‘Financial stress’: Reserve Bank of Australia makes grim prediction for borrowers

The Reserve Bank of Australia has revealed one group of Australians are about to see a sharp drop in their disposable income.

Inflation and rising interest rates will make it tough for some people to repay their debts, and one group of Aussies will soon be down $1300 a month, the Reserve Bank of Australia has conceded.

Releasing its twice-yearly financial stability review on Friday, the RBA said there was a small group of borrowers who could fail to meet debt payments due to low savings and high levels of debt.

“Financial stress could be more widespread if economic activity turns out to be much weaker than expected,” the RBA said.

“Higher interest rates will increase borrowers’ debt payments. Despite a strong labour market, income growth has not kept up with inflation in Australia, leaving households with less capacity to service their debts.”

The RBA predicts other households will manage by reducing their spending and/or their rate of saving.

“Housing loan arrears rates are likely to increase in the period ahead from currently very low levels,” the RBA said.

“Debt-servicing challenges will become more widespread if economic conditions, particularly the level of unemployment, turn out to be worse than expected and housing prices fall sharply.”

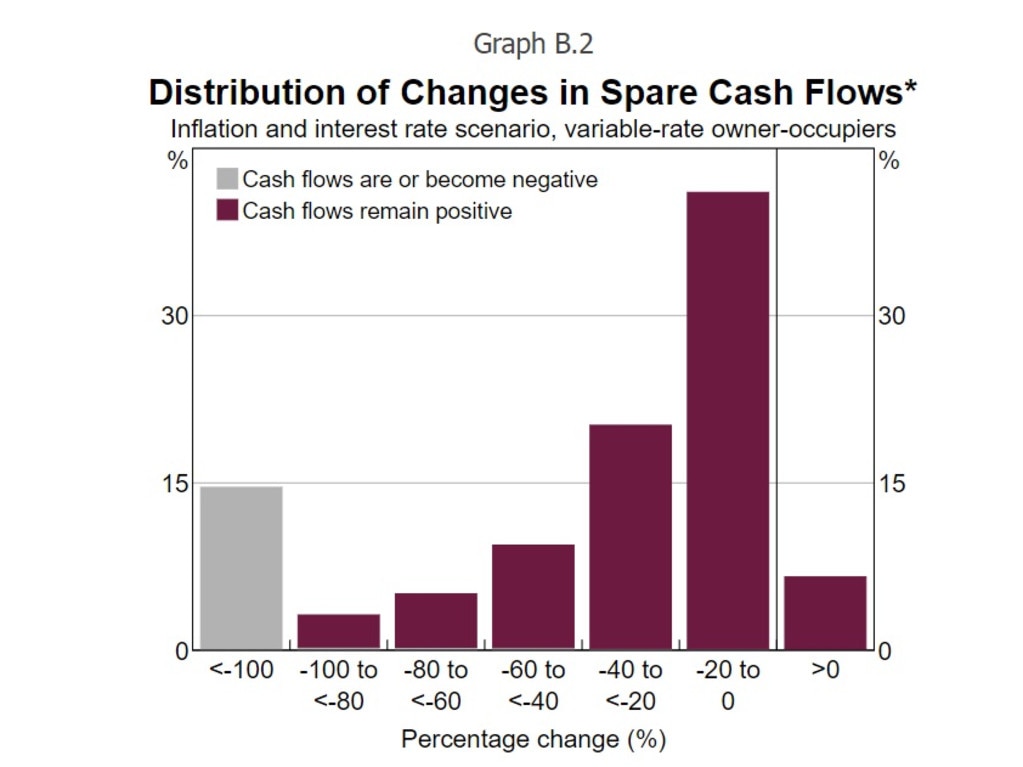

Looking at households with owner-occupier variable rate loans, the RBA said those borrowers made up about two-fifths of outstanding housing credit.

Just over half would see their spare cash flows drop more than 20 per cent over the next couple of years, including about 15 per cent whose spare cash flows would turn negative, the RBA predicted.

“While a relatively small share of the sample of households appears to be at high risk of falling behind on their loan payments, most borrowers will likely be able to manage for at least two years by reducing their non-essential spending, reducing their saving flows and/or drawing down on their accumulated prepayment buffers,” the RBA said.

“Should labour and housing market conditions deteriorate further than assumed in the Bank’s central scenario, however, a larger share of households would be expected to fall into arrears on their mortgages.”

