RBA chief’s awkward conversation after embarrassing summit song choice

RBA boss Philip Lowe refused to comment after he was awkwardly welcomed to a finance summit only a day after he served a blow to mortgage holders.

An uplifting song choice at a Sydney financial summit left Reserve Bank boss Philip Lowe a little red faced, with its lyrics quite contrary to how Australians are feeling about a 12th rate rise.

The Governor was welcomed to present on stage at the Morgan Stanley Australia Summit on Wednesday morning, less than 24 hours after serving another major blow to mortgage holders.

As he stepped onto the stage to deliver a speech on inflation, the song Can’t Stop the Feeling by Justin Timberlake played in the background in an attempt to boost spirits in the room.

The feel-good song – which was produced for Dreamworks movie Trolls (2016) – promotes a theme of self-love, with its lyrics centring around dancing and being cheerful.

Predictably, the speech which followed the song was far from that theme, with Dr Lowe using his time in the spotlight to discuss the “bumpy path” ahead which would hopefully reduce Australia’s money woes.

“Today, I would like to talk about the importance of the destination – that is, a sustainable return of inflation to target – and our strategy for getting there, including the decision yesterday to increase the cash rate again,” he said.

“It is still possible to navigate this path and our ambition is to do so. But it is a narrow path and likely to be a bumpy one, with risks on both sides.”

The speech contained 14 graphs ranging from economic indicators, labour market, inflation trends and future expectations. Dr Lowe referred to each graph in his speech before responding to a series of questions.

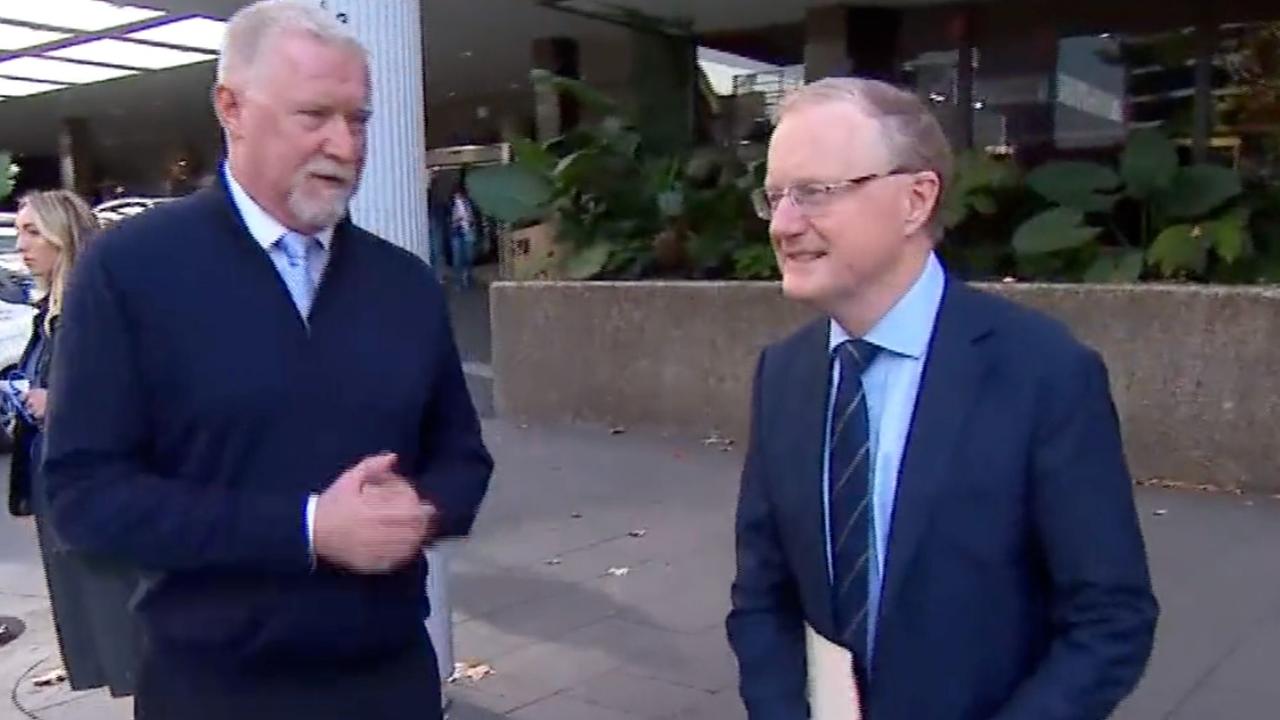

However question-time inside the conference wasn’t enough for A Current Affair who posed some tough questions to Dr Lowe as he left the building post-speech.

