‘No room to move’: Graph exposes economy’s ‘risky’ gamble

Something very strange is happening with Australia’s economic policy. If things don’t change soon, it leaves us dangerously exposed.

There is a weird feeling in the economy. Little by little, Australia’s economic policy has arrived at emergency settings, even though we’re not yet in an emergency.

Interest rates are at record lows, despite unemployment being at fairly average levels, and the number of employed people growing strongly. This is unusual. It creates the vague sense that something is not right.

If an actual economic crisis arrives, this uneasy feeling could transform into a catastrophe. Australia has so little it can do if a global recession comes. With official interest rates at just 0.75 per cent, we can cut interest rates by just 0.75 percentage points before they are at zero.

That is not much room to move.

In the global financial crisis, the Reserve Bank (RBA) had space to cut and the bank used it. It slashed rates by 1.75 percentage points in just two months in late 2008. Then it cut them by another 2 percentage points at its next two meetings.

Without the ability to meaningfully cut interest rates, the RBA would be forced to move to risky alternatives. It has hinted it won’t make interest rates negative. Instead it would have to do quantitative easing — an untested policy in this country with potential long-term ramifications.

BUT HEY, WHAT CHANCE IS THERE OF A CRISIS?

Funny you should ask. The RBA has been pointing out the kind of events that could bring about a major global economic disruption.

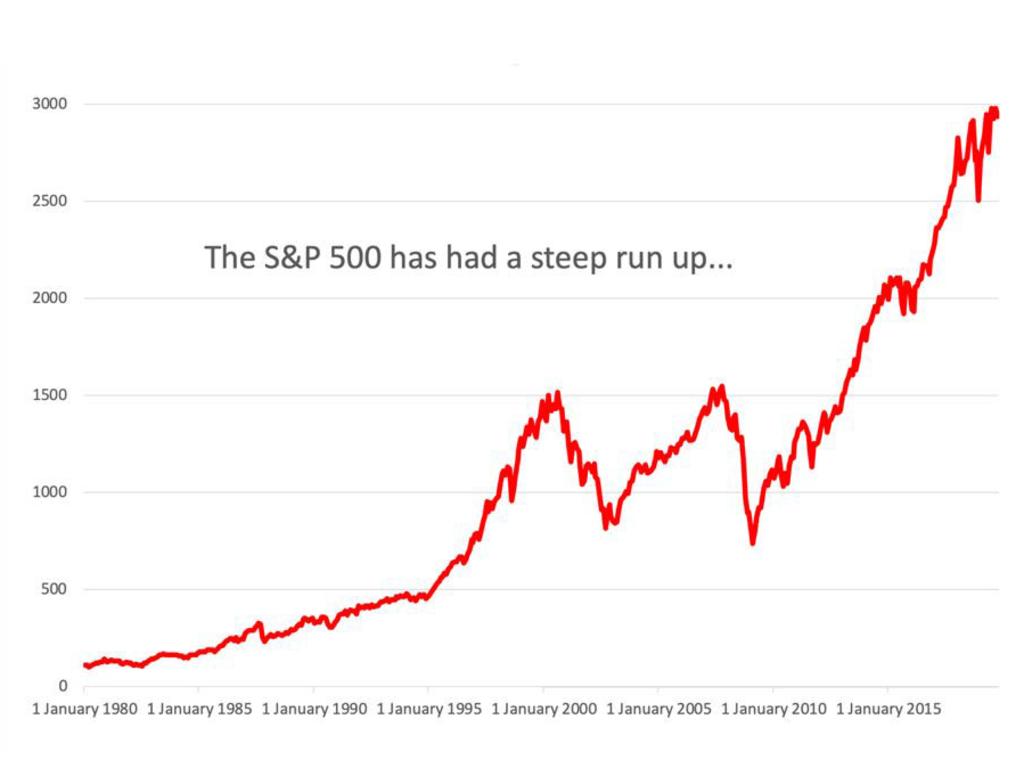

The bank is focused on overpriced assets, and what happens if their prices fall. It’s not just houses in Australian cities that are pricey. US stock markets are very high these days, and plenty of market observers say they are overpriced. It has been a decade or more since the last US stock market crash.

