RBA interest rate hike could crash house prices by 25 per cent

On Tuesday, the RBA shocked with their latest cash rate rise and the consequences of further hikes could be devastating.

ANALYSIS

On Tuesday, the Reserve Bank of Australia (RBA) shocked borrowers with a 0.5 per cent hike in interest rates, taking the official cash rate (OCR) to 0.85 per cent.

The 0.5 per cent rise beat most analyst’s expectations and was the first time the RBA has done a double rate hike since February 2000.

Before yesterday’s decision, the median economists’ forecast was for the OCR to peak at around 2.5 per cent mid next year. Now they are predicting another 50 bps hike in July.

The futures market is even more hawkish, tipping the RBA will lift the OCR to around 3.5 per cent by May 2023.

A shot through the heart of Aussie consumers

Never before has the RBA commenced an interest rate tightening cycle with such poor consumer confidence.

As shown in the next chart, the ANZ-Roy Morgan consumer confidence index was tracking below the Global Financial Crisis (GFC) trough before yesterday’s shock 0.5 per cent OCR rise.

Concerned about rising interest rates? Read Compare Money's guide to fixed rate v variable home loans >

Should the RBA follow through with the economists’ – let alone the futures market’s – forecast, then we are likely to see consumer confidence fall to historically low levels.

It is easy to see why. Australian consumers are being hit with a cost-of-living crisis impacting everything from petrol to food to rents to electricity and gas. At the same time, wages are barely growing.

Cost of living

Most of Australia’s inflationary pressures are either imported or weather-related, so hiking interest rates will do little to resolve them.

In particular, the tearaway energy price rises that the RBA singled out in its statement on Tuesday can only be fixed by the Albanese government using regulation to break the link between local and global gas and coal prices.

If it does not act to domestically reserve or appropriately levy coal and gas to bring prices down, then, instead, soaring interest rates will engineer the biggest proportional rise in mortgage repayments in the nation’s history, adding to household’s cost of living crisis.

To illustrate why, consider the next table showing the average monthly repayment on the median priced dwelling across Australia, assuming a 30-year principal and interest variable rate mortgage and a 20 per cent deposit.

The figures for May are before yesterday’s 0.5 per cent OCR hike.

If the economists’ forecast comes to fruition, and the OCR rises to 2.5 per cent, then the average monthly mortgage repayment on the median priced Australian home would rise by $781, or 28 per cent. Borrowers in Sydney would be most impacted, with monthly mortgage repayments on the median priced home jumping by $1163.

If the futures market’s forecast comes true, and the OCR rises to 3.5 per cent, then the average monthly mortgage repayment on the median priced Australian home would soar by $1174 (42 per cent), with repayments across Sydney ballooning by $1748 a month.

The impact would be even more severe for borrowers that took out a fixed-rate mortgage during the height of the pandemic at rock bottom rates below 2.5 per cent.

These borrowers would face a doubling or tripling of mortgage rates when it comes to refinance in 2023 and 2024, depending on whether the economists’ or market’s OCR projection comes to fruition.

Australian house prices would crash

With soaring interest rates, demand for mortgages would plummet. Given nearly every homebuyer purchases with borrowed money, changes in mortgage demand has historically been one of the best indicators of house price growth, as illustrated in the next chart.

