RBA interest rate cut: Interest in rock-bottom mortgages skyrocketed after cut

ANZ and Westpac refused to pass on the entirety of the Reserve Bank’s rate cut and it may prove costly for the major banks.

When ANZ and Westpac refused demands to pass on the entirety of the Reserve Bank’s rate cut, a furious Treasurer Josh Frydenberg implored their customers to find a better deal.

And it appears a huge number of Australians took his advice.

Search activity for home loans on the country’s biggest comparison site Finder jumped more than 650 per cent in the two days after RBA governor Philip Lowe slashed the official rate to 1.25 per cent on Tuesday.

Interest in variable rates on the site grew by more than 560 per cent and there was a jump of nearly 370 per cent in those looking to refinance.

“It’s great to see Aussies being proactive and looking for better value,” Finder insights manager Graham Cooke said.

“This historically low rate will open lots of eyes to just how good the current offers are — and that’s the case for variable and fixed rates, alike.

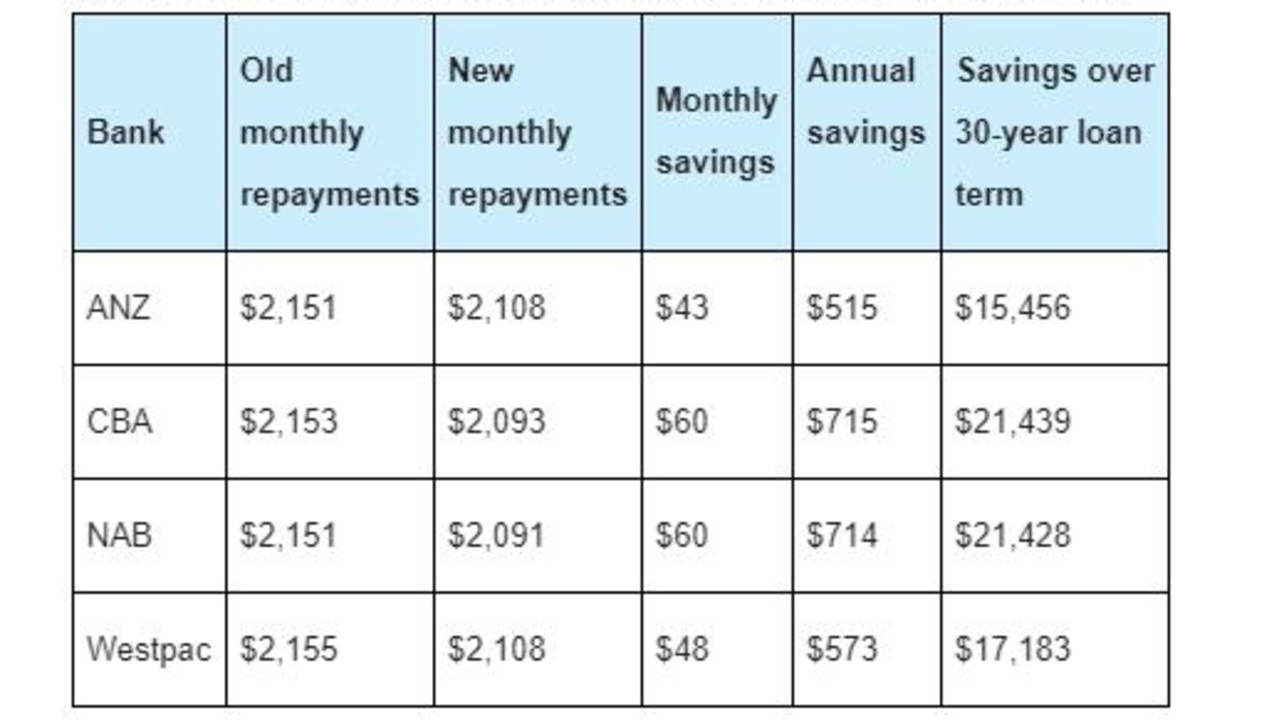

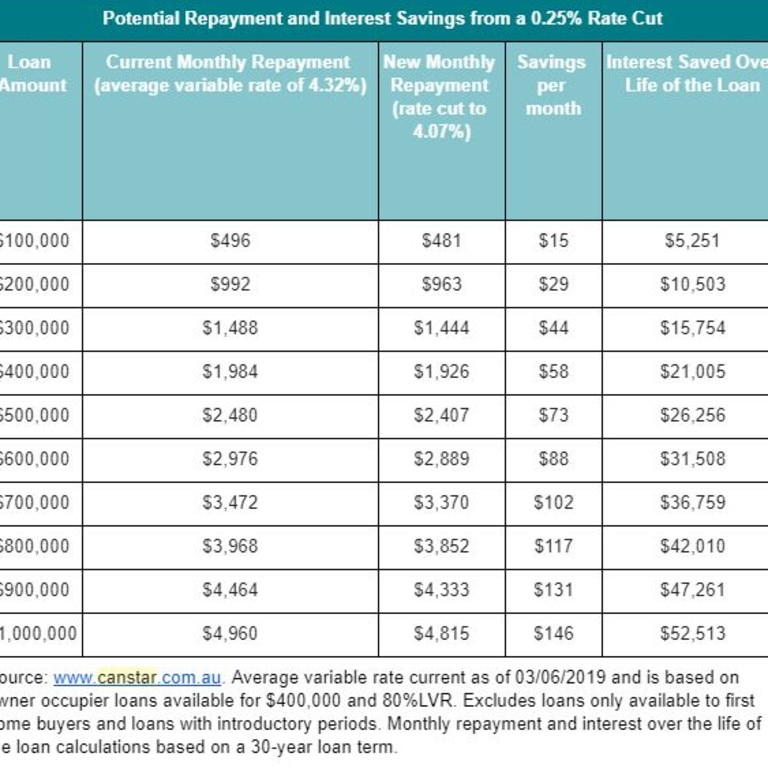

“Generally speaking, for those with an average home loan size of just less than $400,000, a 25 basis point drop could save you $60 a month or more. “

This means the borrower can pocket $21,000 over the 30-year life of a loan.

RELATED: Will you get the rate cut? Big banks announce plans

RELATED: Delaying rate cut will allow big four to pocket $110 million

RELATED: Australians should expect another rate cut

As politicians and borrowers squabble over the 0.07 per cent difference between the major banks’ reduction in the interest rates, consumer advocates say people should consider the bargain deals on offer by the smaller lenders.

Comparison site Canstar’s finance expert, Steve Mickenbecker, said there’s already a difference of about 0.75 per cent between the smaller institutions and the big four.

And even a further rate cut from the RBA won’t have a dramatic impact on bridging that difference.

“People owe it to themselves to have a good look,” he said. “It’s not good enough to say you’ll wait for the Reserve Bank.

“It might drop again but you’ll still be on a reasonably high rate (with the major banks) relative to the deals you can get currently.

“There are some great rates out there, why would you pay 1 per cent more than that?”

NAB and Commonwealth Bank passed on the full 0.25 per cent cut, while ANZ and Westpac each announced they would lower interest rates on mortgages by 0.18 and 0.20 per cent respectively.

