The best time to buy a property revealed, after new trend sparks house pricing fears

Prospective property buyers are being urged to err on the side of caution as a new trend in house-buying habits could see property prices soar across the country.

New data has revealed a growing trend in the property-buying habits of Australians, however housing experts have warned it may come with a cost.

As interest rates continue to rise, a survey commissioned by money.com.au found prospective buyers are waiting for a slump in the housing market before they start bidding for their new home.

Just over 1000 respondents engaged in the questionnaire which evaluated whether Australians were willing to change their buying behaviours to pay less for a property.

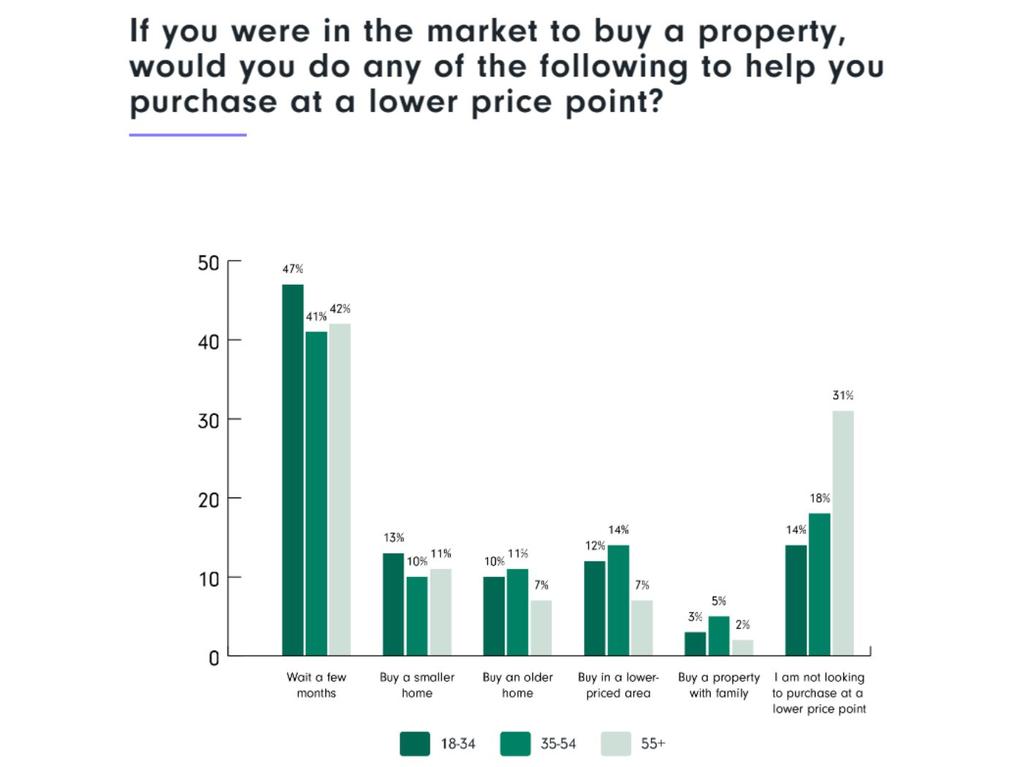

Results indicated that 43 per cent of participants were inclined to wait a few months for property prices to drop even further before entering the market, with those in the ACT, West Australia and South Australia more likely to actively buy at a lower price point.

Additionally, the idea of waiting was the preferred choice over buying a smaller or older home in a low-priced area or with family, which collectively only 36 per cent of participants voted for.

Should you rent or should you buy? Compare Money's guide to buying a house vs renting could help you decide >

And while property insight platform PropTrack is anticipating a further fall in housing prices nationally by about 15 per cent from peak rates, one financial adviser has cautioned that prices could soar if demand for homes increase.

Helen Baker, licensed financial adviser and spokesperson for money.com.au, told news.com.au it’s a simple case of supply versus demand that will see prices skyrocket if too many homebuyers wait to purchase in the same period.

“Ironically, if 43 per cent of buyers try to time the market and enter the market all at once, prices will bounce back quickly,” she said.

Ms Baker referred to Queensland as an example where property prices have soared since more Australians relocated to the state post pandemic.

Data from last year’s census revealed more than 73,000 people moved to the Sunshine State over the 2021 period, which is a 1.4 per cent population increase.

That same year, the median property price for a three-bedroom house in the state went up by 34 per cent from $572,068 to $767,358, according to SQM Research.

Today, it sits at around $791,716.

“The last two years have led to a significant increase in internal migration to the Sunshine State, while many residents in Sydney and Melbourne have also migrated to the regions,” Ms Baker said. “These movements have increased demand and could continue driving up prices in these areas.”

As for why homebuyers prefer to hold-off on buying a home opposed to purchasing a cheaper home that’s older or smaller, Ms Baker said convenience as well as not having to fork out extra costs for renovations, plays a big role in why homebuyers are avoiding such alternatives.

“(Buying a property) is one of your biggest commitments and I think homebuyers just want to get the right place and do it once,” she said.

“I think people are just waiting for something that’s all done for them. They can just walk in, and life’s easy.”

But, not all property experts agree a sudden surge in demand for lower-priced properties will see house prices rise.

Cameron Kusher, Director Economic Research at PropTrack, told news.com.au that house prices will only significantly increase if an abundance of people purchase properties at the same time.

“The truth of the matter is, everyone tries to pick the bottom of the market but not many people are actually that successful at picking the bottom of the market,” he said.

“If everyone did pile into the market at a similar time, it likely will push prices up, but there’s a few factors there to consider and I think it’s probably unlikely that people would pile in enough to offset the greater impact of higher interest rates and the slowdown in the property market.”

Mr Kusher added that first-home buyers are better off waiting opposed to those who already have a home due to the country’s rental crisis.

“A lot of people that want to buy would have to sell … but finding somewhere to rent is a big problem at the moment as well so where are you gonna live in the meantime?” he said.

So when is the right time to buy?

While a homebuyer’s individual situation plays a fundamental role in determining when the right time is to buy, both homebuyer experts agree rising interest rates should be front of mind when a prospective buyer is considering their budget.

While property prices are anticipated to decline even further over the coming months, mortgage holders are being urged to brace themselves for even further interest rate hikes by the Reserve Bank of Australia (RBA).

“If you are going to buy, you need to be very clear in your mindset that interest rates are going to continue to go up from here for a little while,” Mr Kusher said.

“Undoubtedly, there’ll be opportunities in the future and I think maybe once interest rates hit their peak, which is probably early next year, that will be a good time to start assessing the market.”

Additionally, NSW first home buyers are being encouraged to wait for the Perrottet government’s new initiative to commence on January 16, 2023 where buyers can elect to not pay the stamp duty at the time of purchase.

Instead, they’ll have to pay an annual property tax of $400 plus 0.3 per cent of the current land value of the property.

“I wouldn’t say don’t buy now but I would say you know, keep an eye on things and be mindful of where interest rates are going and the fact that prices are likely to continue to decline over the coming months,” Mr Kusher said.