fighting inflation.

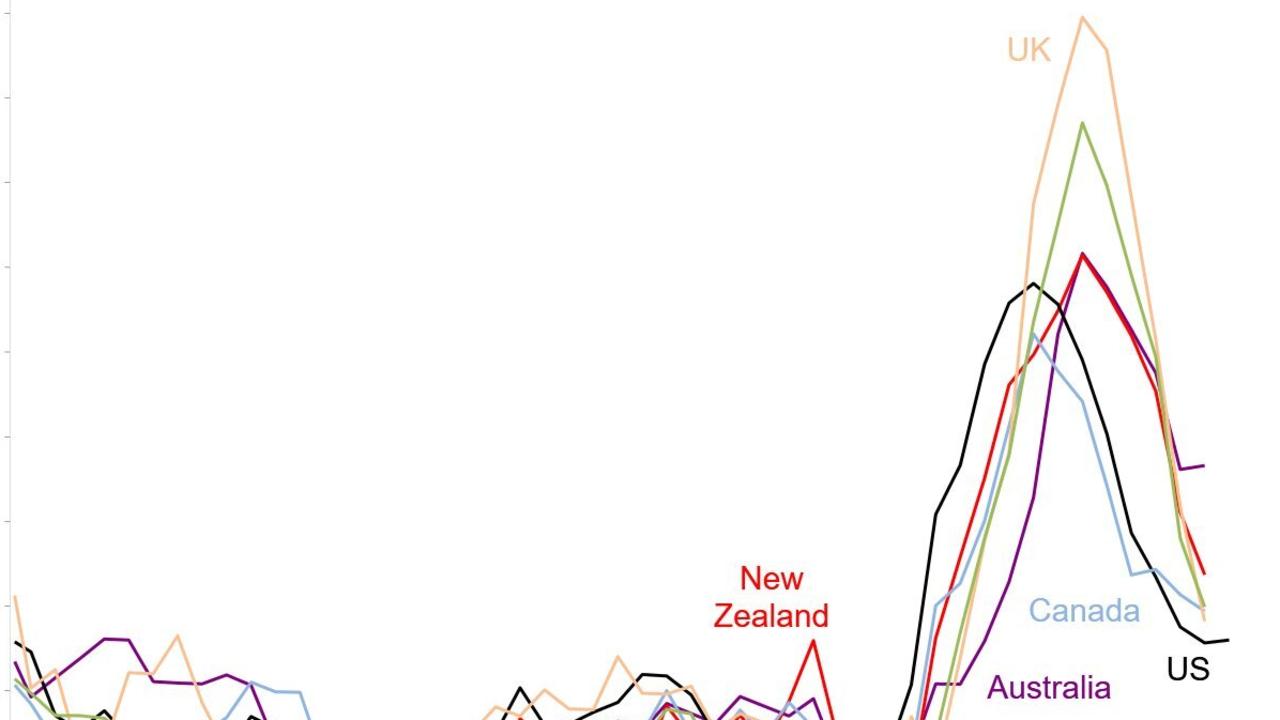

“It took a calculated risk in not raising rates as aggressively as other countries but will be alert to the dangers of allowing inflation to resume an upward trend or to become entrenched.

“The cumulative risks related to continued strength in the labour market, unexpected resilience in household consumption and fiscal policy that includes tax cuts and temporary cost of living relief make this period particularly difficult for the bank.”

Economists have voiced concerns that the Stage 3 tax cuts alongside new federal and state spending has poured an extra $46 billion into the economy this financial year, which could seriously hamper the RBA’s efforts to tame inflation.

Judo economist Warren Hogan said unfortunately it looked like it would be very hard to bring inflation down in the current quarter based on recently released data.

Instead, he warned there was a risk inflation would go even higher.

“No one wants to hear it or believe it but it looks like underlying inflation is picking up in Australia in 2024,” he said in June.

“The 4.35 per cent cash rate won’t get the job done on inflation. And there is a $40 billion plus fiscal bomb about to hit in a few days.”

He has warned interest rates might have to go as high as 5 per cent to tackle inflation – adding consumer spending data revealed how little impact the current cash rate had on behaviour.

Betashares chief economist David Bassanese also agrees that the June quarter CPI report on 31 July is critical to what happens next, although he said it will need to sit at the RBA forecast of 3.8 per cent.

“If that confirms the still bubbling inflationary pressure evident in the monthly CPI reports over recent months, the RBA will have no choice but to act,” he warned.

Mr Malakellis warned raising rates is a blunt tool. He said that although the RBA will recognise that if inflation resumes its upward momentum then delaying rate rises risks entrenching inflation.

But the issue is that inflation is hitting services such as rent, insurance, education and health – where rate hikes don’t really have an impact.

“In this scenario the narrow path to avoiding a recession while getting inflation within the target range is littered with potholes,” he warned.

“It is a challenging time for forecasting, but overall, KPMG continues to assess that inflation will not surprise on the upside and that current rate setting will engineer the soft landing that the RBA has been trying to engineer.

“Our central case scenario has been a fall in inflation in the second half of 2024, allowing the next move in rates to be a cut in the first quarter of 2025, although we recognise there are significant upside risks to this scenario.”

The RBA wants inflation back within a 2 to 3 per cent target range by the end of 2025 but if inflation has ticked up by 1.1 per cent or more in the past quarter, it spells trouble.