But they aren’t alone.

Westpac’s subsidiaries St George, Bank of Melbourne, Bank SA and RAMS will pass on a 0.20 per cent cut to their owner-occupier customers. They are however, cutting investor interest-only rates above and beyond the RBA, by 0.35 per cent.

Suncorp Bank has also announced it will cut all variable home loan interest rates by 0.20 per cent, effective June 21.

Band of Queensland is only passing 0.15 per cent, Virgin Money is passing on 0.22 per cent,

In contrast, Macquarie bank, Athena, RACQ and Reduce Home Loans announced they’ll be passing on the full 0.25 per cent cut.

ING, Australia’s fifth largest home loan lender chose to pass the full 0.25 per cent cut on to their variable rate customers, effective June 25, 2019.

Banks still yet to announce their intentions include BankWest, Bendigo Bank, Adelaide Bank, ME Bank, HSBC and AMP.

Rate City research director Sally Tindall said Westpac and ANZ customers would be frustrated but said they have a choice to switch to a cheaper lender.

“One of the best things about being on a variable rate is that you’re well within your rights to take your business elsewhere,” she said.

“Check whether your lender is passing on the rate cut, but also see what the competition is offering, because ultimately the lower the comparison rate, the more money you’re likely to have left in your pocket.

“Although it’s good to see Australia’s largest bank, Commonwealth Bank, pass on the full cut, it’s a pity they are making their customers wait three weeks before they see any savings.”

That delay to enact the cuts will allow CBA to pocket $50 million from the temporary improved margin, comparison site Mozo says.

Combined, the big four will bank $108.8 million by delaying the effective date of the cut.

Mozo spokesperson Tom Godfrey said customers should see these eye-watering figures as an “open invitation” to shop around for a better deal.

“While two of the big four have passed the official rate cut on in full, they are still well short of offering the most competitive rates on the market,” he said.

“When it comes to some of the best variable home loan rates on the market, Mozo found smaller lenders are on top.”

Reduce Home Loans is offering 3.19 per cent, Homestar 3.24 per cent, Mortgage House 3.29 per cent and Athena 3.34 per cent.

Comparison site Canstar also pointed to these four deals for consumers as well as TicToc Home Loans which is offering a loan at 3.48 per cent.

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au