Reserve Bank of Australia governor Philip Lowe ‘soul searching’ after big economic miss but will not quit

Reserve Bank of Australia governor Philip Lowe is “soul searching” after badly misreading the growing inflation crisis but has ruled out one thing.

Reserve Bank of Australia governor Philip Lowe has admitted he is doing some “soul searching” after badly misjudging the economic outlook but says he has no plans to quit.

Dr Lowe has been criticised by both Nationals Senator Matt Canavan and Greens Senator Nick McKim over the spate of interest rate rises in the past five months, both of whom have called for him “to go”.

“I can assure you, I have no plans to resign,” Dr Lowe said when asked about the criticism after giving a speech at the Anika Foundation on Thursday.

“The unemployment rate in Australia today is the lowest in 50 years.

“Labour force participation is a record high, young Australians can get jobs in a way that they haven’t been able to do before, people are getting more hours of work and underemployment is down.

“We’ve struggled for 50 years to get to full employment. It’s been, from my perspective, a blight on what’s otherwise been a very successful economy.

“So we’re closer to full employment, maybe there than we’ve ever been for 50 years. So that is a legacy of what we’ve done.

“We’ve certainly got higher inflation and that’s partly because of the insurance policy we took out during the pandemic.”

Dr Lowe said the board had discussed during the pandemic whether they do too little or too much.

“If we did too much, then we’d have to increase interest rates and I’d get all this criticism and calls for my resignation,” he said.

“I think we made the right choice ... turns out we didn’t need as much insurance and we’re having to increase interest rates, but people have jobs, kids have opportunity, household incomes are rising.

“That’s what I would say to people who don’t like me in my job.”

His response to the question drew a loud applause.

It comes after Senator McKim said this week that real wages were going backwards.

“We are seeing the furthest thing from sustained wages growth,” he told the ABC.

“So the preconditions that Dr Lowe set when he said interest rates wouldn’t go up until 2024 have not been met.

“The issue here is that he effectively induced a lot of Australians into taking on massive debt levels, borrowing significant amounts of money, to purchase a house or a property in the expectation that he would stick to his word and not put interest rates up until 2024.

“They’re going up through the roof. Now this is going to send some households to the wall and there has to be some accountability in the system. So we’re saying today, Dr Lowe should go.”

It has been widely understood that Dr Lowe promised not to raise interest rates until 2024.

But when asked about it on Thursday, Dr Lowe was quick to set the record straight, saying he made no such “promise”.

“I know many people interpret my previous statements as saying that, but if you look back carefully, I never said that,” he said.

“What we said was we thought the pandemic was going to have long-lasting, disruptive effects on the economy that would keep inflation low, it would keep unemployment high for years, and we wanted to do what we could to prevent it.

“That meant that we were likely to keep interest rates low for a long period of time out to 2024. So it was highly conditional — we did not make a promise.

“The health situation improved much faster than the advice that we and others had, and we’ve had to rewind those decreases in interest rates and it’s been obviously a difficult thing for the community to accept.”

Earlier during his speech, Dr Lowe said a lot had changed in the past year.

“A year ago the RBA was forecasting that inflation in 2022 would be just 1.75 per cent,” he said.

“Now we’re expecting CPI inflation to be around 7.75 per cent.”

While some forecasters had expected inflation to be a little higher than the RBA, others were expecting it to be lower.

“The magnitude of the pick-up and inflation has come as a surprise to everyone,” he said.

Dr Lowe said the same was true internationally and it had led to some “soul searching at the RBA”.

“Forecast misses of this scale should lead to soul searching by forecasters and they certainly have at the RBA,” he said.

“It is important that we learn from this and improve our understanding of the inflation process.

“One starting point for understanding the unexpected surge in inflation is the big lift in energy prices stemming from Russia’s invasion of Ukraine and various problems in the production of energy around the world.”

Dr Lowe said while the lift in energy prices explained some of the surge in inflation, it was not the full story, and major changes were needed to avoid misses like this in the future.

“We can make some further progress in understanding this surge by using the standard workhorse models of inflation, which explain inflation by inflation expectations and the aggregate output gap,” he said.

“Strong demand at a time of impaired supply – and thus a closure of the output gap – certainly helps explain part of the recent higher inflation.

“But these models fall well short of explaining the magnitude of the lift in inflation and, in my view, face some real challenges.

“One of these challenges is that the focus on the aggregate output gap is insufficient in a world in which shocks are highly uneven across sectors.

“We need to pay more attention to developments in individual sectors.”

Dr Lowe said the board was committed to doing what was “necessary” to ensure inflation returned to target over time, saying high inflation was a “scourge”.

“It damages our standard of living, creates additional uncertainty for households and businesses, erodes the value of people‘s savings and adds to inequality,” he said.

“Without price stability, it is not possible to achieve a sustained period of low unemployment.