“Asset prices are vulnerable to a destabilising correction if risk premiums were to rise suddenly,” the RBA said.

What they are saying is that people are treating risky assets like they are safe assets, but if they realise those assets are not so safe, prices could come tumbling down. You can see how such an event could feed on itself, with price falls generating fear and fear creating price falls.

The RBA says global markets have got major vulnerabilities at the moment, pointing to a number of UK investment funds that recently faced “runs” where lots of people tried to take their money out at once. That causes investment funds to sell, which can cause price falls and contagion in other markets.

TRIGGER WARNING

But what might be the trigger for a crash? The RBA lists a couple of candidates, including “a negative growth shock” or a “geopolitical event”.

There’s no shortage of geopolitical events to choose from at the moment, from Asia to the Middle East, from London to Washington DC, 2019 feels like a dangerous era in world history.

But even without one of those blowing up further, the world could be facing that “growth shock” we were warned about. In a speech this week, the head of the World Bank announced things were worse than previously thought.

“Global growth is slowing,” World Bank president David Malpass said. “In June, the World Bank Group forecast that the global economy in 2019 would grow at 2.6 per cent, the slowest pace in three years.

“We now expect growth to be even weaker than that, hurt by Brexit, Europe’s recession and trade uncertainty.”

BACK TO AUSTRALIA

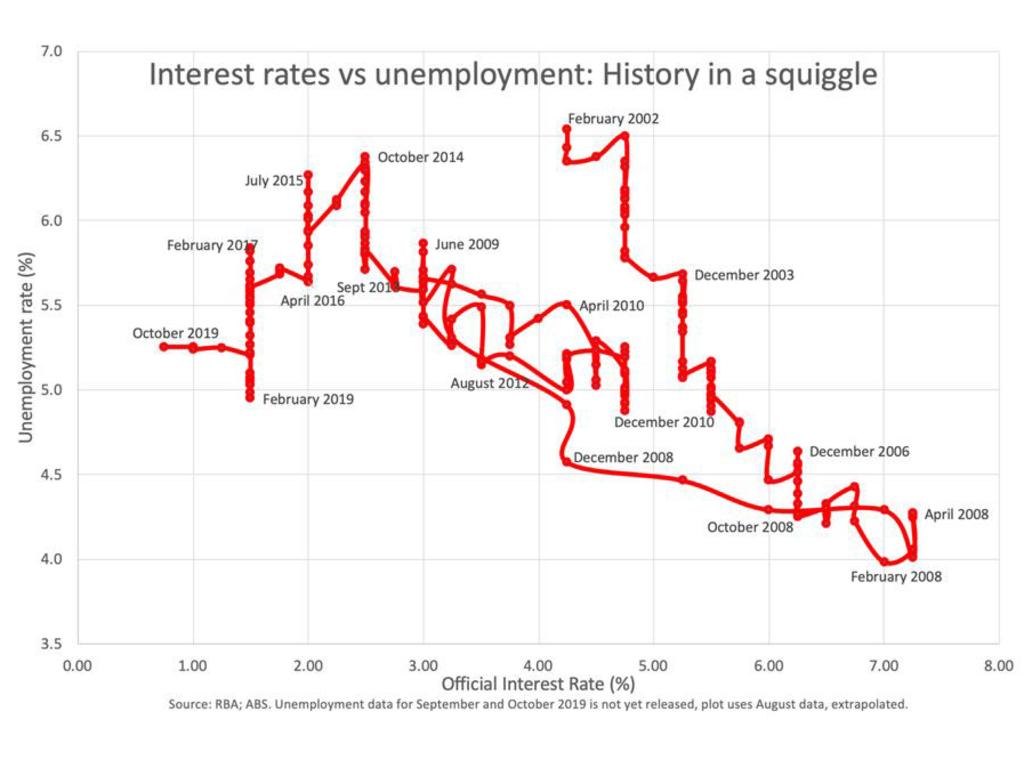

As the next graph shows, we’re at emergency settings with almost nowhere to go when things get bad. Interest rates have never been this low, even though we’ve had higher unemployment in the past.

