Delaying the rate cut will allow big four banks to pocket $110 million

The major banks all say they will pass on some or all of the rate cut, but a tricky tactic will see them pocket millions of dollars.

The big four banks all said they would pass on some or all of the interest rate cuts announced by the Reserve Bank on Tuesday.

But a delay in enacting the cuts means there will be a period where the major lenders are charging the same interest on mortgage despite the central bank’s cut having come into effect.

Commonwealth Bank won’t pass on the cut to customers until June 25 which means the largest bank in the country will pocket $50 million from the improved margin, comparison site Mozo says.

Combined, the big four will bank $108.8 million by delaying the effective date of the cut.

NAB has pushed back the date of change to June 14, which will amount to $13.7 million extra.

ANZ and Westpac refused demands from both sides of politics to pass on the entirety of the RBA’s cut, instead announcing each would lower interest rates on mortgages by 0.18 and 0.20 per cent respectively.

This stronger margin for the two major lenders means they will collectively pocket $193 million over the next 12 months.

On top of this, Westpac will pocket $31.5 million from delaying its cut by 13 days, while ANZ will earn $134 million by stretching out the time to enact its partial cut by nine days.

RELATED: Will you get the rate cut? Big banks announce plans

RELATED: RBA slashes cash rate to all-time low of 1.25 per cent

RELATED: Australians should expect another rate cut

Mozo spokesperson Tom Godfrey said customers should see these eye-watering figures as an “open invitation” to shop around for a better deal.

“While two of the big four have passed the official rate cut on in full, they are still well short of offering the most competitive rates on the market,” he said.

