RBA interest rate cuts: How you can get the full rate cut

Comparison sites break down which bank did and didn’t pass on the Reserve Bank’s interest rate cut and how to best capitalise on the savings.

Don’t assume you will automatically pay less on your mortgage after the Reserve Bank’s historic rate cut yesterday.

Those who want cash in their hands will likely need to call their bank and ask for their monthly repayments to be reduced.

The borrower will otherwise continue paying the same amount but more will go towards paying for the home rather than interest.

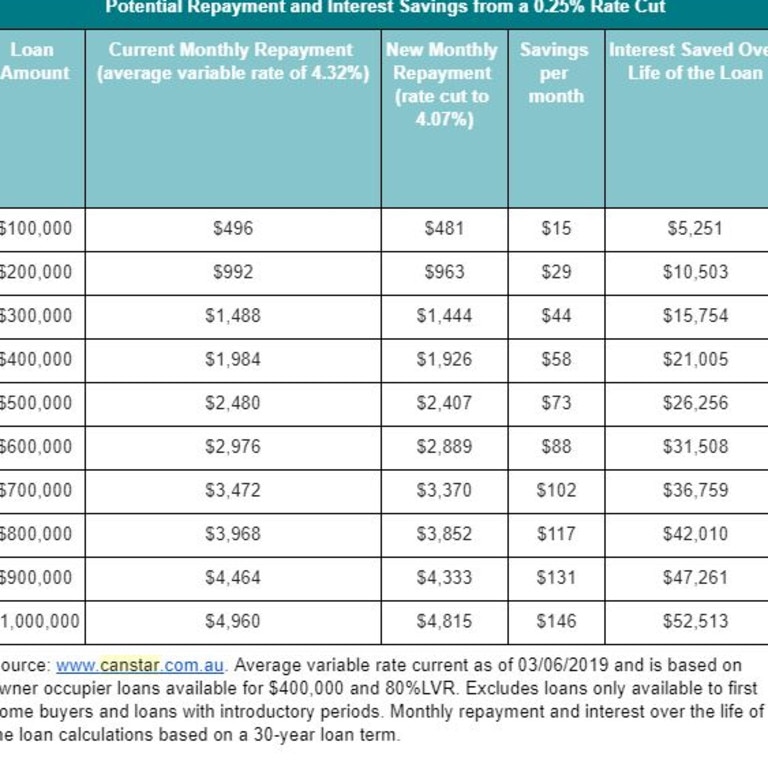

RBA governor Philip Lowe slashed the official rate to 1.25 per cent yesterday, which will result in a savings of nearly $90 a month on a $600,000 loan, according to comparison site Canstar.

But the site’s finance expert Steve Mickenbecker has urged consumers to go without that $90 stimulus and instead pump it back into their mortgage to capitalise on the lowest interest rates ever experienced in Australia.

“If you are getting by on your household budget, why would you reduce the repayments?” Mr Mickenbecker told news.com.au.

RELATED: Will you get the rate cut? Big banks announce plans

RELATED: Delaying rate cut will allow big four to pocket $110 million

RELATED: Australians should expect another rate cut

“Eventually rates will go up, it might not be for a few years, but they’ll go up eventually so why would you not take advantage of it now when rates are low?”

Otherwise you pay the same on your mortgage but the portion going to interest repayments reduces and you pay off more of the principal this paying down the debt quicker 2/