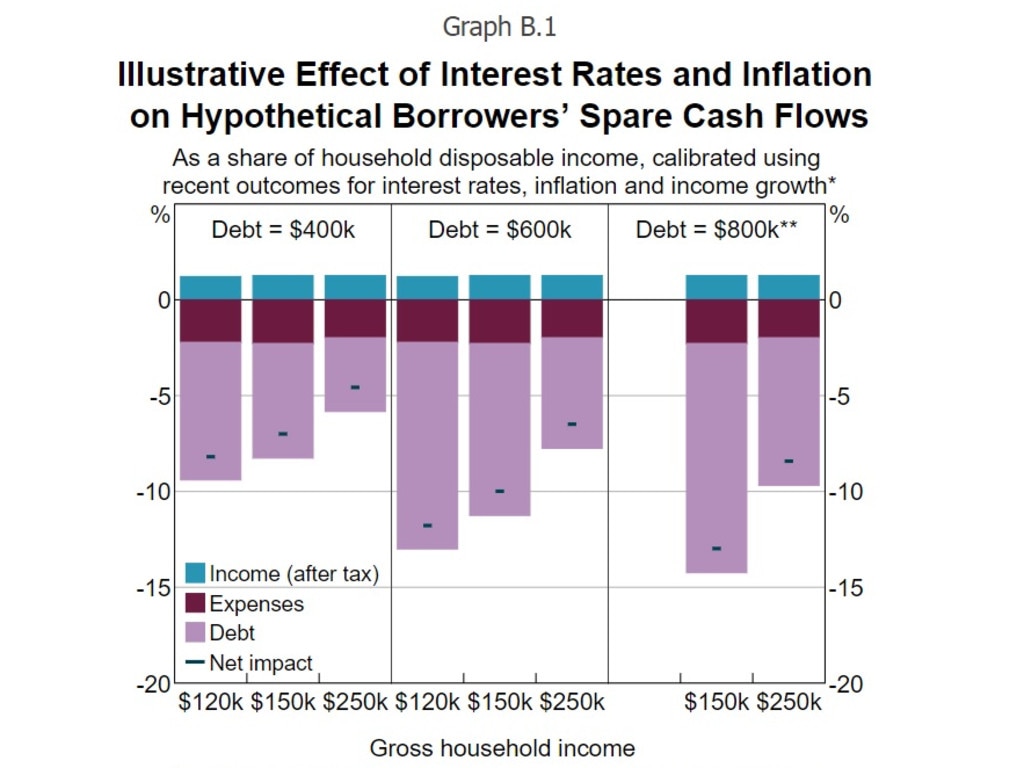

For a household earning $150,000 with $800,000 in debt, the net effect would be a reduction in monthly spare cash flow of about $1300 – or 13 per cent of household disposable income, the RBA said.

About 80 per cent of the overall reduction in spare cash flows would be due to the impact of rising interest rates on their mortgage payments.

For a household with the same income but with $600,000 in debt, the net decline in spare cash flow would be 10 per cent of disposable income.

“Households that have borrowed more recently tend to have larger debts than earlier cohorts and so are likely to be more affected than other borrowers,” the RBA said.

“For a given amount of debt, households with lower incomes than these hypothetical borrowers would also likely be more affected.”

But it is not just households that will be hit.

Some businesses had been impacted by sharp rises in costs, labour shortages and supply disruptions, the RBA noted.

“This is especially evident in the construction industry, where insolvencies have risen from low levels,” the RBA said.

Meanwhile, the risk of cyber attacks was “elevated” and a major incident could affect financial stability, the RBA warned.

“Financial institutions and policymakers are progressing their work on managing risks that originate outside the financial system, such as cyber crime and climate change,” the RBA said.

“There have been further high profile cyber incidents in recent months, including the recent Optus data breach.

“A significant cyber event could undermine confidence in the financial system and have systemic implications.”

Climate change also presented a “systemic challenge”, the RBA warned.

“Financial institutions are vulnerable to direct losses on assets from climate events and risks stemming from the transition to a lower emissions economy,” the RBA said.

“Financial institutions have begun to take action to manage such risks. However, adjustments to lending and risk management practices will take time.”

Looking at the global market, the RBA predicted economic growth would slow.

“In Europe, high and volatile energy prices are complicating the macroeconomic outlook and could exacerbate fragilities related to high sovereign debt and banking exposures in some euro area economies,” the RBA said.

“Emerging market economies that are commodity-importers or are more reliant on foreign currency funding are particularly vulnerable to financial stress.”

China has provided further policy support to boost the stressed property market, but the RBA warned the country’s challenges were complex.

“The outlook is increasingly uncertain,” the RBA said.

Read related topics:Reserve Bank