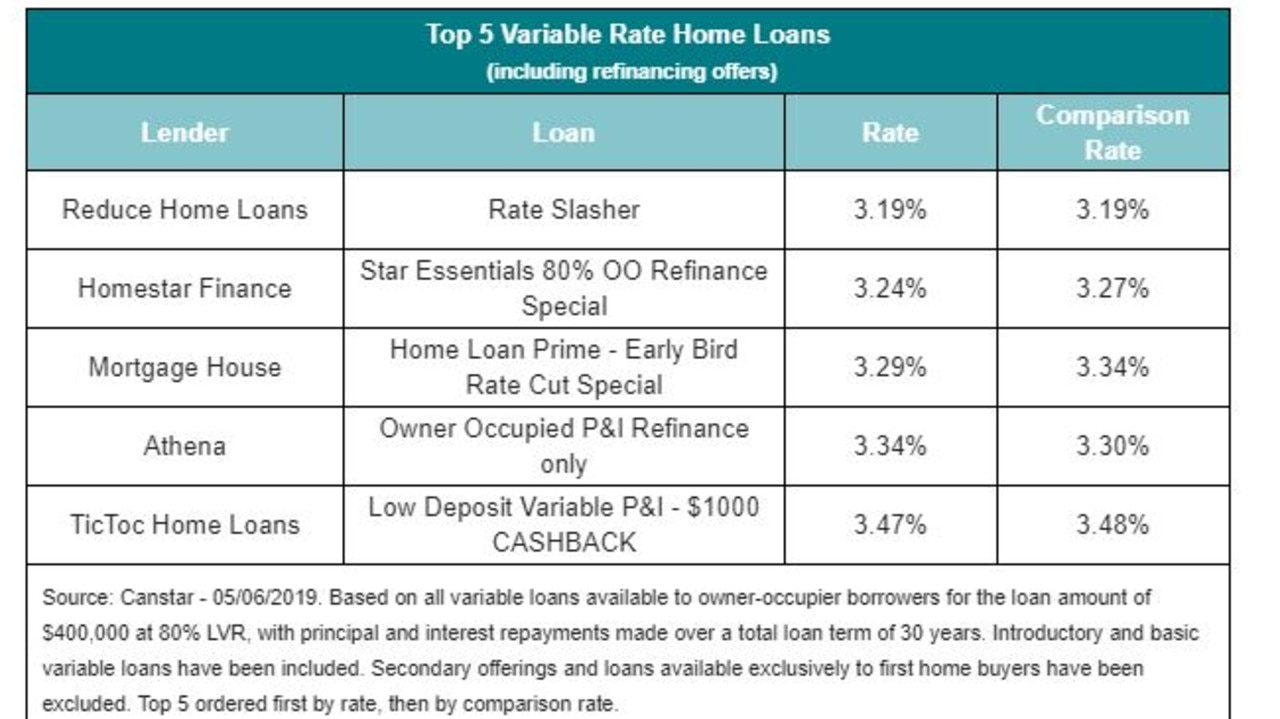

“When it comes to some of the best variable home loan rates on the market, Mozo found smaller lenders are on top.”

Reduce Home Loans is offering 3.19 per cent, Homestar 3.24 per cent, Mortgage House 3.29 per cent and Athena 3.34 per cent.

Comparison site Canstar also pointed to these four deals for consumers as well as TicToc Home Loans which is offering a loan at 3.48 per cent.

Canstar’s finance expert, Steve Mickenbecker, said the delay from the major banks to enact the cut is designed to boost the net interest margins — the difference between interest charged on a loan and that paid to fund it.

But he did say the lenders do need time to organise loans before the cut comes in.

“It’s not trivial lining them all up because of the number of loans they have and the number of variations,” he told news.com.au.

“So they need a reasonable time.

“You don’t want them rushing in, making mistakes, getting it all wrong and having to go back to people multiple times.

“But they don’t need 21 days.”

However, Mr Mickenbecker said a lower interest rate on a borrower’s mortgage was clearly better in the long run.

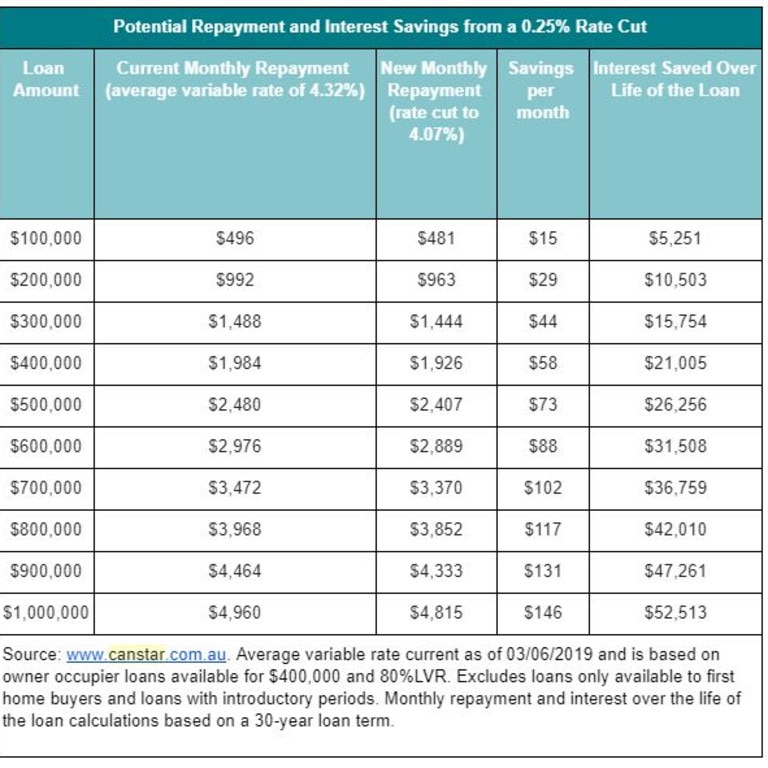

“Would I prefer to be getting 0.18 points in nine days, or 0.25 points in 21 days? I can tell you I’d prefer to be getting the full 0.25 per cent and waiting an extra week or so for it,” he said.

Canstar figures say borrowers will save nearly $90 a week from the reduction in mortgage repayments on a $600,000 loan when the 0.25 per cent cut is factored in.

Macquarie bank, Athena, RACQ and Reduce Home Loans announced they’ll be passing on the full 0.25 per cent cut.

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au