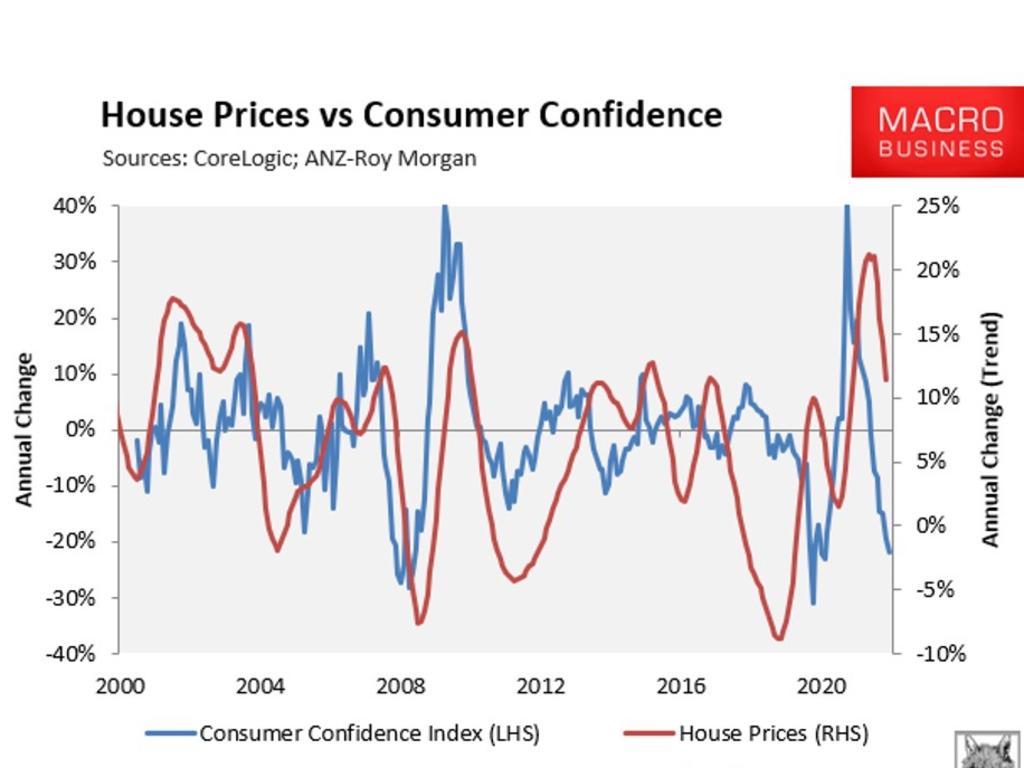

Changes in consumer confidence have also historically been a good leading indicator for house prices, as illustrated in the next chart.

With both mortgage demand and consumer confidence facing heavy falls on the back of rate rises, the RBA risks sending house prices into a tailspin if it hikes as aggressively as economists let alone the market are forecasting.

Given Australian house prices soared around 35 per cent over the pandemic on the back of deep cuts to mortgage rates, heavy price falls would necessarily result from the sharpest lift in mortgage repayments in the nation’s history. Interest rates are a double-edged sword.

Indeed, in its latest Financial Stability Review, the RBA estimated “that a 200-basis-point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period”.

Thus, the economists’ forecast 2.5 per cent OCR suggests a peak-to-trough fall in real Australian house prices of more than 15 per cent, with nominal values falling by more than 20 per cent.

The futures market’s forecast 3.5 per cent OCR would ‘crash’ the housing market, with real housing prices falling by around 25 per cent in real terms and by more than 30 per cent in nominal terms under the RBA’s modelling.

The RBA would also crash the economy

Household consumption is by far the biggest driver of the nation’s economic growth, accounting for around 55 per cent of final demand in a typical quarter. Therefore, where household consumption goes the economy usually follows, as illustrated in the next chart.

If mortgage repayments rise as sharply as forecast, this will mean there are less funds available for spending across the economy, in turn draining economic growth.

The negative drag on household consumption would also be exacerbated by a sharp fall in house prices, which would make Australians feel poorer.

History repeating?

At the beginning of the GFC in 2008, the RBA mistakenly hiked the OCR by 1.0 per cent. After the economy teetered and house prices began to fall, it was forced into a sharp reversal whereby the RBA slashed rates by 4.0 per cent over just six months. Something similar may happen again after the RBA goes too hard on tightening.

There is another ever darker scenario. If the Albanese government fails to curb the energy crisis then inflation could remain unusually sticky even as house prices and the economy fall apart, pushing the RBA to severely over-tighten and crash everything in sight.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.