“Mr Lowe, would you just have a couple of minutes for me please,” Crime Editor Simon Bouda asked.

“We believe you had quite an entrance into the Morgan Stanley event sir. The music that was played, do you think it was appropriate?”

Apologetically, Dr Lowe said he didn’t have any remarks to make, replying: “I just answered a lot of questions and I have no more comments”.

“Well I mean, it was unusual, Can’t Stop the Feeling, I mean the feeling that most mortgage holders have got today wouldn’t be good,” Mr Bouda said in response.

“You’re not a little bit embarrassed about that at all?”

Dr Lowe remained silent as he quickened his walking pace, before Mr Bouda added: “I mean I know you didn’t choose the music sir, but wouldn’t that give you some reason to give us some comment about the appropriateness of it?”

“No, I have no comment for you,” Dr Lowe replied.

LOWE BLOW: In another kick to the guts for struggling mortgage holders, the Reserve Bank Governor Philip Lowe has walked out to Justin Timberlake's 'Can't Stop The Feeling!' during a financial summit in Sydney today.

— A Current Affair (@ACurrentAffair9) June 7, 2023

The move comes a day after upping interest rates again. #9ACApic.twitter.com/1d4B4JS5d5

The Governor’s appearance at the seminar comes less than 24 hours after the Reserve Bank of Australia decided to hike the cash rate again by 25 basis points on Tuesday.

The interest rate rise was the 12th to occur since May 2022 and is the highest the cash rate has been for the past 11 years.

The cash rate now sits at 4.10 per cent, which is a significant climb from the historic pandemic low of 0.1 per cent that Australians enjoyed for more than two years.

Westpac was the first big four bank to pass on the rise to its customers, with mortgage holders desperately waiting to see which bank will pass on the costs next.

Homeowners have been hit with a 400 basis point hike in the space of a year in what has been hailed as the fastest tightening cycle on record, as inflation stays stubbornly high.

April 2023 has been the only exception, when the RBA briefly paused rates, giving mortgage holders a much-needed reprieve.

It comes as inflation across the country remains stubbornly high, sitting at 6.8 per cent in the past 12 months ending April, according to the Australian Bureau of Statistics.

In a worrying trend, the RBA’s inflation target is to keep consumer price inflation between two to three per cent, which is clearly nowhere near current levels.

Dr Lowe believes one way to bring this down is to continue with interest rate hikes, with the RBA governor warning more increases could be on the cards.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon how the economy and inflation evolve.”

He also flagged that inflation was not at the level it ought to be.

“Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range,” Mr Lowe said.

“This further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable time frame.”

Dr Lowe’s handling of inflation and rising interest rates has long come under fire from mortgage holders who are on the brink of losing their homes because they’re unable to keep up with repayments.

His unsolicited advice on how to save money and stay afloat has also infuriated Australians, with some of his recommendations including working extra hours, moving in with a roommate or living with parents for longer.

Many have taken to Twitter and Reddit to vent their frustrations.

“Already work a 40hr day job and a 10ish hr night job mate. F**k these c***s,’’ one man said.

Another user said he did not understand the apologists for Dr Lowe.

“He’s paid a million bucks a year to control one lever. And he keeps getting it wrong,’’ he said.

“Badly. He stuffed up by keeping rates low for too long and then promising to keep them low “until at least 2024”. And now he’s stuffing up again by hiking rates beyond what people can sustain, probably forcing us into recession.

“And then he makes these ridiculous out-of-touch comments, showing he is completely detached from the consequences of his decisions.”

The Reserve Bank will hold another board meeting on July 4, to discuss whether interest rates will climb again.