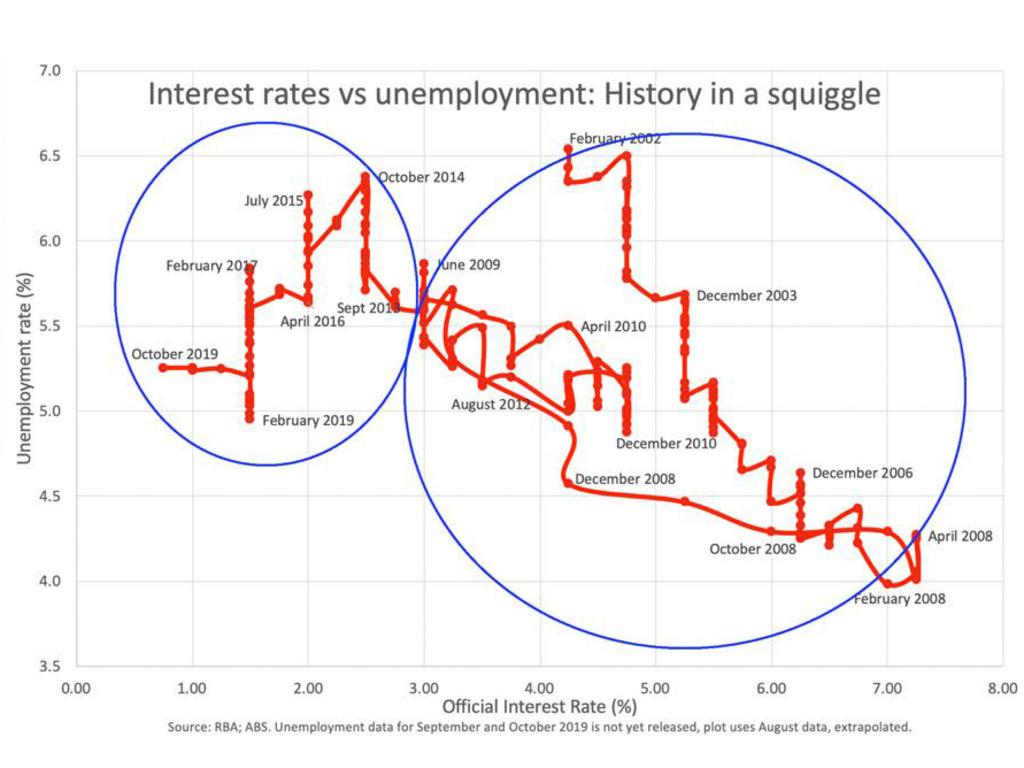

We can divide this graph up into two parts. The normal part and the abnormal part, shown in the next graph.

On the right, in the big blue circle, is the normal part. At first unemployment falls and the RBA raises rates. Unemployment turns and begins to go up, and we see the RBA cutting rates. These two trends creates squiggly diagonal lines that go from top left to bottom right. Which is what you’d expect: low interest rates when unemployment is high, and high rates when unemployment is low.

Then we get into the blue circle on the left. The interest rate is falling at the same time as the unemployment rate. The diagonal trend line seems to be pointing the opposite way: Even though unemployment has fallen a little, interest rates have fallen too.

Another way to look at this graph is to consider where interest rates were on previous occasions we had 5.3 per cent unemployment. If you scan your eyes across, you can see they were always between 3 and 5.5 per cent — much higher than they are now. That makes our current situation very much anomalous.

One day another big economic crisis will hit — you can’t avoid them forever. We need to hope we can normalise before it does.

Jason Murphy is an economist. He is the author of the new book Incentivology. Tweet him at @jasemurphy