Consumer Price Index: Sign interest rate rise will be put on hold

Households are likely to be spared from another rate rise when the Reserve Bank meets next week after the latest inflation figures.

Households are almost certain to be spared from another rate rise when the Reserve Bank meets next week after inflation eased amid falling consumer demand.

The latest consumer price index figures, released by the Australian Bureau of Statistics, show annual inflation eased to 4.9 per cent in July, down from 5.4 per cent in June. That will be welcome news to borrowers who are struggling to keep up with repayments after stomaching 12 rate rises since last May.

The result undershot market expectations that anticipated price pressures would be more stubborn and decelerate to 5.2 per cent.

Following the fresh inflation figures, markets trimmed their expectations for a rate rise before years end to just 38 per cent.

KPMG chief economist Brendan Rynne said there was “nothing in today’s figures to lead the RBA to increase rates next week, so the cash rate is likely to take another breather in the September meeting”.

But underlying price pressures remain persistent, with economists and the RBA flagging that rates may need to rise again later this year in order to tame stubbornly high inflation.

The most significant contributor to the July increase was housing, up 7.3 per cent, spurred by soaring rental costs and the rising cost of new dwellings, but this was well below the peak recorded 12 months earlier of 21.7 per cent in July 2022.

Annual inflation for food also eased to 5.6 per cent over a 12-month period. It was as high as 9.6 per cent in September last year.

Electricity prices rose 15.7 per cent over the past 12 months, up 6 per cent in July alone. Rebates and subsidies took the sting out of higher prices that would have risen 19.2 per cent without government intervention.

Reducing the July increase was fuel prices, which fell 7.6 per cent.

The softer-than-expected headline inflation figure sent the sharemarket up 1.1 per cent.

However, excluding volatile items, including petrol, fresh produce and holiday travel, the drop in inflation was far more modest, easing to 5.8 per cent, down from 6.1 per cent in June, showing that broad inflationary pressures continue to exist.

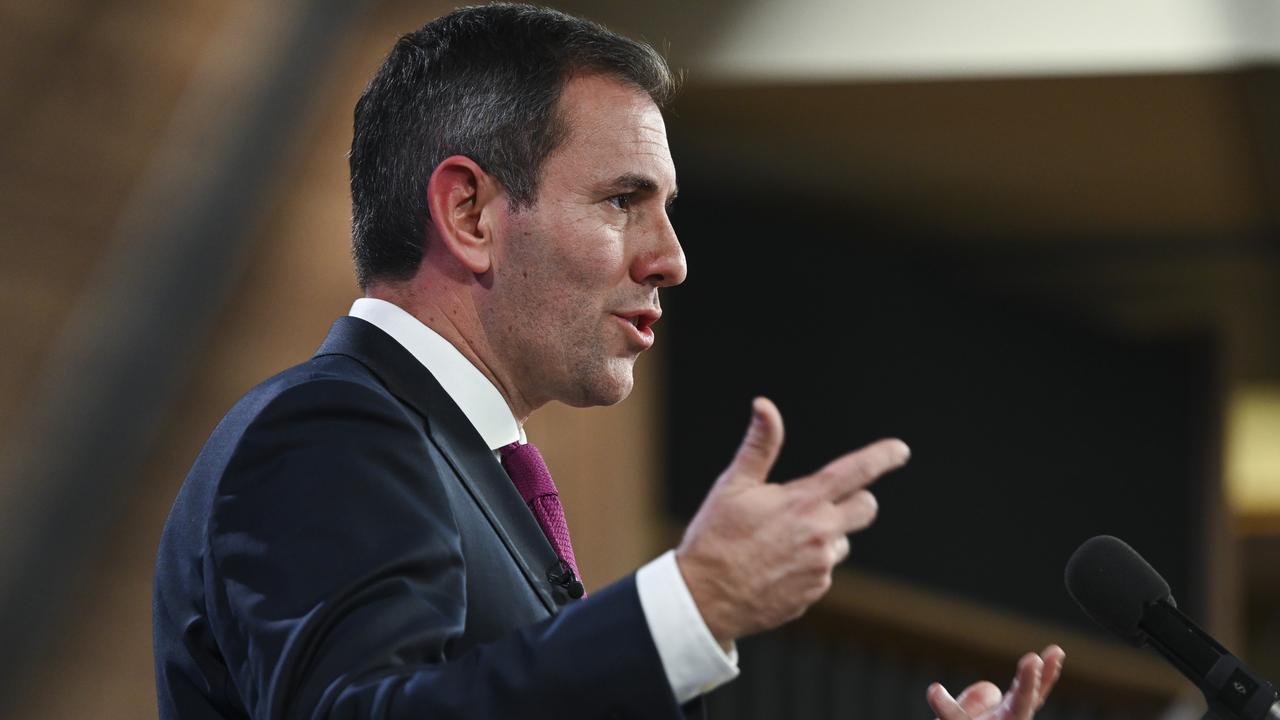

Conceding that inflation was not falling as fast as he would like, Treasurer Jim Chalmers said that Australians were still under the pump.

“It’s pleasing to see inflation is moderating but we know it will remain higher than we’d like for longer than we’d like,” Dr Chalmers said.

“Inflation remains the primary challenge in our economy and that’s why the primary focus of the Albanese Government is rolling out billions of dollars in assistance to take some of the edge off cost of living pressures without adding to inflation.”

Analysts warned that the ABS’ monthly CPI indicator did not provide a full picture of the price pressures across the economy. Due to an overrepresentation of the prices of goods, the indicator did not fully account for still-high services inflation.

The fresh figures come ahead of the September RBA board meeting next Tuesday – outgoing governor Philip Lowe’s last – where members will carefully assess the effects of elevated borrowing costs on households against the risks of allowing inflation to remain elevated for an extended period.

More Coverage

Speaking on Tuesday at the Australian National University, incoming governor Michele Bullock refused to rule out lifting the cash rate above 4.1 per cent where it sits currently.

“We may have to raise interest rates again, but we’re watching the data very carefully. And we’ll be taking decisions for the time being until next year at least month by month,” Ms Bullock said.

“All central banks at the moment are grappling with how much further they need to go.”

Read related topics:Reserve Bank