“It is important, therefore, that this current surge in inflation is only temporary and that we once again return to the two to three per cent range.”

Dr Lowe said the board was committed to the return of inflation to target.

“It is seeking to do this in a way that keeps the economy on an even keel; it is possible to achieve this, but the path here is a narrow one and it is clouded in uncertainty,” he said.

Dr Lowe pointed to three sources of the uncertainty — the global economic environment, how inflation expectations and the inflation psychology in Australia adjust to the period of high inflation, and how households respond to higher interest rates.

“Interest rates are increasing for the first time in 12 years and they are rising quickly. The full effects of this are still to be felt,” he said.

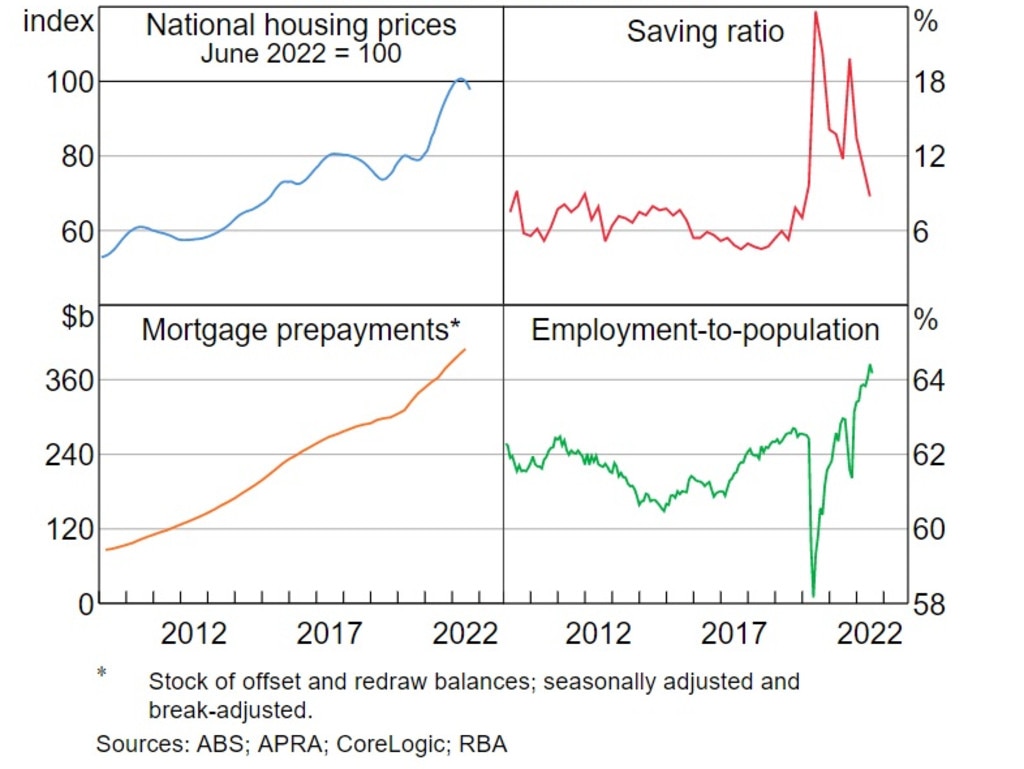

“Household budgets are also under pressure from higher inflation, and housing prices are declining after large gains.

“On the other hand, many households have built up large financial buffers, including through offset accounts, and the household saving rate remains higher than it was before the pandemic.

“Many households are also benefiting from the strong labour market, with a higher share of Australians having a job than ever before.

“It is still difficult to know how all of these factors will balance out, but recent data continues to suggest resilience in consumer spending.”

But he also noted the global economy was gradually improving and the demand for goods was stabilising.

“It is also noteworthy that inflation expectations in Australia remain consistent with the inflation target,” he said.

Dr Lowe said how high interest rates needed to go and how quickly it happened would be guided by the “incoming data and the evolving outlook for inflation and the labour market”.

His comments come after the central bank hiked the cash rate for the fifth consecutive month on Tuesday.

The RBA announced a 0.50 per cent rate rise in a bid to bring inflation under control, taking the cash rate to 2.35 per cent.

It is the first time it has been above two per cent since April 2016 and its highest level since December 2014.

Banks have also been increasing interest rates in line with the rise to the cash rate.

Dr Lowe has repeatedly said the RBA was committed to returning inflation somewhere between two and three per cent over time, while it was expected to peak later this year.

The bank’s central forecast for inflation is expected to be around 7.75 per cent over this year.

However, it is expected to drop to a little above four per cent over 2023 and about three per cent in 2024.

Dr Lowe said this week that the increase in interest rates would help bring inflation back to target and “create a more sustainable balance of demand and supply in the Australian economy”.

“The board expects to increase interest rates further over the months ahead, but it is not on a preset path,” he said.

Read related topics:Reserve Bank