— Cameron Kusher (@cmkusher) June 4, 2019

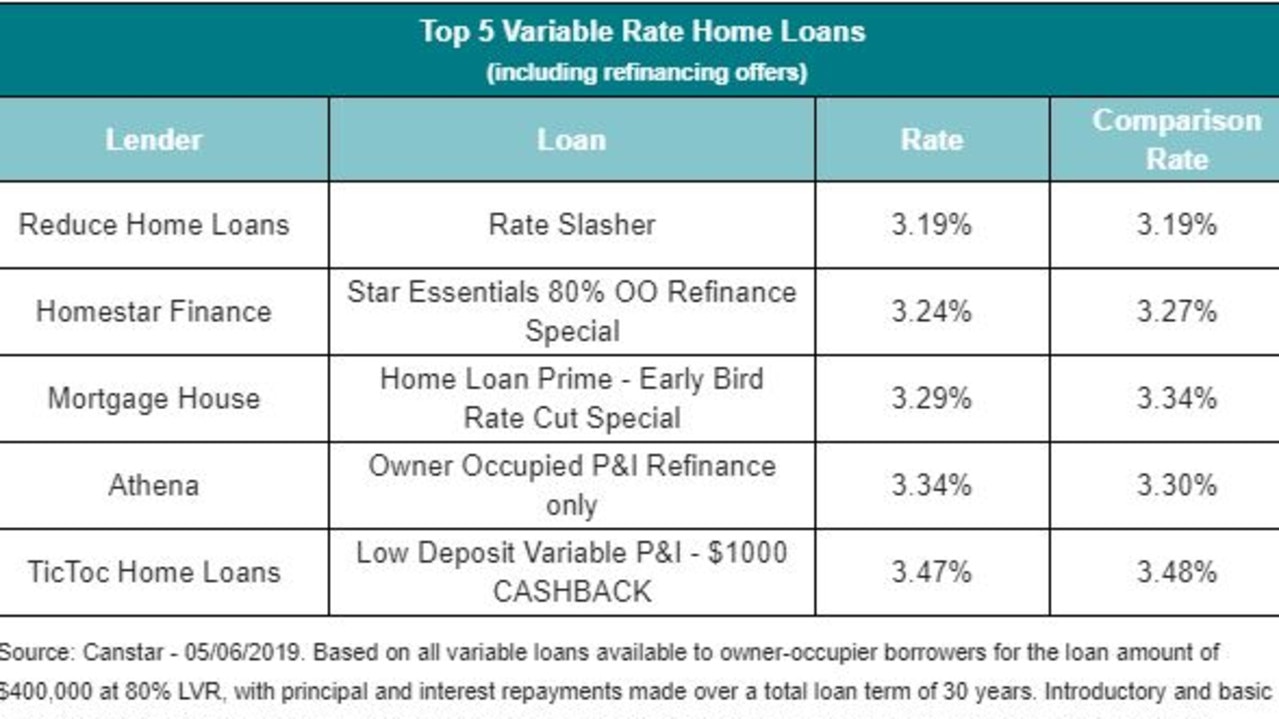

As politicians and borrowers squabble over the 0.07 per cent difference between the major banks’ reduction in the interest rates, consumer advocates say people should consider the bargain deals on offer by the smaller lenders.

Mr Mickenbecker said there’s already a difference of about 0.75 per cent between the smaller institutions and the big four.

And even a further rate cut from the RBA won’t have a dramatic impact on bridging that difference.

“People owe it to themselves to have a good look,” he said. “It’s not good enough to say you’ll wait for the Reserve Bank.

“It might drop again but you’ll still be on a reasonably high rate (with the major banks) relative to the deals you can get currently.

“There are some great rates out there, why would you pay 1 per cent more than that?”

ANZ and Westpac refused demands from both sides of politics to pass on the entirety of the RBA’s cut, instead announcing each would lower interest rates on mortgages by 0.18 and 0.20 per cent respectively.

But they aren’t alone.

Westpac’s subsidiaries St George, Bank of Melbourne, Bank SA and RAMS will pass on a 0.20 per cent cut to their owner-occupier customers. They are however, cutting investor interest-only rates above and beyond the RBA, by 0.35 per cent.

Suncorp Bank has also announced it will cut all variable home loan interest rates by 0.20 per cent, effective June 21.

In contrast, Macquarie bank, Athena, RACQ and Reduce Home Loans announced they’ll be passing on the full 0.25 per cent cut.

Rate City research director Sally Tindall said Westpac and ANZ customers would be frustrated but said they have a choice to switch to a cheaper lender.

“One of the best things about being on a variable rate is that you’re well within your rights to take your business elsewhere,” she said.

“Check whether your lender is passing on the rate cut, but also see what the competition is offering, because ultimately the lower the comparison rate, the more money you’re likely to have left in your pocket.

“Although it’s good to see Australia’s largest bank, Commonwealth Bank, pass on the full cut, it’s a pity they are making their customers wait three weeks before they see any savings.”

That delay to enact the cuts will allow CBA to pocket $50 million from the temporary improved margin, comparison site Mozo says.

Combined, the big four will bank $108.8 million by delaying the effective date of the cut.

Mozo spokesperson Tom Godfrey said customers should see these eye-watering figures as an “open invitation” to shop around for a better deal.

“While two of the big four have passed the official rate cut on in full, they are still well short of offering the most competitive rates on the market,” he said.

“When it comes to some of the best variable home loan rates on the market, Mozo found smaller lenders are on top.”

Reduce Home Loans is offering 3.19 per cent, Homestar 3.24 per cent, Mortgage House 3.29 per cent and Athena 3.34 per cent.

Comparison site Canstar also pointed to these four deals for consumers as well as TicToc Home Loans which is offering a loan at 3.48 per cent.

Finance expert at comparison site Finder Graham Cooke said consumers should check their lender’s social media and website to see what the rate cut materialises for them.

“If your bank hasn’t passed on the full cut, it may be time to go home loan shopping,” he said.

“But firstly, get in touch with your current lender to see if there’s anything better they can do for you — use your loyalty as leverage, especially if you have multiple accounts or products with them.

“At the end of the day, they don’t want to lose your business.”

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au