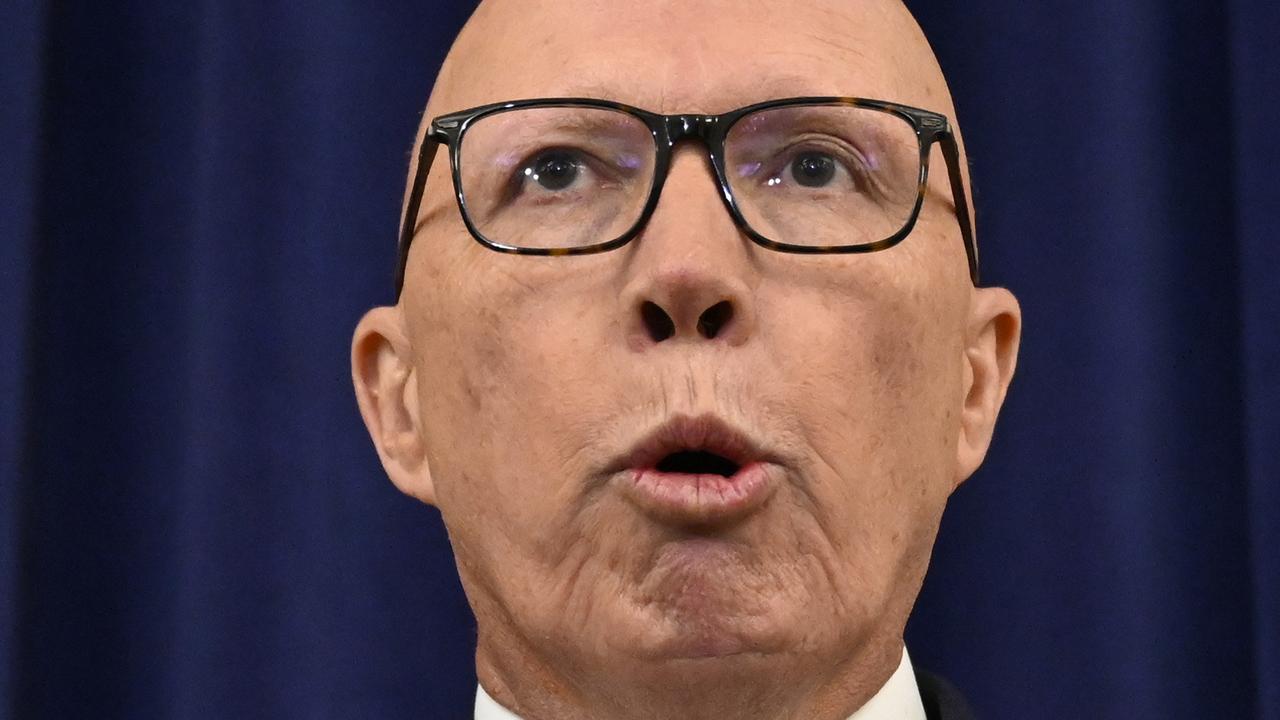

Interest rate hikes won’t add to cost-of-living, RBA data reveals

The RBA’s interest rate hike has sparked fears of more cost-of-living stress but official data points to a surprising outcome.

Most Australian households are well-placed to absorb interest rate hikes despite fears of more cost-of-living stress, official Reserve Bank data shows.

The RBA announced a higher-than-expected rate rise of 50 basis points to 0.85 per cent on Tuesday, fuelling fears of more living costs amid surging inflation.

However the hike is intended to do the opposite and Australian households are poised to handle it, according to official data.

“(Tuesday’s) increase in interest rates will assist with the return of inflation to target (2-3 per cent) over time,” RBA governor Phillip Lowe said in a statement.

“Given the current inflation pressures in the economy, and the still very low level of interest rates, the Board decided to move by 50 basis points today.”

RBA data shows households are generally well ahead on mortgage repayments, with financial stress “low and declining”.

Most households were also buoyed by an increase in savings over the pandemic due to low-interest payments on existing debt and significant policy support for incomes, such as JobKeeper.

Homeowners with variable-rate loans have a median 21-month buffer on scheduled repayments, official data shows, compared to 10 months’ worth at the start of the pandemic.

Given this, general household stress also remains “very low”, according to the RBA’s most recent financial stability review.

RBA analysis indicates if variable rates were to lift by 200 basis points – a doomsday scenario considering the cash rate was only hiked by 50 basis points on Tuesday – more than 40 per cent of borrowers were already making monthly repayments in 2021 large enough to cover the increase.

While a quarter of homeowners would be struck with repayment increases of more than 30 per cent, “around half of these borrowers have accumulated excess payment buffers equivalent to one year’s worth of their current minimum repayments”, the report says, suggesting many households have ample time to adjust to future hikes.